Quick Second Mortgage Loan in 2025: Fast Home Equity Loans & HELOCs Explained

Life throws curveballs. That unexpected medical bill, a sudden chance to consolidate high-interest debts, or a critical home repair that just can't wait – sometimes you need cash, and you need it fast. You’ve worked hard to build equity in your home, and now you wonder: Can I actually tap into that value quickly? The answer is a resounding yes. Forget the weeks-long nightmares of traditional mortgages. Today, getting a quick second mortgage – whether as a fast home equity loan or a fast HELOC – is entirely possible, often in a matter of days. This guide cuts through the confusion. We’ll show you the absolute fastest loan options, what lenders really look for, and exactly how to streamline your application to get funded before your next paycheck hits. Let’s unlock your home’s potential, swiftly and smartly.

What is a "Second Mortgage"? Understanding Your Fast Cash Options

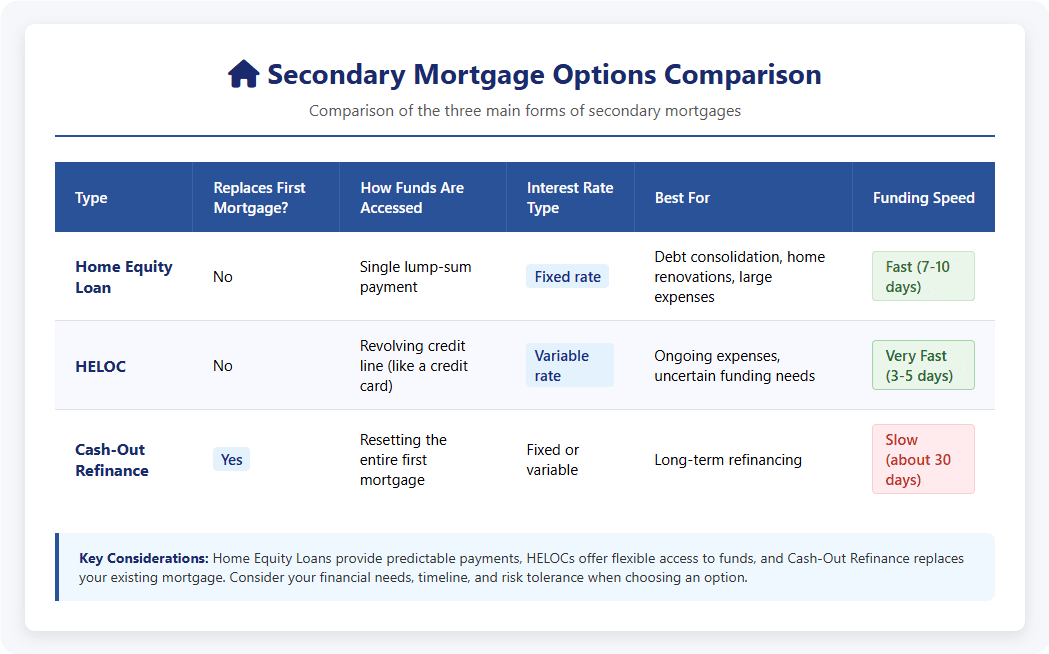

Think of your primary mortgage as the main act. A "second mortgage" is exactly what it sounds like – another loan secured by your home, sitting right behind that first one in line for repayment. It’s not one specific product, but an umbrella term covering your main choices for accessing your home’s equity without refinancing your first loan. Your toolbox includes the predictable home equity loan, the flexible HELOC, and sometimes cash-out refinance is mentioned (though it replaces your first mortgage entirely). The key difference? These loans use your home’s value minus what you still owe on mortgage #1 as collateral. You’re borrowing against home equity you’ve already built. Understanding these distinct loan options is crucial for picking the right tool for your specific financial need.

People Also Read

- Apply for a Second Mortgage Online: Fast Approval, Paperless Process and Bank-Level Security

- Easy Second Mortgage Loans in 2025: Fast Approval, Low Hassle Guide

- How to Get Approved for a Second Mortgage: Key Requirements & Strategies

- Do I Need 20% Down to Buy a Second Home

- Second-Time Home Buyer Mortgages: Requirements, Programs & Strategies

Home Equity Loan: The Fast, Fixed-Rate Lump Sum

Imagine needing a specific sum for a single, clear purpose – maybe replacing that ancient roof or finally tackling those pesky credit cards. A home equity loan delivers exactly that: one lump sum of cash deposited directly into your account. The beauty? You lock in a fixed interest rate upfront. That means predictable payments every single month, making budgeting a breeze. It’s the go-to choice for debt consolidation (rolling high-rate debts into one lower payment) or planned home improvement projects where you know the total cost. No surprises, just straightforward cash when you need it.

HELOC (Home Equity Line of Credit): The Quick & Flexible Option

Need flexibility? Think of a HELOC like a powerful credit card backed by your home’s value. Instead of a single lump sum, you get access to a line of credit – a pre-approved spending limit you can tap into as needed during an initial draw period (often 5-10 years). Saw a killer deal on new windows? Need to cover unexpected tuition? Just withdraw what you require, when you require it. You only pay interest on the amount you've actually used. While the variable interest rate means payments can fluctuate, the flexible borrowing power is unmatched. Perfect for ongoing projects, fluctuating expenses, or having a safety net.

Quick Comparison: Cash-Out Refinance vs. Personal Loans

Let’s clear the air. Cash-out refinance replaces your entire first mortgage with a new, larger loan, pocketing the difference in cash. While it can access equity, it’s generally not the quick second mortgage solution. Why? It involves restarting your primary mortgage clock and often takes 30+ days to close. On the flip side, personal loans offer blazing approval speed (sometimes 1-3 days!) and no home collateral. Sounds great? Hold on. They come with significantly higher interest rates and lower borrowing limits. For substantial amounts secured by your home’s value at better rates, a fast home equity loan or HELOC is usually the smarter, faster play than a personal loan for major needs.

Let’s clear the air. Cash-out refinance replaces your entire first mortgage with a new, larger loan, pocketing the difference in cash. While it can access equity, it’s generally not the quick second mortgage solution. Why? It involves restarting your primary mortgage clock and often takes 30+ days to close. On the flip side, personal loans offer blazing approval speed (sometimes 1-3 days!) and no home collateral. Sounds great? Hold on. They come with significantly higher interest rates and lower borrowing limits. For substantial amounts secured by your home’s value at better rates, a fast home equity loan or HELOC is usually the smarter, faster play than a personal loan for major needs.

The Need for Speed: How to Get Funded in Days, Not Weeks

Finding the Fastest Lenders: Who Offers 5-Day Funding?

The key to fast closing lies with lenders built for the digital age. Traditional banks often lag. Instead, target nimble online lenders and innovative fintech companies that prioritize speed. Names like Figure and Better Mortgage aren't just marketing hype; they actively advertise 5-day funding timelines for qualified borrowers using streamlined processes. These fastest HELOC lenders and quick home equity loan providers have engineered their systems for velocity. Choosing one of these speed demons is your first critical step to get funded fast.

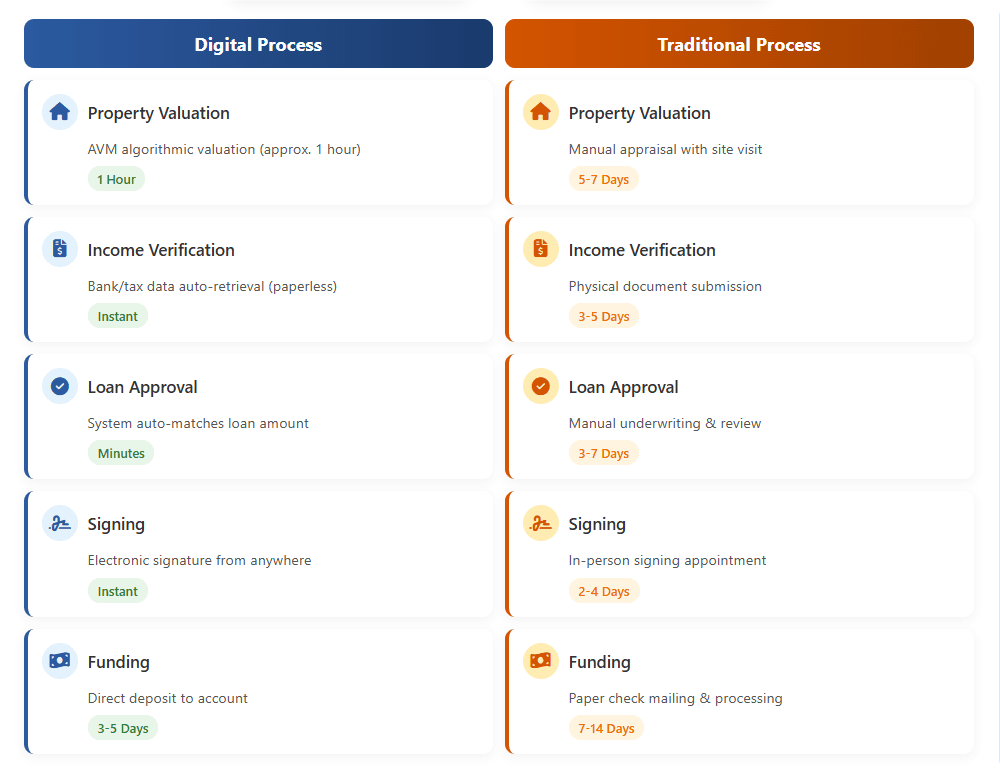

The Technology Behind Quick Closings: AVMs & Digital Verification

So, how do these fastest lenders slash the timeline? Technology is the magic wand. Gone are the days of waiting weeks for an appraiser. Automated Valuation Models (AVMs) use algorithms and recent data to estimate your home’s value instantly, often eliminating the need for a traditional no in-person appraisal (especially for loans under $250k-$400k). Pair this with electronic income verification – where lenders securely pull your pay stubs, tax returns, and bank statements directly from your accounts – and you've got a recipe for a lightning-fast digital mortgage. Less paperwork, less waiting, more speed.

Your Checklist for a Speedy Process: Documents to Prepare Now

Even with tech, you hold the reins on speed. Delays happen when lenders wait on you. Get these loan documents ready before you hit apply:

- Proof of Income: Recent pay stubs (last 30 days), last two years' W-2s/1099s, and tax returns (last two years)

- Asset Proof: Recent bank statements (checking/savings, last 2 months) and investment account statements

- Existing Mortgage Info: Your latest mortgage statement showing loan balance and payment

- Homeowners Insurance: Current policy declaration page

- ID: Government-issued photo ID (Driver's license, passport)

Having this digital or readily available shaves days off your closing.

Do You Qualify? Key Requirements for a Fast Second Mortgage

Getting a quick second mortgage isn't just about speed; you need to meet the lender's bar. Let’s break down the core home equity loan requirements and HELOC requirements so you know where you stand before applying. Qualifying for a second mortgage hinges on three pillars: your creditworthiness, your home's equity, and your ability to repay.

Credit Score: What's the Minimum Number?

Your credit score is the gatekeeper. While requirements vary, the minimum credit score for most fast HELOC or home equity loan providers typically starts around 620. However, landing in the "good credit" territory (700+) significantly boosts your chances of approval and snags you the best available interest rates. A lower score might not slam the door entirely, but it could mean higher costs or require you to look harder for specialized lenders. Know your number before you start.

Home Equity & LTV: How Much Can You Actually Borrow?

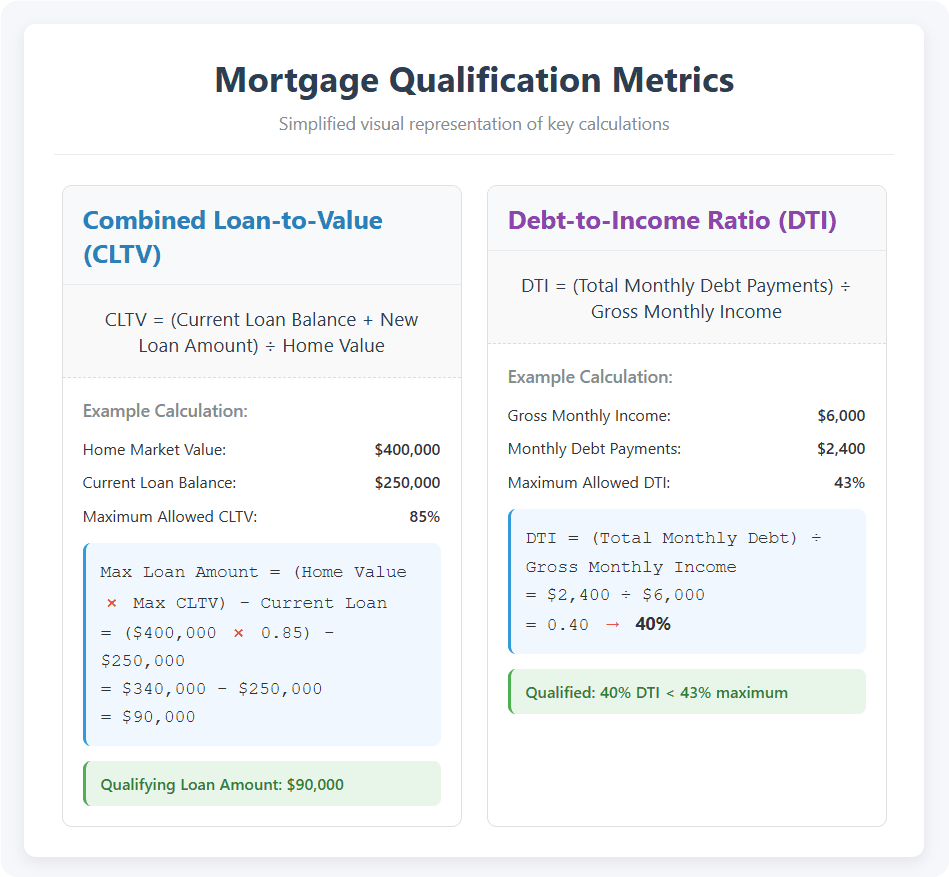

This is your fuel. Home equity is simply your home's current market value minus what you owe on your first mortgage. Lenders measure risk using Loan-to-Value (LTV) and Combined Loan-to-Value (CLTV) ratios. Your CLTV adds your desired second mortgage amount to your existing first mortgage balance, then divides by your home's value. Most fast home equity loan and HELOC lenders cap the maximum CLTV at 85% LTV. That means you must retain at least 15% equity cushion. Example: Home worth $400,000; First mortgage $250,000. Max potential equity access? ($400,000 * 0.85) - $250,000 = $90,000.

Debt-to-Income (DTI) Ratio: Can You Handle Another Payment?

Lenders need confidence you can manage the new payment. Your Debt-to-Income Ratio (DTI) is key. It’s calculated by dividing your total monthly debt payments (including the proposed new loan) by your gross monthly income. The magic threshold for most quick second mortgage approvals? Keeping your total DTI under 43%. So, if you earn $6,000 gross monthly and your existing debts (car, credit cards, student loans) plus the new home equity payment total $2,400, your DTI is 40% – generally acceptable. Exceeding 43% DTI makes approval much tougher.

The True Cost of Speed: Analyzing Interest Rates & Fees

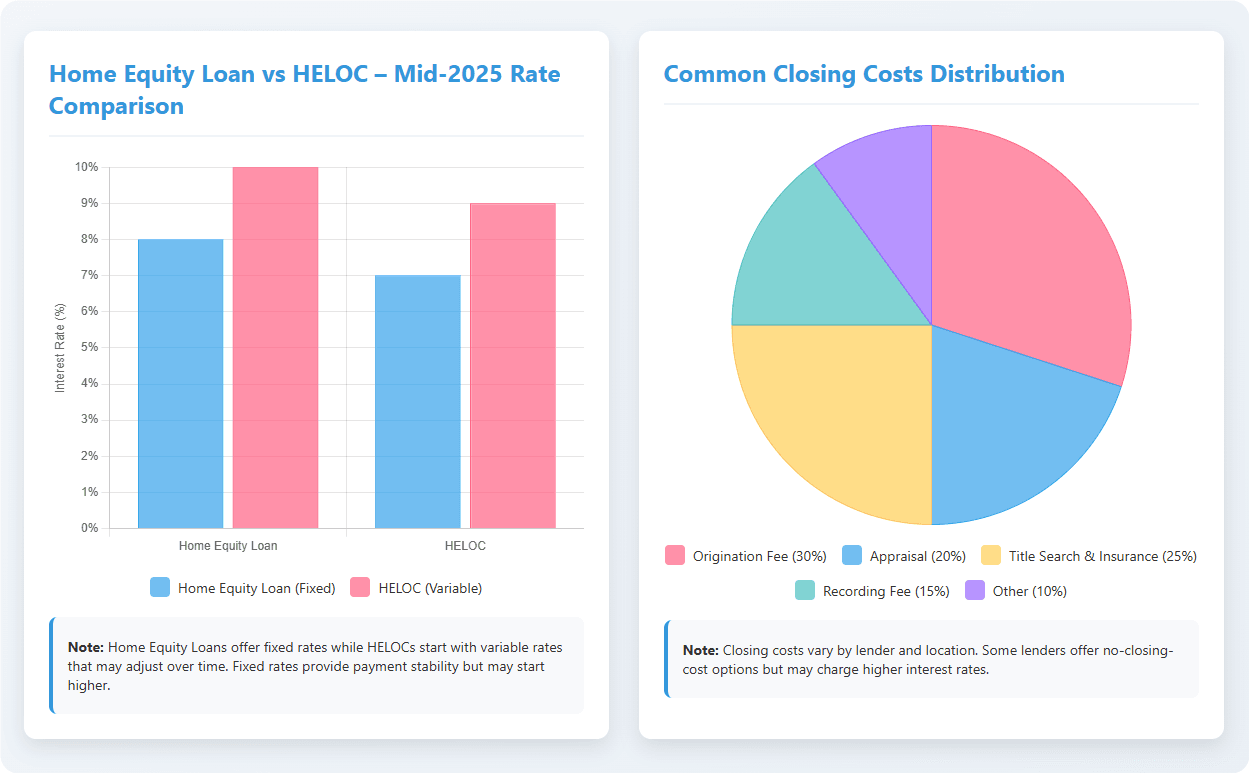

Comparing Interest Rates: Fixed vs. Variable

Your choice between a loan and a HELOC dictates your rate structure. Home equity loans almost always come with a fixed rate – locked in for the life of the loan. Predictability is the trade-off for lacking HELOC flexibility. HELOCs, conversely, typically start with a lower introductory rate but feature a variable rate tied to the prime rate, meaning your payments can rise (or fall) over time, especially during the repayment period. As of mid-2025, expect current home equity rates for fixed loans to hover significantly higher than primary mortgage rates, often in the 8-10%+ range, with HELOC rates starting slightly lower but variable.

Understanding Closing Costs (And How to Find "No-Cost" Loans)

Yes, even quick second mortgage loans often have closing costs, typically ranging from 2% to 5% of the loan amount. These can include:

- Origination fee: The lender's processing fee

- Appraisal fee: If an AVM isn't sufficient and a full appraisal is needed

- Title search & insurance: Ensuring clear ownership

- Recording fees: Charged by the county

The good news? Savvy shoppers can find lenders offering "no closing cost" loans. How? The lender might slightly increase your interest rate to cover the fees, or absorb them as a promotion (especially common with HELOCs from lenders like Discover or Navy Federal). Always ask and compare the total cost (APR) – not just the rate.

Step-by-Step: Your Action Plan to Get a Quick Second Mortgage

Check Your Financial Vitals (Equity, Credit, DTI)

Before diving in, do a quick self-check. Estimate your home's value (Zillow/Redfin offer ballparks, lenders will verify). Know your first mortgage balance. Pull your free credit report (AnnualCreditReport.com). Calculate your DTI. Are you in the ballpark (620+ credit, sub-43% DTI, 15%+ equity)? If yes, proceed!

Gather Your Financial Documents

Refer back to our checklist (Pay Stubs, Tax Returns, Bank/Mortgage Statements, ID, Insurance). Get digital copies ready. This step is crucial for speed.

Compare Fast Lenders and Apply Online

Don't waste time with slow players. Research and compare at least 2-3 of the fastest lenders known for quick home equity loans or fast HELOCs (like Figure, Better, or other fintechs). Focus on their advertised timelines, rates, fees (especially "no-cost" options), and minimum requirements. Once you’ve picked your top contenders, apply online directly through their platforms. The digital application is your express lane to get pre-approved and funded rapidly.

Fast Cash is Possible with the Right Preparation

So, there you have it. That urgent financial pressure valve can be released faster than you might have thought. Securing a quick second mortgage – be it a fast home equity loan for a defined sum or a nimble fast HELOC for flexible access – is absolutely within reach in 2025, potentially in under a week. The formula? Partnering with tech-savvy lenders, understanding the key requirements (credit, equity, income), and walking in with your documents prepped and ready.

Yes, this speed and convenience come with responsibility. You’re using your home as collateral. That means borrow responsibly. Weigh the true cost – the interest rates and potential fees – against the undeniable benefit of rapid access to significant funds.

The power is yours. Armed with this knowledge, you can confidently navigate your options, choose the right lender, and make an informed decision that aligns with your financial goals. Your home’s equity is a powerful tool. Now you know how to wield it swiftly and wisely. Go unlock those possibilities!