FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

Your FHA monthly mortgage insurance rate (MIP) isn't just a number on a page; it directly shapes your loan payment, month after month. Think of it as a necessary companion for your FHA loan journey, helping you get into a home with a smaller down payment. But understanding this monthly premium – its cost, its calculation, and how long it sticks around – is crucial. Feeling overwhelmed by MIP costs? This friendly guide cuts through the jargon, revealing the current 2025 FHA MIP rates and showing you exactly how to calculate your payment, so there are no surprises down the road.

People Also Read

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies?)

- Dreaming Of A North Carolina Home? How to Meet FHA Loan Requirements

- 15-Year FHA Streamline Refinance Rates and APR Guide for Homeowners in 2025

- FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

- FHA Loan VS. Conventional Loan: Which Mortgage Really Works for You?

What Determines Your FHA Monthly Mortgage Insurance Rate?

So, what decides the size of this monthly tagalong fee? It boils down to three key factors set by the big boss, HUD (the U.S. Department of Housing and Urban Development). Once set, your MIP rate is fixed for the entire life of your loan.

Your Down Payment (aka Loan-to-Value Ratio - LTV): This is the heavyweight champion. The smaller your down payment (meaning the higher your LTV), the higher your monthly premium tends to be. Skinny down payment? Expect a slightly heftier MIP.

Your Loan Term: Choose a shorter sprint (a 15-year loan), and you'll generally get a nicer, lower FHA MIP rate compared to the long marathon (a 30-year loan).

Your Base Loan Amount: Your monthly MIP cost is calculated based on the original amount you borrow (your base loan amount), not what you owe later.

2025 FHA MIP Rates: Current Monthly Cost Tables

Let's get down to the brass tacks – what are the actual current MIP rates for 2025? HUD sets these annually, and here's the scoop for the most common loan types.

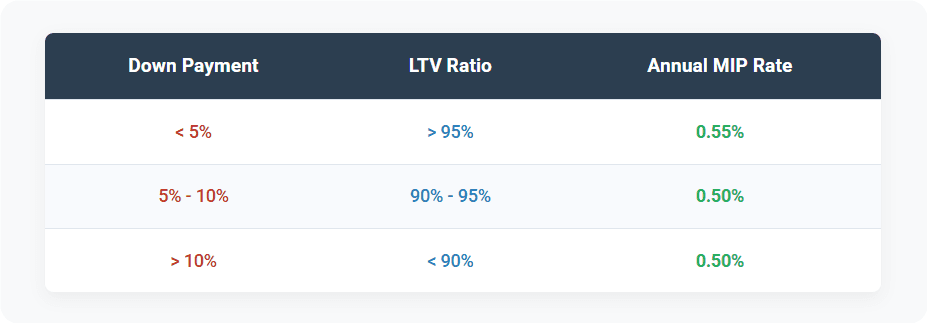

Standard 30-Year Loan MIP Rates (2025)

For the classic 30-year FHA loan, your annual MIP rate looks like this:

15-Year Loan MIP Rates (Lower Cost Option)

Opting for a faster payoff with a 15-year FHA loan? Your reward is significantly lower MIP rates, dipping as low as 0.15% if you manage a down payment greater than 10%. That’s a sweet deal for paying off your loan quicker!

How to Calculate Your Monthly FHA MIP Payment

Don't worry, calculating your exact monthly mortgage insurance rate isn't rocket science! It just needs a simple formula and your loan details.

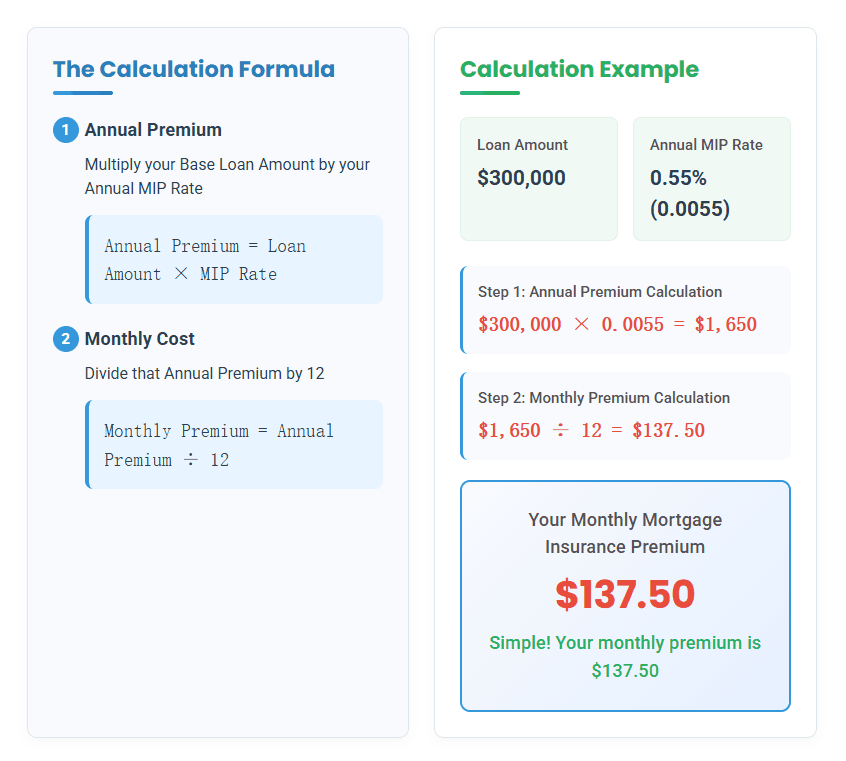

The Exact Calculation Formula

Ready to play with some numbers? Here's how it works:

Find Your Annual Premium: Multiply your Base Loan Amount by your Annual MIP Rate.

Find Your Monthly Cost: Divide that Annual Premium by 12.

Let's see it in action: Imagine you're getting a $300,000 FHA loan with an annual MIP rate of 0.55%.

Annual Cost = $300,000 × 0.0055 = $1,650

Monthly Mortgage Insurance Rate = $1,650 ÷ 12 = $137.50

See? Your monthly premium in this case is $137.50. Simple!

Impact of Upfront MIP on Total Cost

Remember, FHA loans also usually come with an Upfront MIP fee (still 1.75% in 2025) of your base loan amount. This isn't paid out-of-pocket at closing; it's added to your loan balance. So, your actual loan amount used for calculating the monthly MIP is slightly higher:

Adjusted Loan Amount = Base Loan Amount × 1.0175

Using our $300,000 example: $300,000 × 1.0175 = $305,250. That's the number you'd use in the annual premium calculation above.

How Long You Pay FHA Monthly Mortgage Insurance

Ah, the million-dollar question: "How long does this monthly premium cling to my payment?" That depends heavily on your down payment:

Down Payment ≥ 10%: Congratulations! You only have to pay the monthly MIP for 11 years. After that, you can finally cancel MIP (assuming you've kept up with payments).

Down Payment < 10%: Brace yourself. You'll pay the FHA monthly mortgage insurance rate for the entire duration of your loan – whether it's 15, 20, or 30 years. Here's the critical warning: Most 30-year FHA loans with the minimum 3.5% down payment require lifetime MIP! It becomes a permanent fixture on your payment.

3 Ways to Reduce Your Monthly FHA MIP Rate

Feeling the pinch of your monthly MIP cost? Don't despair! You have escape routes:

Boost Your Down Payment: If possible, aim for that magic 10% down payment right from the start. This automatically qualifies you for a lower annual MIP rate (as shown in the tables) and limits the payment duration to 11 years.

Refinance to a Conventional Loan: Once your home's value grows, and you have at least 20% equity, refinancing out of your FHA loan into a conventional loan lets you shake off MIP completely (though you might pay PMI initially if equity is just 20%).

Request Cancellation After 11 Years: If you started with ≥10% down, mark your calendar! Once you hit that 11-year mark and your loan is in good standing, you can formally request to cancel MIP. Freedom!

Key Takeaways: Your FHA MIP Cheat Sheet

Let's recap the essentials about your FHA monthly mortgage insurance rate in 2025:

Current annual MIP rates range from a low of 0.15% (for 15-year loans with >10% down) up to 0.55%.

Your rate is locked in by HUD based on your down payment (LTV) and loan term.

Calculate your exact monthly MIP cost using the simple formula: (Base Loan Amount × Annual MIP Rate) ÷ 12.

With <10% down on a 30-year loan, expect lifetime MIP – it won't vanish on its own.

Strategies exist! Increase your down payment, refinance later, or cancel after 11 years (if eligible) to reduce or eliminate this cost.

Armed with this knowledge, you're ready to tackle your FHA loan confidently! Use the formula above to calculate your exact cost before applying. Need to find the lowest possible rates? Compare offers from FHA-approved lenders today – your perfect mortgage match is out there!