FHA Mortgage Insurance Cost: Calculate Premiums & Removal Guide

Okay, let's talk FHA mortgage insurance cost. It's that necessary, yet sometimes groan-inducing, fee that tags along with your fantastic low-down-payment FHA loan. Think of it as the price of admission for getting into homeownership with less cash upfront. This MIP (Mortgage Insurance Premium) comes in two flavors: a hefty chunk paid upfront at closing (the upfront premium) and smaller, recurring bites added to your monthly payment (the annual payment, paid monthly). Understanding these costs – how they're calculated, what the 2025 rates are, and crucially, how you can eventually ditch them – is absolutely vital. Good news: 2025 MIP rates start at a low 0.15% – plug your numbers into our FHA loan calculator below to instantly estimate your real cost! Let's break down this essential piece of your FHA puzzle.

FHA Upfront MIP and Annual Premium Costs

So, what exactly are you paying for that FHA backing?

What is the FHA Upfront Mortgage Insurance Premium?

Picture this fee as your initial membership cost for the FHA club. The FHA upfront MIP is a one-time charge, calculated as 1.75% of your base loan amount. Yep, that's right – 1.75%. So, if you borrow $200,000, your upfront MIP is $3,500 ($200,000 x 0.0175). The catch? You rarely need to write a check for this at closing. Most folks opt for financing this premium, meaning it gets rolled right into the total loan amount. Essentially, you're borrowing an extra 1.75% to cover this insurance cost, spreading the payment over your entire loan term. Remember, this financing choice increases your base loan amount, affecting your overall interest paid long-term.

Annual MIP Payments: How Much is MIP Monthly?

People Also Read

People Also Read

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies?)

- Dreaming Of A North Carolina Home? How to Meet FHA Loan Requirements

- FHA Mortgage PMI Rules Explained: MIP Rates, Duration & Cancellation Options

- FHA Loan Underwriting Requirements Explained: Income, DTI, Inspection & Manual Review Tips

- FHA Loan VS. Conventional Loan: Which Mortgage Really Works for You?

This is the recurring part of your FHA mortgage insurance cost. Unlike the upfront hit, the annual MIP is divided into twelve smaller installments added to your monthly mortgage payment. How much you pay monthly depends on several key factors:

- Your Loan's Specifics: The loan amount and term (15 vs. 30 years).

- Your Down Payment: A larger down payment usually means a lower annual MIP rate.

- Loan-to-Value Ratio (LTV): Closely tied to your down payment. Higher LTV (meaning less equity) often equals higher MIP.

- Base Loan Amount: The annual MIP rate is applied yearly to your outstanding principal balance, though your monthly cost is fixed initially.

So, how much is MIP monthly? It varies! Your credit score itself doesn't directly change the MIP rate, but it influences your overall loan eligibility and interest rate. The actual rate is set by the FHA based primarily on your down payment and loan term.

2025 FHA MIP Chart and Rate Changes

Navigating the current landscape is key to predicting your costs.

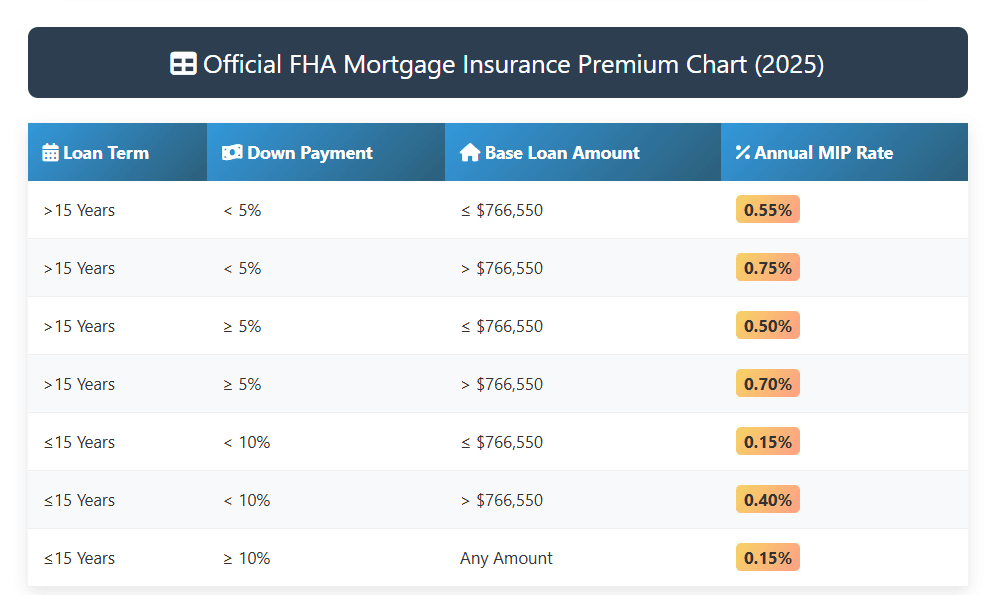

Official FHA Mortgage Insurance Premium Chart (2025)

Here's the breakdown for most borrowers taking out an FHA loan in 2025 (based on FHA Mortgagee Letter 2023-05, which established these rates):

Note: These rates apply for the entire life of the loan if your down payment is less than 10%. Loans with ≥10% down have MIP for 11 years.

Note: These rates apply for the entire life of the loan if your down payment is less than 10%. Loans with ≥10% down have MIP for 11 years.

These rates reflect the policy changes solidified in 2023, offering slightly lower annual premiums for some borrowers compared to prior years.

Why Did My FHA Mortgage Insurance Go Up?

Feeling a pinch? If your existing FHA loan's monthly payment jumped, it's probably not your annual MIP rate magically increasing. The FHA sets your MIP rate at closing, and it generally stays fixed unless:

- Your Loan was Endorsed Before June 3, 2013: Older loans had annual MIP that could decrease slightly as the principal balance decreased.

- Your Escrow Payment Adjusted: While your MIP premium amount might be stable, changes in your property taxes or homeowner's insurance (also paid from escrow) can cause your total monthly payment increase.

- You Have an ARM: If you have an Adjustable-Rate Mortgage, the interest portion of your payment can increase, making the total payment larger, even if the MIP portion is unchanged.

- Refinance: If you refinanced into a new FHA loan, you are subject to the MIP rates and rules at the time of your new refinance closing, which might be higher or have a longer duration than your original loan. Remember, lowering your LTV significantly might allow you to refinance into a conventional loan to ditch MIP entirely!

FHA Loan Calculator: Estimate Your Costs、

Stop guessing! Crunch your real numbers.

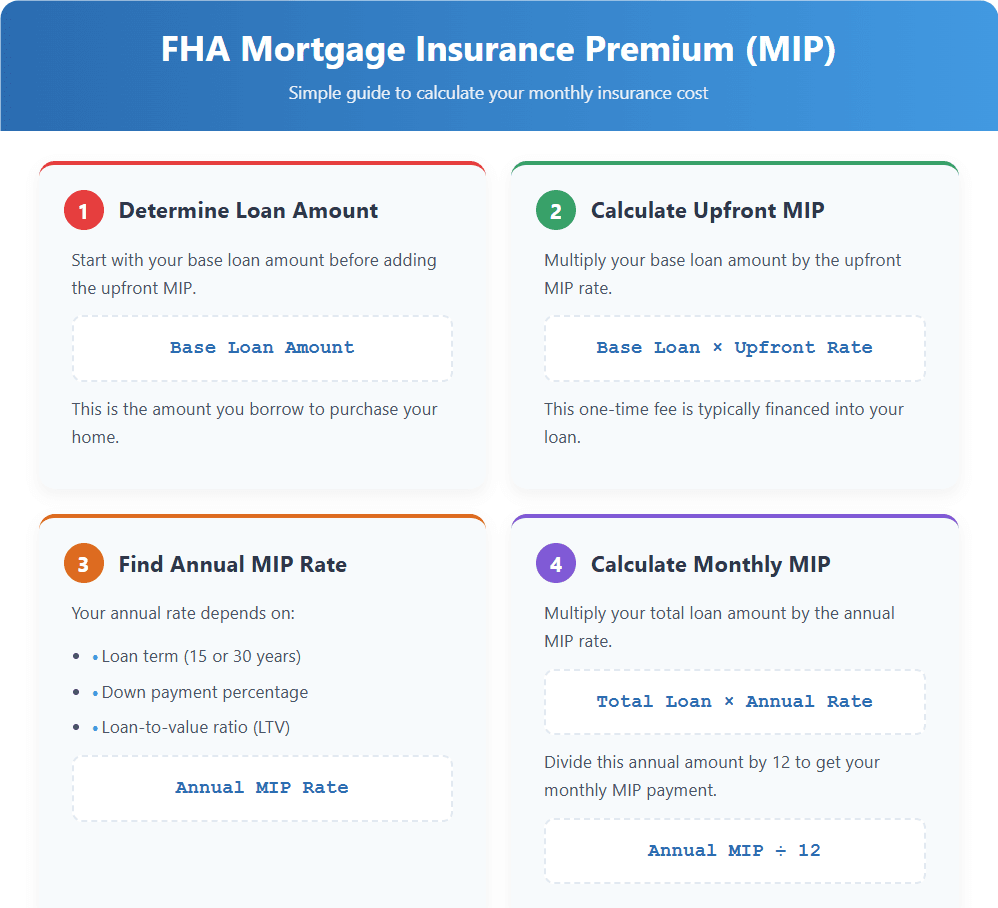

Step-by-Step FHA Mortgage Insurance Calculation

Estimating your total FHA mortgage insurance cost involves both parts:

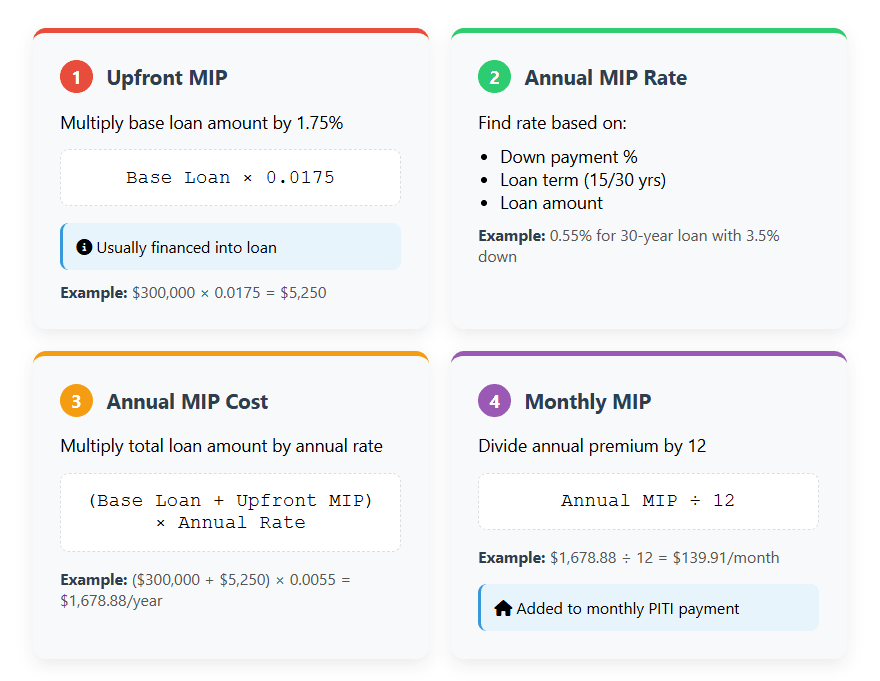

Upfront MIP: Multiply your base loan amount by 1.75% (0.0175). Remember, this is usually financed.

Annual MIP:

- Find your applicable annual rate from the 2025 chart above (based on down payment, loan term, and amount).

- Multiply your total loan amount (base loan + financed upfront MIP) by the annual rate.

- Divide that annual premium by 12 to get your monthly cost.

This monthly cost gets added to your principal, interest, taxes, and insurance (PITI) payment.

Your down payment directly impacts the annual rate. The loan term (15 or 30 years) also determines your rate bracket and how long you pay annual MIP. Need it easier? Use a dedicated FHA loan calculator!

$350,000 Home Example: Upfront vs Monthly MIP

Let's make it concrete! Assume a $350,000 purchase price with a 3.5% down payment ($12,250).

- Base Loan Amount: $337,750 ($350,000 - $12,250)

- Upfront MIP (Financed): $337,750 x 1.75% = $5,910.63 (added to loan, making new loan balance ~$343,660.63)

- Annual MIP Rate: (30-year term, <5% down, loan ≤ $766,550) = 0.55%

- Annual MIP Cost: $343,660.63 x 0.55% = $1,890.13

- Monthly MIP Cost: $1,890.13 / 12 = $157.51 (≈ $158/month)

Key Takeaway: You finance $5,910.63 upfront and pay roughly $158/month for FHA mortgage insurance on this example.

FHA Mortgage Insurance Removal Guidelines

The dream: Saying goodbye to that monthly MIP payment! Here's how it can happen.

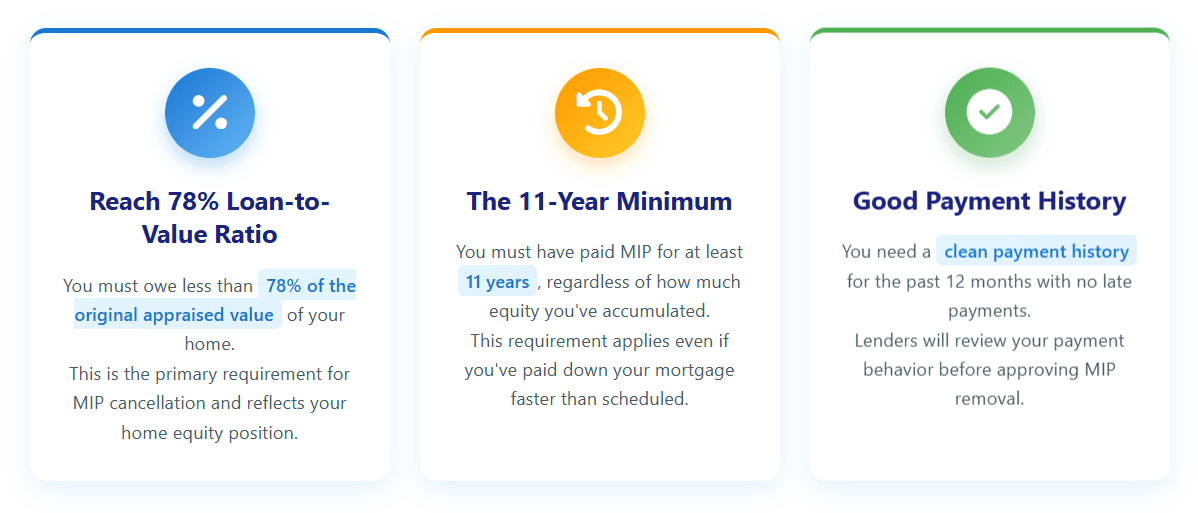

How to Qualify for MIP Cancellation in 2025

For loans closed on or after June 3, 2013, getting rid of annual MIP isn't automatic and has strict rules:

- Reach 78% Loan-to-Value Ratio (LTV): You must owe less than 78% of the original appraised value of your home.

- The 11-Year Minimum: You must have paid MIP for at least 11 years, regardless of how much equity you have.

- Payment History: You generally need a good payment history for the past 12 months.

Crucially: If you made a down payment of less than 10%, you cannot cancel MIP before the loan's full 30-year term unless you meet the 78% LTV rule and hit the 11-year mark. Loans with ≥10% down have MIP removed automatically after 11 years if the 78% LTV is met.

Refinancing to Conventional Loan for MIP Removal

This is often the most practical escape hatch! If your home's value has increased or you've paid down the balance significantly, refinancing out of your FHA loan into a conventional loan can eliminate MIP. Here's the trade-off:

- FHA vs Conventional: Conventional loans typically require higher credit scores (often 680+ or 720+ for best rates) and lower Debt-to-Income Ratios (DTI) than FHA.

- PMI vs MIP: Conventional loans use Private Mortgage Insurance (PMI), which is cancellable much more easily (once you reach 78–80% LTV based on current value, no minimum time requirement besides lender-specific rules).

- Credit Requirements: Your improved credit score since getting your FHA loan is key to qualifying for a conventional refinance with a good rate. You'll also need sufficient equity (usually at least 20% to avoid PMI altogether, or 5–15% to get cancellable PMI).

Bottom Line: Understanding your FHA mortgage insurance cost – the upfront hit, the monthly bite, the 2025 rates, and your escape routes – empowers you to make smarter decisions. Use the tools, know the rules, and plan your path to eventually kicking MIP to the curb!