How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

That FHA loan helped you get the keys. But now there's this unwanted guest: the Mortgage Insurance Premium (MIP). Unlike its conventional cousin PMI, this one can be a real long-term squatter, thanks largely to a rule shift back in June 2013. It changed the game for removing MIP from FHA loan, especially for those with smaller down payments. Feeling stuck? You basically have two exits: wait for automatic cancellation (hitting that magic 78% LTV after minimum years), or pack MIP's bags yourself by refinancing out of the FHA world. Knowing the HUD guidelines is your first step to freedom. Let's break down your battle plan.

What is FHA MIP & Why It’s Stubbornly Sticky

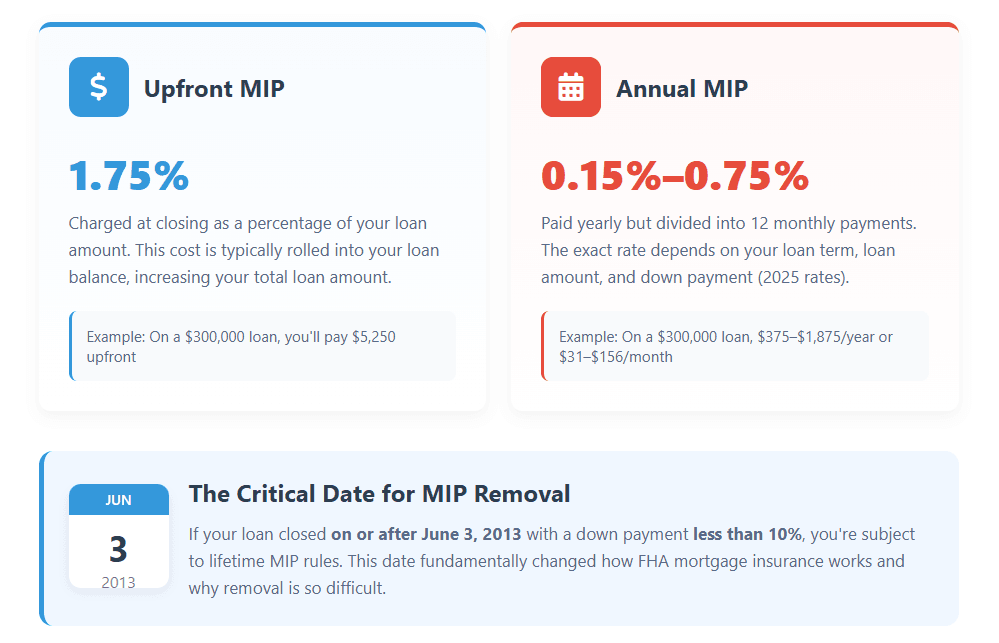

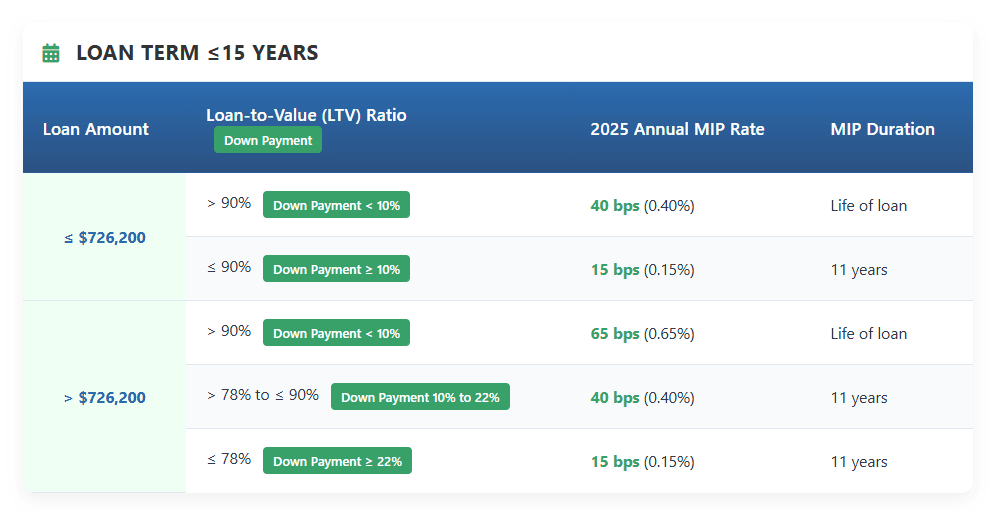

Think of MIP as a double punch. First, you got smacked with an Upfront MIP (1.75% of your loan, usually rolled in). Then, you pay an Annual MIP (0.15% – 0.75% in 2025) divided into twelve monthly nibbles. Ouch.

Here's the real kicker, the reason removing MIP from FHA loan feels glued on: Loan Origination Date is everything. If your down payment was less than 10% and your loan closed on or after June 3, 2013? Buckle up. For most standard 30-year loans, that means Lifetime MIP. Yep, you read that right. It stays for the entire loan term unless you take drastic action. Even if you somehow hit 78% LTV early, that rule slams the door on automatic removal. Put down 10% or more? You get an 11-year sentence before you might qualify for auto-removal (more on that tightrope walk later).

People Also Read

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies?)

- Dreaming Of A North Carolina Home? How to Meet FHA Loan Requirements

- 15-Year FHA Streamline Refinance Rates and APR Guide for Homeowners in 2025

- Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

- FHA Loan VS. Conventional Loan: Which Mortgage Really Works for You?

How to Remove FHA MIP Without Refinancing (The Uphill Climb)

This path for removing MIP from FHA loan isn't for the faint of heart. It demands patience, a rising market, or extra cash. Think of it as the "prove you don't need it anymore" route.

This path for removing MIP from FHA loan isn't for the faint of heart. It demands patience, a rising market, or extra cash. Think of it as the "prove you don't need it anymore" route.

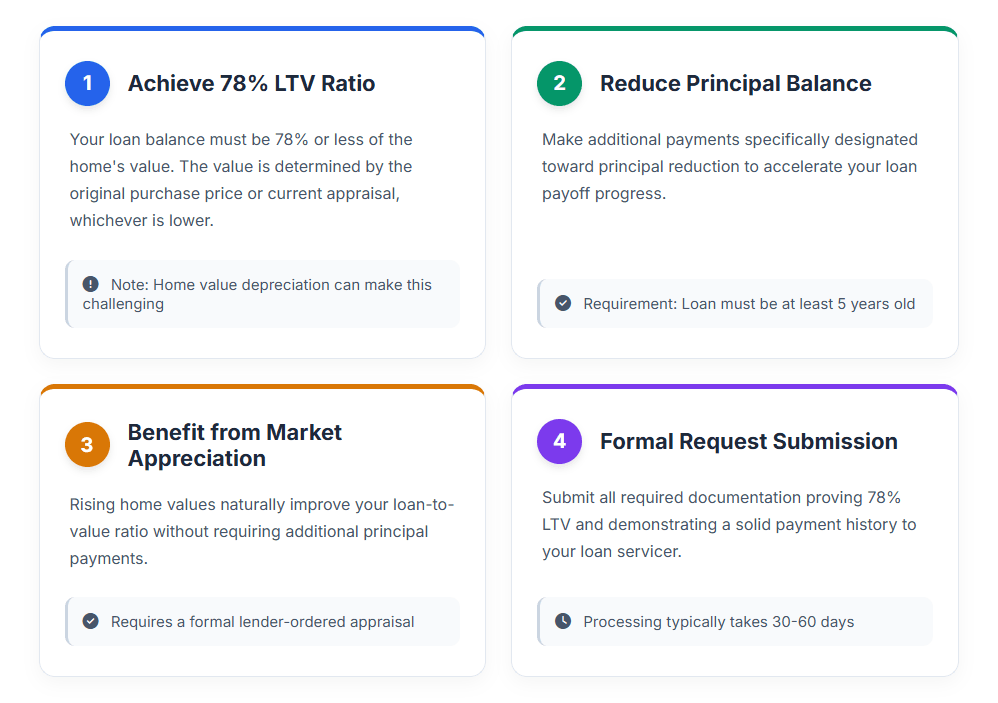

Conquering the 78% Loan-to-Value (LTV) Mountain

This is your non-negotiable summit for removing MIP from FHA loan: 78% LTV. Not a penny more owed compared to the value. Crucially, the value used is the lesser of your original purchase price or the current appraised value. Ouch if your neighborhood took a dip.

How do you scale this peak?

- Principal Reduction: Throw extra money at your mortgage principal like it's a dartboard.

- Home Value Appreciation: Pray the market gods smile upon you. A rising tide lifts all boats... and hopefully your home's appraisal value significantly. You'll need a formal appraisal ordered by your lender to prove it.

Warning: If your home value drops, reaching 78% for removing MIP becomes a steeper, often impossible, climb.

Serving the Minimum Time: The 11-Year Rule

Even if you miraculously hit 78% LTV after just 5 years? Hold your horses. Time matters too for removing MIP from FHA loan, especially if you managed a down payment of 10% or more.

- Down Payment ≥ 10%: You must make payments for at least 11 years AND have reached 78% LTV based on the original purchase price (appreciation doesn't count for this time requirement!). On-time payments throughout are absolutely essential.

- Down Payment < 10% (Post-June 2013 Loans): Forget removing MIP. The lifetime MIP rule means automatic removal is not an option, period. No matter how much you pay down or how much your home appreciates. Your only escape is refinancing.

Knocking on Your Lender's Door: The Request

So, you think you meet both the LTV and time requirements for removing MIP from FHA loan? Now you gotta ask nicely.

- Verify: Double-check your payment history is spotless – lenders scrutinize this.

- Pay Up: Be ready to cover the cost of a new appraisal (several hundred dollars).

- Formal Request: Submit a written request for cancellation to your loan servicer. Don't just call; get it in writing.

- Fine Print: Your lender might have extra hoops. A common one? Perfect payments for the last 12–24 months. No slip-ups allowed.

Refinancing: Your Most Reliable Escape Hatch for Removing MIP

Let’s be honest, the automatic path for removing MIP from FHA loan is narrow and rocky. For most folks saddled with post-2013 FHA loans (or anyone wanting out faster), refinancing is the golden ticket.

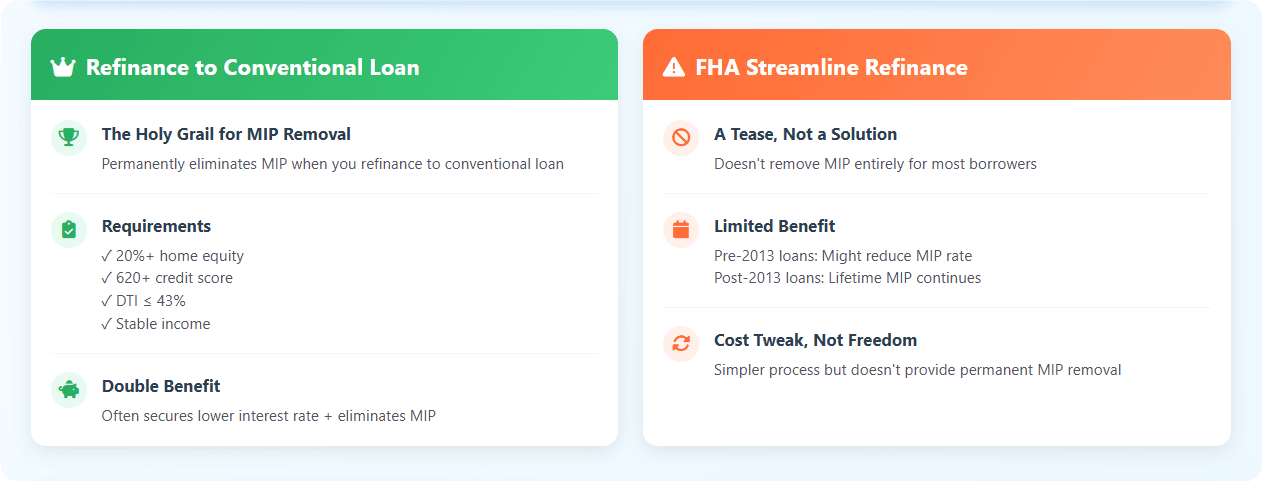

Ditching FHA Altogether: Refinance to Conventional

This is the holy grail for removing MIP from FHA loan. When you’ve built up enough home equity (usually 20% or more), you can refinance to a conventional loan. Poof! All mortgage insurance vanishes. Gone. For good.

What You Need: A decent credit score (typically 620+), manageable debt (DTI ≤ 43% is a common target), and stable income to meet conventional loan requirements.

The Sweetener: Often, you might snag a lower interest rate too! Killing the MIP and lowering your rate? That’s a double win for your monthly budget.

FHA Streamline Refinance: A Tease, Not a Solution

Heard about the FHA Streamline Refinance? It’s easier (less paperwork, often no appraisal, maybe lower credit requirements), but here’s the catch: It usually cannot achieve removing MIP from FHA loan entirely. At best, if you closed your original FHA loan before June 3, 2013, and you meet certain criteria, you might get a reduced Annual MIP rate under the new FHA mortgage insurance rules. If your loan is post-2013? Streamline likely just keeps your lifetime MIP in place, maybe at a slightly different rate. It’s a cost tweak, not liberation.

Is the Refi Math Worth It? Finding Your Break-Even

Refinancing for removing MIP from FHA loan isn’t free magic. There are closing costs (loan fees, appraisal, title insurance, etc.). Do a simple cost-benefit analysis:

- Total Refi Cost: Let’s say $6,000.

- Monthly MIP Savings: Say your MIP is $150/month.

- Break-Even Point: $6,000 / $150 = 40 months (about 3 years and 4 months).

The Rule: If you plan to stay in the house longer than your break-even period, refinancing likely makes solid financial sense. Planning to move in 2 years? Probably not worth the upfront cost. Crunch your numbers!

FHA MIP Removal After 2013: Why Refinancing is Your Lifeline

If your FHA loan closed on or after June 3, 2013, and you put down less than 10%, this is critical: You have lifetime MIP. Full stop. That automatic removing MIP from FHA loan path? Barricaded. The 2013 rule change slammed that door shut. Your only way to shed this burden is to refinance into a conventional loan once you have sufficient equity (usually 20%). The sole exception is if you miraculously scraped together a 10%+ down payment back then – you're still subject to the 11-year rule, but those cases are rare birds indeed.

Tools & Resources to Plot Your MIP Escape

Knowledge is power (and savings!) for removing MIP from FHA loan. Use these:

FHA MIP Removal Calculator: How Long 'Til Freedom?

Wondering how many years of extra payments it'll take, or how much home appreciation you need, to hit that elusive 78% LTV for removing MIP? Search for an "FHA MIP removal calculator" or "FHA PMI removal calculator". Plug in your current loan balance, interest rate, original purchase price/value estimate, and how much extra you might pay each month. It'll project your timeline. Remember, your local home value appreciation trends and your principal reduction efforts are the biggest variables.

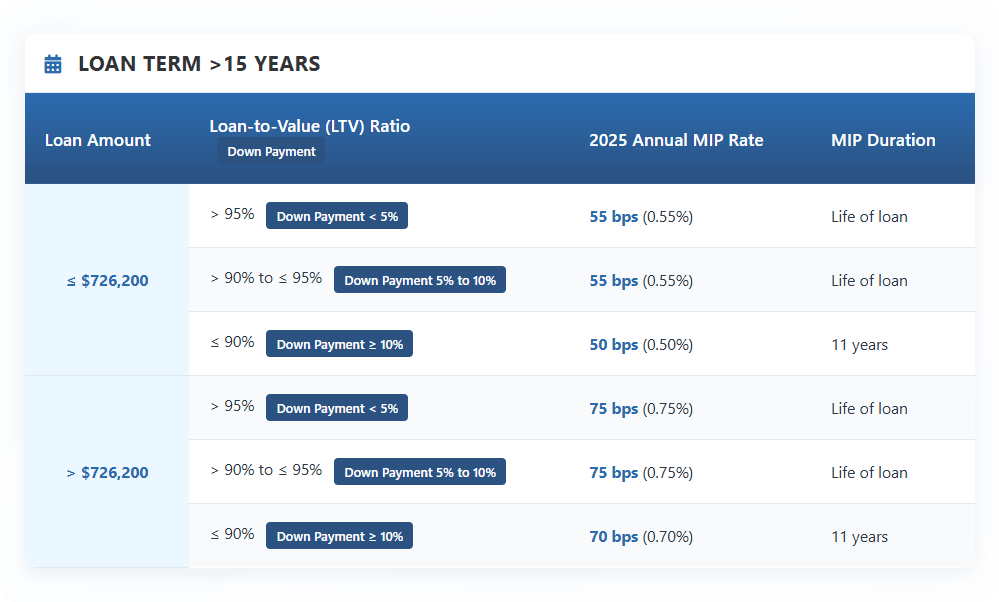

Current FHA MIP Rates & Duration Charts (2025)

Confused about your exact MIP cost or how long you're stuck? Find the latest official FHA mortgage insurance premium chart from HUD. It clearly shows:

- Annual MIP rates based on your down payment percentage and loan term (15yr vs 30yr).

- Duration: Crucially, it highlights the lifetime MIP requirement for loans with <10% down after June 2013 (blocking removing MIP). Look for the red flags or asterisks!

Your Burning FHA MIP Questions Answered (FAQs)

"Can I remove MIP on an FHA loan before 11 years?" Only if you made a down payment of 10% or more AND you've already reached 78% Loan-to-Value based on the original purchase price (not appraisal). This scenario is uncommon. Removing MIP from FHA loan early is very rare and requires strict lender approval. For <10% down post-2013? No chance without refinancing.

"My lender denied my MIP removal request even though I have 78% LTV! Why?" Ouch. Common culprits for blocking removing MIP from FHA loan:

- Loan Origination Date: You have a post-June 2013 loan with <10% down (lifetime MIP applies, no removal allowed).

- Appraisal Dispute: The lender's appraisal came in lower than you expected, meaning your actual LTV is still above 78%.

- On-time Payments: You might have a recent late payment (even one!) violating the lender's requirement for a perfect payment history (often 12–24 months clean).

- Time Requirement: For 10%+ down loans, you haven't hit the 11-year minimum seasoning period yet.

"Is FHA MIP tax deductible?" This is a common search! Under current tax law (as of 2025), FHA Annual MIP can still be deductible as mortgage insurance if you itemize deductions and your income falls below certain limits. This provision has been extended through tax year 2025, but check the latest IRS updates. The Upfront MIP is not deductible in the year you pay it; instead, it's typically deducted proportionally over the life of the loan or when you refinance/sell. Always consult a tax professional for your specific situation!