FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

Hey there, future homeowner! So, you're diving into FHA loans and keep bumping into this term: FHA upfront mortgage insurance (UFMIP). It sounds important (and honestly, maybe a bit pricey?), and you're spot on for paying attention. Think of UFMIP as FHA's mandatory entry fee – it's the upfront premium you pay to secure that low down payment magic. Unlike the annual MIP that adds a bit to your monthly payment, UFMIP is a one-time chunk.

Let's break down what this means for you. We'll cover exactly what UFMIP is, how much it costs, how you actually pay it, why it's non-negotiable, and clear up the big question about getting rid of it.

What is FHA Upfront Mortgage Insurance (UFMIP)? Plain & Simple

UFMIP is the upfront portion of your FHA mortgage insurance premium (MIP). It's a fee charged by the Department of Housing and Urban Development (HUD) – the agency backing your FHA loan. This isn't optional; it's required for every single FHA borrower.

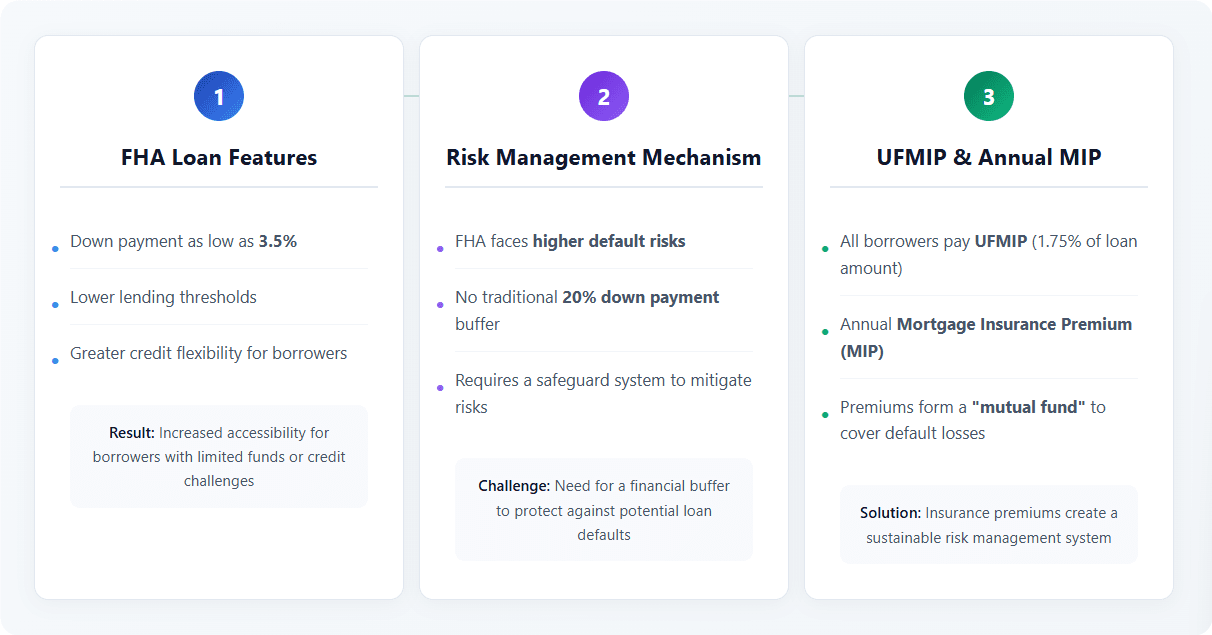

Why? Because FHA loans are government-backed, allowing low down payments (as low as 3.5%). That's amazing for home buyers, but it means lenders take on more risk. UFMIP (alongside the annual MIP) builds the FHA insurance fund – a safety net protecting the lender if you, the borrower, hit hard times and can't make payments. It's the price tag for that invaluable low down payment benefit.

Crunching the Numbers: How Much is UFMIP?

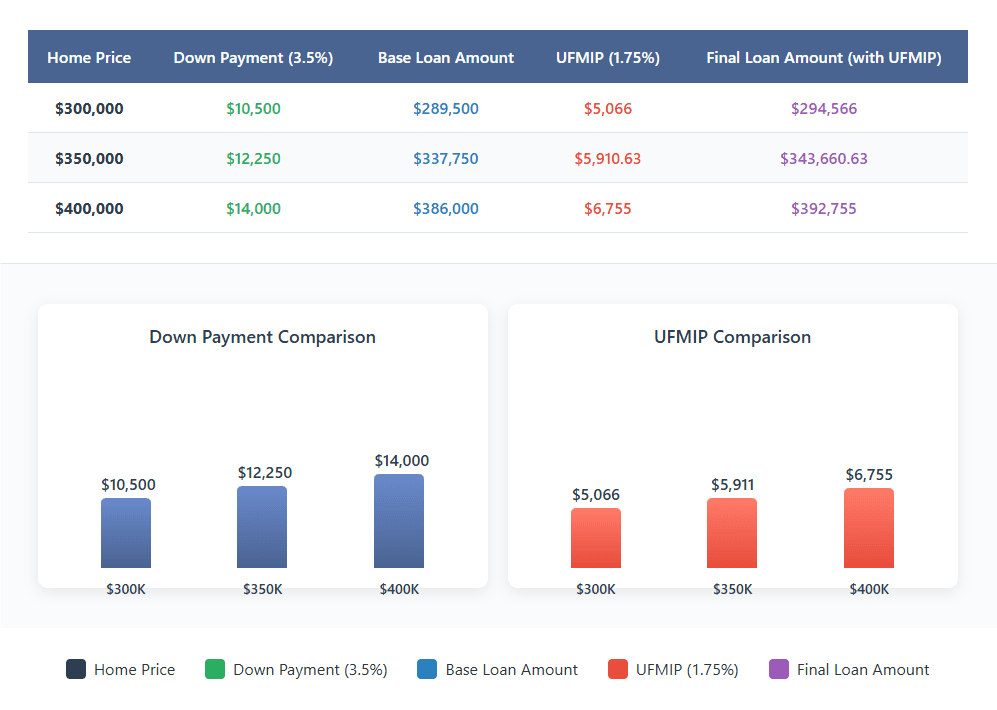

Let's talk dollars and cents. Calculating your UFMIP cost is straightforward. HUD sets a current UFMIP rate (it’s still 1.75% in 2025, unchanged from prior years).

What's the Base Loan Amount?

It's your home's purchase price, plus certain allowable closing costs, minus your down payment. (Not necessarily the final loan amount)

The Formula

UFMIP = Base Loan Amount × 1.75% (or current rate)

Quick Example

Buy a $350,000 home with 3.5% down ($12,250). Base loan = $337,750 UFMIP = $337,750 × 0.0175 = $5,910.63

This amount gets added to your total loan cost.

Paying UFMIP: How It Actually Works (Hint: You Rarely Write a Check!)

Here's some good news: You almost never need a separate check for FHA upfront mortgage insurance at closing! Most borrowers finance it. What does that mean?

Your UFMIP amount (like the $5,910.63 above) gets rolled into your total loan amount.

So, instead of borrowing just the base loan amount ($337,750), you borrow $343,660.63.

You pay this back, with interest, over your mortgage term as part of your monthly payment.

Could you pay it in cash at closing? Technically, yes, but it's uncommon because it's a significant upfront cost. Financing spreads it out. Either way, it's a cost you ultimately bear.

Why UFMIP? (Spoiler: You Can't Skip It)

Let's be honest, FHA upfront mortgage insurance feels like an extra cost. Why is it mandatory? It boils down to that incredible low down payment advantage.

FHA loans help people with smaller savings or less-than-perfect credit scores become homeowners. A 3.5% down payment is inherently riskier for lenders than 20% down. UFMIP (plus annual MIP) is how FHA manages that risk.

Think of it as the premium for the insurance policy protecting your lender. If you default, the FHA insurance fund (built by UFMIP and annual MIP payments) reimburses them. This protection makes lenders willing to offer low down payment loans.

So, while it's a cost to you, UFMIP is the engine making the FHA loan program work, opening doors for home buyers.

Can I Cancel or Avoid UFMIP? The Straight Scoop

This causes a lot of confusion, so let's be crystal clear:

UFMIP (The Upfront Fee)

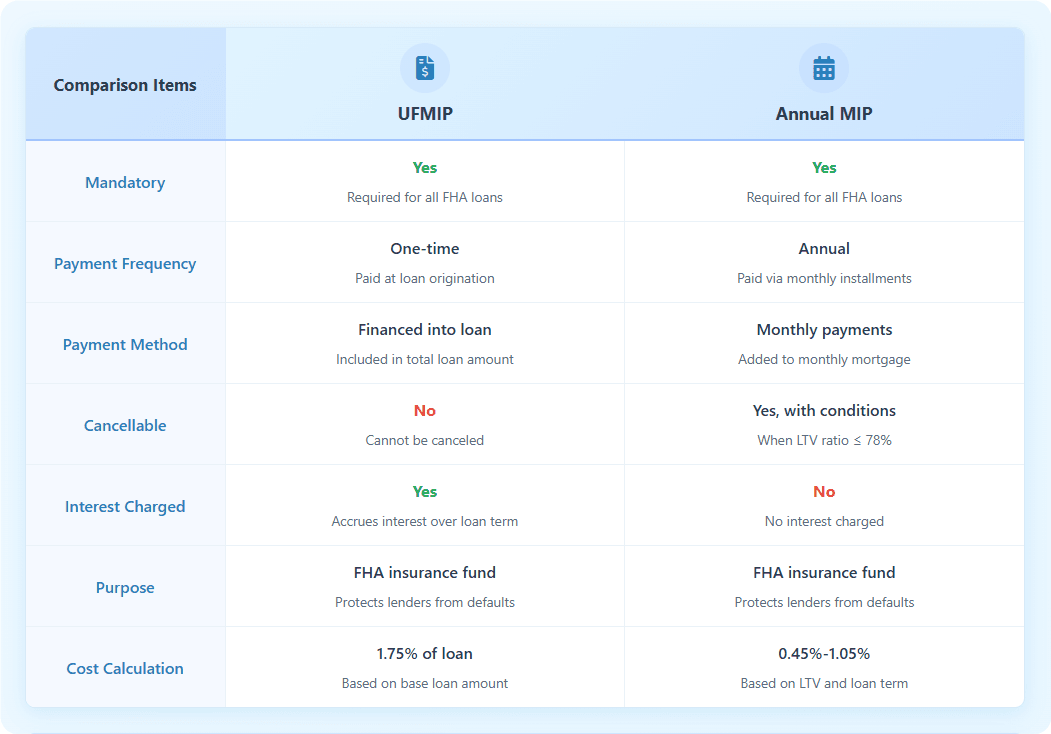

No. You cannot cancel UFMIP or get a refund. Once paid (cash or financed), that cost is locked in for your original FHA loan. It's a one-time, non-refundable premium paid to HUD.

Annual MIP (The Ongoing Fee)

This part can sometimes be canceled, but rules are strict (mainly due to 2013 changes). In 2025, most borrowers pay an annual MIP of around 0.55% of the loan amount.

Generally, you need at least 11 years of payments and a loan-to-value ratio (LTV) of 78% or lower (you owe less than 78% of the home's original value). With a down payment of 10% or more, the 11-year rule might still apply, but 78% LTV is key.

Refinancing into a conventional loan (with its own PMI rules) stops annual MIP, but doesn't erase the UFMIP you paid.

Avoid UFMIP Altogether?

The only way is to choose a different loan type, like a conventional loan. However, these often require higher down payments (5–20%) and stronger credit scores to avoid PMI.

FHA UFMIP: Key Takeaways & Your Questions Answered

In a nutshell:

- Required: For every FHA borrower

- Upfront: Paid once at closing

- Usually Financed: Rolled into your loan amount

- Non-Cancellable: Stays with your original loan

- Rate-Based: 1.75% (current in 2025) of your base loan amount

- HUD's Fee: Funds the FHA insurance program

Quick Answers to Common Questions (FAQs)

Q: Can I get my UFMIP money back? A: No. Once paid (or financed), it’s non-refundable.

Q: What’s the current UFMIP rate? A: As of 2025, it’s 1.75%. Always double-check the absolute latest rate with your lender.

Q: Do I have to finance UFMIP? A: No, you can pay it in cash at closing. But most folks finance it to avoid the big upfront hit.

Q: Does a bigger down payment help with UFMIP? A: Absolutely! A larger down payment shrinks your base loan amount. Since UFMIP is a percentage of that amount (1.75%), a smaller base means a lower UFMIP cost. A smart way to reduce this upfront cost.

Q: What’s the difference between UFMIP and annual MIP? A: UFMIP is a one-time, upfront premium (usually financed). Annual MIP is an ongoing premium paid yearly (via monthly payments). Annual MIP might be cancelable later; UFMIP is permanent on your original loan.

Final Thoughts

Understanding FHA upfront mortgage insurance (UFMIP) is crucial for budgeting your FHA loan. It’s the required cost for accessing that low down payment path to homeownership. Factor it into your plans, and best of luck finding your perfect home!

People Also Read

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies?)

- FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

- Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You