FHA Mortgage PMI Rules Explained: MIP Rates, Duration & Cancellation Options

Feeling overwhelmed searching "FHA mortgage PMI rules"? Breathe! You've actually stumbled into the world of FHA MIP – the official mortgage insurance for government-backed loans. Let's clear the air right away: PMI (Private Mortgage Insurance) is for conventional loans. FHA loans have their own beast: MIP (Mortgage Insurance Premium), and its rules are a different ball game. Feeling tangled? Don't sweat it. We're slicing through the complexity to serve you the essential FHA MIP rules on a platter: what upfront costs and annual premiums you'll pay, the notoriously strict duration policies, the tight cancellation rules tied to your low down payment, and why refinancing is often your only escape hatch. Let's untangle this mortgage mystery!

FHA MIP Rules: Costs & Payment Structure

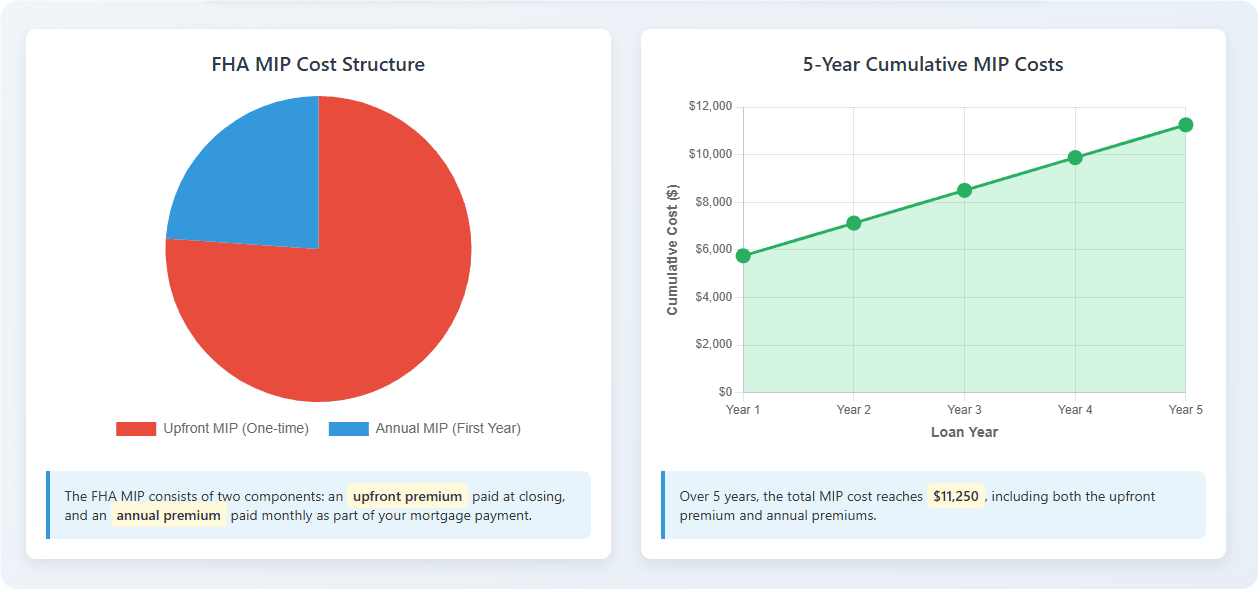

Think of FHA MIP as having two distinct price tags: one you pay at the start and another you chip away at monthly. Understanding this structure is key to knowing your true loan cost.

Upfront MIP (UFMIP) Rules: Your Opening Act

UFMIP kicks things off. It's a mandatory fee equal to 1.75% of your base loan amount. The catch? You usually don't write a big check at closing. Instead, this hefty sum is typically financed into your total loan amount. So, that $250,000 loan suddenly becomes $254,375 ($250,000 + 1.75%). It becomes part of the principal you pay interest on over the life of the loan. Sneaky, right?

People Also Read

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies?)

- Dreaming Of A North Carolina Home? How to Meet FHA Loan Requirements

- 15-Year FHA Streamline Refinance Rates and APR Guide for Homeowners in 2025

- FHA Loan Underwriting Requirements Explained: Income, DTI, Inspection & Manual Review Tips

- FHA Loan VS. Conventional Loan: Which Mortgage Really Works for You?

Annual MIP Rules & Calculations: The Long Haul

This is the ongoing cost, paid monthly. Don't be fooled by the name "annual" – it's divvied up into your monthly payment and handled via your escrow account. Your annual MIP rate isn't random; it's determined by HUD based on key factors:

Your Loan Term: 15 years or 30 years?

Your Loan-to-Value Ratio (LTV): This is the biggie!

90% LTV (e.g., 3.5% down payment): You pay a higher annual MIP rate (0.55% for a 30-year loan in 2025).

≤90% LTV (e.g., 10% down payment): You qualify for a lower annual MIP rate (0.40% for a 30-year loan in 2025).

Let's Crunch the Numbers (Example):

Imagine a $250,000 base loan with a 3.5% down payment (LTV >90%) and a 30-year term. Your annual MIP rate might be 0.55%.

Annual MIP Cost = $250,000 × 0.0055 = $1,375 Monthly MIP = $1,375 ÷ 12 = $114.58 (added to your principal, interest, taxes, and insurance payment)

(Note: Always verify current MIP rates with your lender or HUD, as they can change.)

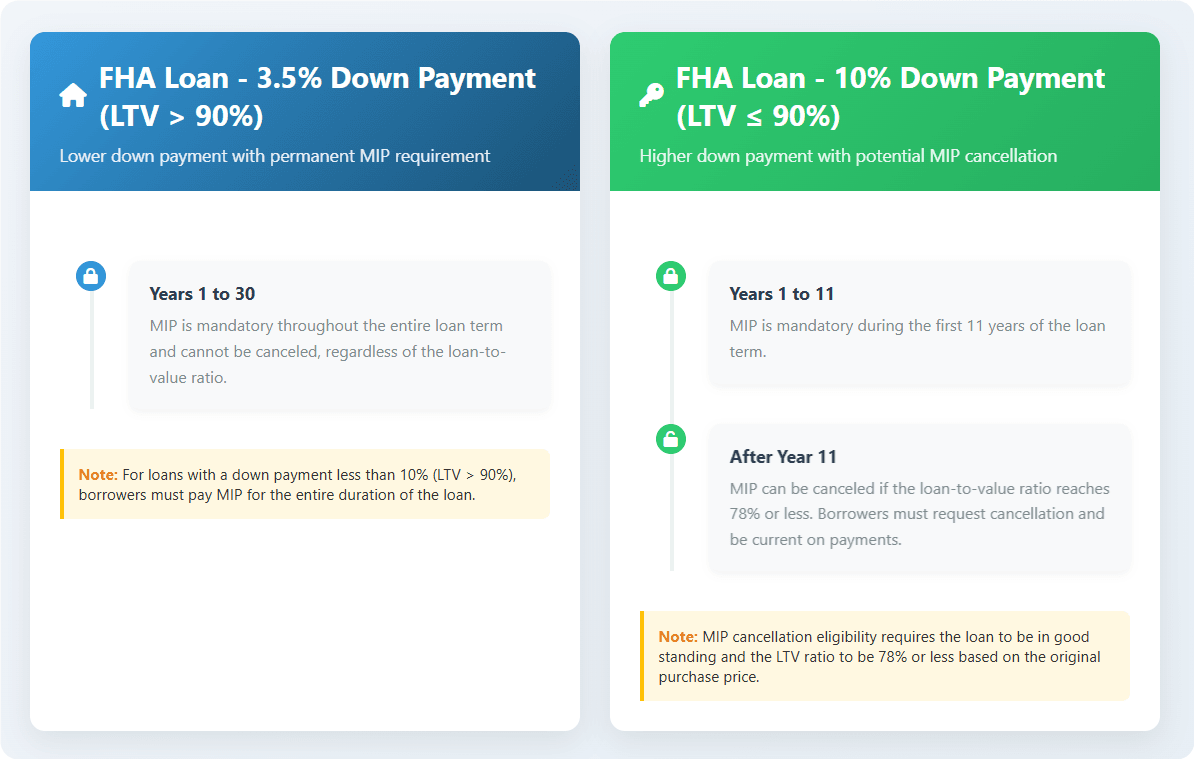

FHA MIP Duration & Cancellation Rules: The Heart of the Matter

Here's where FHA MIP rules truly diverge from conventional PMI and often catch borrowers off guard. Your down payment percentage is the master key determining how long you're stuck with MIP and if you can ever ditch it early. Spoiler: It's tough!

Rule 1: Loans with >90% LTV (3.5% Down Payment) - MIP for Life

If you put down the minimum 3.5%, brace yourself. Your annual MIP isn't just for a few years; it lasts for the entire life of the loan – whether that's 30 years or longer.

No Cancellation: Forget reaching 20% equity. Unlike PMI, hitting that milestone does nothing for you here. There is no option to cancel FHA MIP based on equity alone for these loans.

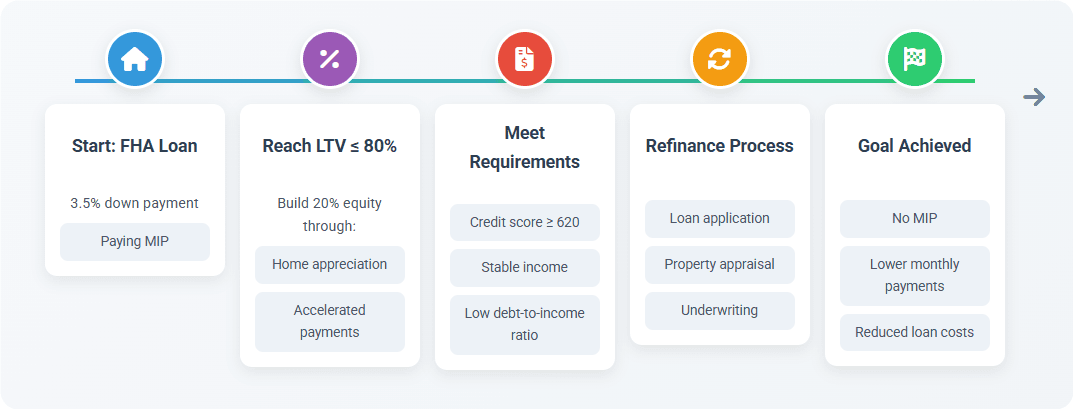

The Only Escape: Your sole exit strategy is to refinance to a conventional loan. This requires building at least 20% equity and qualifying based on credit and income. Refinancing costs money and resets your loan term, but it might save you thousands long-term.

Rule 2: Loans with ≤90% LTV (10%+ Down Payment) - The 11-Year Minimum

Putting down 10% or more gets you slightly better terms, but cancellation rules remain strict.

11-Year Minimum: You must pay annual MIP for a minimum of 11 years, regardless of how much equity you build.

The 78% LTV Threshold: Only after those 11 years and only if your loan balance has reached 78% of the original appraised value can you request cancellation.

The Critical Nuance: This calculation uses the original value, not the current market value. Home appreciation doesn't count! Making extra payments can help you reach the 78% original LTV faster, but they won't shorten the mandatory 11-year clock.

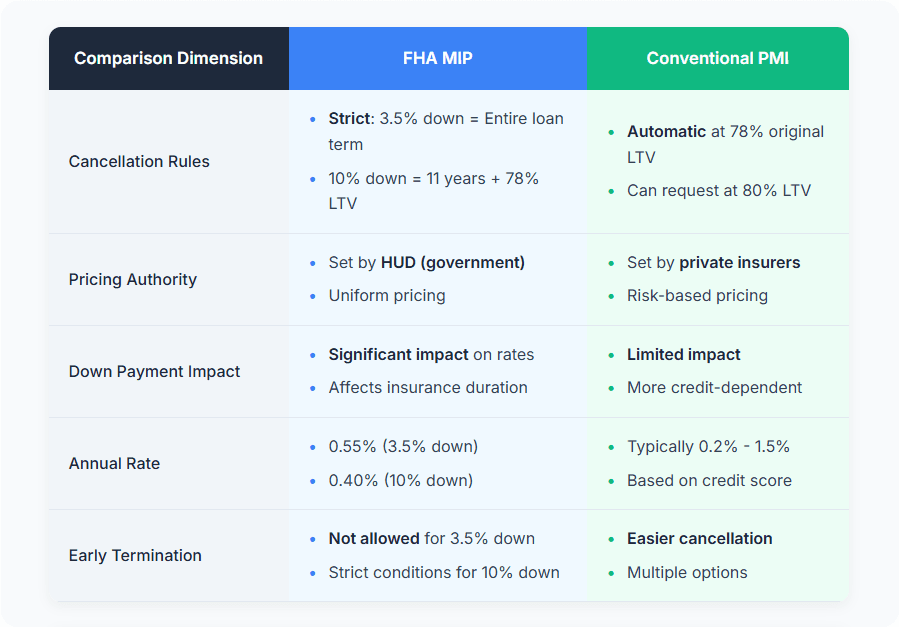

Why FHA MIP Cancellation is Nearly Impossible

Contrast this with conventional PMI rules: it automatically cancels once you reach 78% LTV based on the original value (or can be requested at 80%). FHA MIP rules, especially for the popular 3.5% down loans, create a significant borrower lock-in effect. This long-term cost is a major reason why refinancing becomes such a common goal for FHA borrowers once they build sufficient equity.

FHA MIP vs. Conventional PMI: Rule Differences at a Glance

Let's highlight why confusing MIP with PMI is a costly mistake. Here's the breakdown:

The Bottom Line: FHA’s cancellation rules are the least flexible, making long-term costs potentially much higher, especially for borrowers with the minimum down payment. FHA offers easier qualification, but MIP is the long-term trade-off.

Key Takeaways & Next Steps for Navigating FHA MIP Rules

Let's boil down those FHA mortgage PMI rules (remember, it's MIP!):

- MIP is Mandatory: All FHA loans require both Upfront and Annual MIP.

- Down Payment Dictates Duration: 3.5% down = MIP for life. 10%+ down = 11-year minimum (plus hitting 78% original LTV for cancellation).

- Cancellation is Rare: Automatic removal based on current equity simply doesn't exist for FHA loans under standard rules.

Your Action Plan:

- Calculate the True Cost: Don't just look at the interest rate. Factor in upfront MIP (financed!) and annual MIP over the expected life of the loan (often the full term if you put 3.5% down).

- Demand Comparisons: Ask lenders: "Show me side-by-side comparisons of FHA vs. conventional loan costs, projecting 5, 7, and 10 years out, including all insurance." See when refinancing might break even.

- Plan Your Refinance: If you start with FHA and 3.5% down, actively plan to refinance to a conventional loan once you reach 20% equity (based on current value) and your credit/finances support it. This is your primary escape route from lifelong MIP.

FHA MIP Rules: Quick FAQ

Q: Can I remove FHA MIP once I have 20% equity? A: No, not automatically. If you put only 3.5% down, MIP lasts the full loan term. If you put 10% or more down, you must pay MIP for at least 11 years AND your loan balance must be 78% or less of the original appraised value – home appreciation doesn't count.

Q: Does FHA MIP ever expire on its own? A: Only under specific conditions: You must have made a down payment of 10% or more, paid MIP for at least 11 years, AND your loan balance must be 78% or less of the original purchase price/appraised value. Otherwise, refinancing is required to remove it.

Q:What happens to the FHA upfront MIP if I refinance into a conventional loan? A:When you refinance from an FHA loan to a conventional loan, your upfront MIP is not refunded, except in rare cases where the refinance occurs within 3 years of the original FHA loan. Even then, the refund is partial and calculated on a sliding scale. Most borrowers should assume the upfront MIP is a sunk cost.

Q:Is FHA MIP tax deductible? A:Sometimes — but not always. In certain years, Congress allows mortgage insurance premiums (including FHA MIP) to be tax-deductible if your adjusted gross income (AGI) is below a specific threshold.