Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

When you’re considering an FHA loan in 2025, the very first question you’ll want answered is this: What is the current FHA UFMIP rate? For nearly all borrowers this year, the answer is 1.75%. That means if you’re approved for an FHA loan—whether it’s your first purchase, a refinance, or a streamline—you’ll pay an Upfront Mortgage Insurance Premium of 1.75% of your base loan amount. Usually, this isn’t paid out of pocket, but instead is added to your total loan balance. Still, it’s one of the most significant costs built into the FHA mortgage process, and it’s essential to know exactly how it fits into your overall numbers before you sign anything.

Now that you know the current FHA UFMIP rate for 2025, let’s break down everything else you need to understand about FHA mortgage insurance, including monthly MIP, how the numbers are calculated, how removal works, refund rules, and the differences between FHA and conventional options.

Navigating the world of FHA loans can sometimes feel like trying to solve a Rubik’s Cube with the stickers peeled off. If you’re buying your first place, refinancing, or simply staring at your loan statement wondering what that “MIP” line is all about, you’re in the right spot. This is where we get into the weeds—clearly and simply—on FHA mortgage insurance for 2025.

1. FHA MIP 101: What It Means and Why It’s Required

You’ve probably heard the acronym MIP tossed around, especially if you’re working with a lender who likes to talk fast. MIP stands for Mortgage Insurance Premium. Unlike regular homeowners insurance, MIP isn’t about protecting your house from fire or theft—it’s about protecting the lender (and, by extension, the FHA) if you stop making payments.

Here’s the gist: FHA loans are designed for buyers with lower down payments or less-than-perfect credit. Because these loans carry a bit more risk, the government says, “Fine, but every borrower has to pay insurance—just in case.” That’s your MIP.

You’ll run into two types: Upfront MIP, a one-time fee paid at closing (often rolled into your loan), and Annual MIP, which is actually paid monthly as part of your mortgage payment. Whether you’re buying your first place, refinancing to a better rate, or doing a streamlined FHA refinance, MIP is along for the ride.

And no, it’s not quite the same as PMI (Private Mortgage Insurance) on conventional loans. FHA loans have their own rules—and yes, their own quirks.

2. What’s New for 2025? Rules, Rates, and Trends

Each year, the numbers shift. For 2025, FHA has fine-tuned both its loan limits and some MIP calculations, keeping pace with rising home prices and changes in the housing market. If you’re eyeing a bigger home or a pricier area, pay attention to the updated FHA loan limits. There’s also renewed emphasis on debt-to-income ratios and minimum credit scores—lenders aren’t just rubber-stamping approvals.

Here’s what stands out this year:

- The annual MIP rate remains in that familiar range—generally between 0.55% and 1.05% of your loan amount, depending on your down payment, loan amount, and loan term.

- The Upfront MIP is still 1.75% for most new FHA loans.

- Rules around when you can drop MIP haven’t loosened (more on that in a bit).

Anyone promising you a “secret hack” to avoid MIP altogether probably has a bridge to sell you, too.

3. FHA Loan Types and MIP: Who Pays What?

FHA’s mortgage insurance isn’t one-size-fits-all. If you’re purchasing, refinancing, or using the streamline refinance program, you’ll run into different flavors of MIP.

- Standard FHA Purchase Loans: Upfront MIP + annual MIP.

- FHA Refinance: Also requires both upfront and annual MIP, but the math sometimes changes if you’re refinancing from another FHA loan.

- Streamline Refinance: This option, popular with folks just looking to lower their rate without much paperwork, still involves both upfront and annual MIP—but sometimes at a reduced rate if you qualify.

The specifics depend on factors like your loan-to-value ratio, term length (15-year vs. 30-year), and how much you’re putting down.

4. Understanding FHA MIP Costs: Rate Structure, Tables, and Calculators

Let’s break it down:

Upfront vs. Annual (Monthly) MIP

- Upfront MIP is typically 1.75% of your base loan amount. On a $350,000 loan, that’s $6,125—often rolled right into your total loan balance.

- Annual MIP is paid monthly, calculated as a percentage of your loan amount. Most borrowers see 0.55% to 0.85% (or sometimes up to 1.05%) as their annual rate.

Why Your Numbers May Differ

Your specific MIP rate is determined by:

- Your loan amount

- The length of your loan (15 vs. 30 years)

- Your loan-to-value ratio at closing (how much you put down)

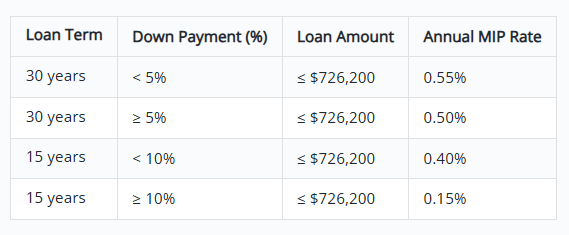

FHA Monthly MIP Chart 2025

For 2025, the most common rates look like this:

If you’re buying a particularly expensive property, or putting more down, your rate might vary—always check the current chart or use a reputable calculator.

How to Calculate Your Monthly MIP

Let’s say you have a $300,000 FHA loan at 0.55% annual MIP.

- Multiply $300,000 × 0.55% = $1,650 per year

- Divide by 12 = $137.50 per month

No rocket science, but easy to get wrong if you mix up annual and monthly numbers. There are plenty of reliable calculators online if you’d rather skip the math.

5. Removing FHA MIP: When (and If) It Goes Away

Now, the question every FHA borrower asks sooner or later: “Can I get rid of this insurance?”

Here’s the honest answer:

- If you put down less than 10%, MIP sticks around for the entire life of your loan.

- If you put down at least 10%, MIP is scheduled to drop off after 11 years.

There’s no “call the lender and ask” trick. These rules are set in stone by the FHA, and lenders have to follow them. If you want to ditch MIP before then, your best move is usually to refinance into a conventional mortgage—assuming you’ve built enough equity and your credit’s in good shape.

A quick word to the wise: don’t confuse MIP with PMI. While both are mortgage insurance, their rules and removal policies are night-and-day different.

6. FHA MIP Refunds: What to Know When Selling or Refinancing

Most borrowers never realize there might be a partial refund of their Upfront MIP if they sell or refinance soon after getting their FHA loan. Here’s how it works:

- Upfront MIP refunds are possible if you pay off your FHA loan (via sale or refinance) within the first three years.

- The refund is not cash-in-hand—it’s typically credited toward the upfront MIP on your next FHA loan, or applied at closing.

Refund amounts shrink each month after closing. For example, if you refinance after one year, you might get about 60% of your upfront MIP back. After three years, there’s nothing left to refund.

You can find the exact numbers on the current FHA MIP Refund Chart (HUD publishes this every year), or ask your lender to run the calculation for you. Don’t leave potential savings on the table.

7. FHA, PMI, UFMIP, and Funding Fees: How They All Stack Up

It’s easy to get lost in the alphabet soup. Here’s a cheat sheet:

- FHA MIP: For all FHA loans—upfront and annual (monthly).

- PMI: Private mortgage insurance, used for conventional loans with less than 20% down.

- UFMIP: Upfront Mortgage Insurance Premium, specific to FHA—usually rolled into your loan.

- Funding Fee: A term you’ll hear with VA and USDA loans, not FHA.

If you’re comparing FHA and conventional side-by-side, remember: PMI on conventional loans can often be cancelled sooner, while FHA MIP is stickier—unless you refinance out of FHA.

8. Common FHA MIP Questions (and Some You Didn’t Know to Ask)

How do I check my current MIP rate or see when it will fall off? Ask your lender for a full payment schedule or look at your closing disclosure—the details are there, though they’re often buried in legalese.

Is there any way to avoid MIP on an FHA loan? Not really. If you want to avoid mortgage insurance altogether, you’ll need to put down 20% and use a conventional loan.

What happens if I refinance my FHA loan into another FHA loan? You’ll pay a new Upfront MIP, but you might get a partial refund of your previous one. This is where the refund chart comes in handy.

Does my credit score impact my MIP rate? Surprisingly, not directly. FHA MIP rates are set by the FHA and don’t adjust for credit the way conventional PMI rates do. However, your credit still matters for loan approval and your interest rate.

9. The Takeaway for 2025

Owning a home with an FHA loan doesn’t mean you’re doomed to pay mortgage insurance forever, but it does mean you need to plan ahead. Keep an eye on your equity. If rates drop and your home value rises, check whether refinancing to a conventional loan makes sense. And if you’re new to FHA loans in 2025, walk in with your eyes open: MIP is part of the deal, but at least now you know exactly what to expect—and how to make the most of it.

Need tailored advice? Every situation is unique. If you’re still unsure how FHA MIP applies to your plans, reach out to a mortgage professional who knows the ropes. A little homework now can save you thousands in the years ahead.

People Also Read

- FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

- FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

- Can You Put 20% Down on an FHA Loan? Everything Homebuyers Need to Know About FHA Down Payments

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You