Easy Second Mortgage Loans in 2025: Fast Approval, Low Hassle Guide

Ever felt like your house is sitting on a pile of cash you just can’t quite reach? You’re not alone. That’s the magic – and sometimes the frustration – of home equity. When folks search for easy second mortgage loans, they’re usually dreaming of a financial life raft that’s simple to grab, doesn’t demand jumping through endless hoops, and arrives quickly. They want that equity unlocked, pronto. This guide is your map to navigating that terrain in 2025, whether you're eyeing a straightforward home equity loan or the flexible rhythm of a HELOC. We’ll explore how to find a truly fast home equity loan that lives up to the "easy" promise.

People Also Read

- Quick Second Mortgage Loan in 2025: Fast Home Equity Loans & HELOCs Explained

- 2nd Mortgage Rates 2025: The Complete Guide to Saving Money

- How to Get Approved for a Second Mortgage: Key Requirements & Strategies

- Do I Need 20% Down to Buy a Second Home

- Second-Time Home Buyer Mortgages: Requirements, Programs & Strategies

What Exactly Are "Easy Second Mortgage Loans"? It's More Than Just a Name

Okay, let’s peel back the label. A second mortgage is exactly what it sounds like: another loan secured by your house, behind your main mortgage. Think of it as pulling cash out of the value you’ve built up – your home equity. But here’s the catch lenders might whisper: it’s a junior lien. Translation? If things go south and your house is sold, the first mortgage gets paid off completely before this second loan sees a dime. That extra risk for the lender is why second mortgage interest rates usually sit higher than your primary loan. So, when we talk "easy," it’s crucial to understand the trade-off – simpler access often comes with a price tag reflecting that risk. True easy second mortgage loans streamline the process, not necessarily the cost.

People Also Read

- Apply for a Second Mortgage Online: Fast Approval, Paperless Process and Bank-Level Security

- Easy Second Mortgage Loans in 2025: Fast Approval, Low Hassle Guide

- How to Get Approved for a Second Mortgage: Key Requirements & Strategies

- Do I Need 20% Down to Buy a Second Home

- Second-Time Home Buyer Mortgages: Requirements, Programs & Strategies

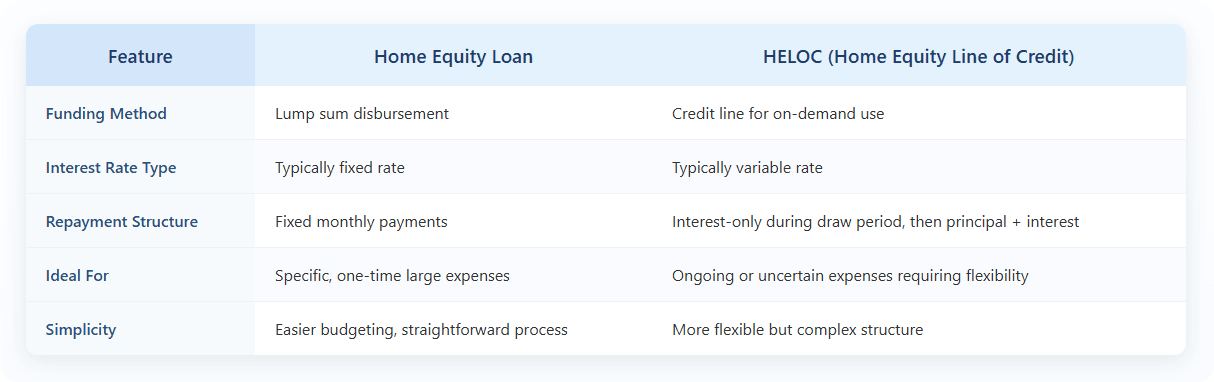

Your Two Main Paths: Home Equity Loan vs. HELOC – Which Feels Simpler?

Home Equity Loan: The Predictable Power Play

Imagine getting one big lump sum of cash, deposited straight into your account. That’s the home equity loan. You repay it with regular installments, usually at a fixed interest rate, so your payment stays the same month after month. This predictability? That’s its "easy" superpower. Budgeting becomes straightforward. It’s tailor-made for those big, known expenses – like finally tackling that dream kitchen renovation or strategically doing some debt consolidation to simplify your monthly payments. If knowing exactly what you owe and when brings you peace of mind, this route often feels like the simpler easy second mortgage loans option for a single, defined goal.

HELOC: Your Flexible Financial Tap

Need more of a "use it as you need it" approach? Enter the HELOC – a Home Equity Line of Credit. Picture it like a credit card backed by your house. You get a credit limit, and during the "draw period" (often 5-10 years), you can tap into it repeatedly, paying interest only on what you’ve actually borrowed. Need funds for unexpected medical bills? Just draw. Building an emergency fund? It’s there. This flexible access is the core of its "easy" appeal. After the draw period, you enter the repayment phase, paying back the balance plus interest. If your needs are ongoing or uncertain, the HELOC offers a fluidity that other easy second mortgage loans can’t match.

Cracking the Code: What Do You Really Need to Qualify for Easy Second Mortgage Loans?

Lenders aren’t just handing out cash willy-nilly. They peek under your financial hood. Here’s what they’re checking to see if you qualify for a second mortgage:

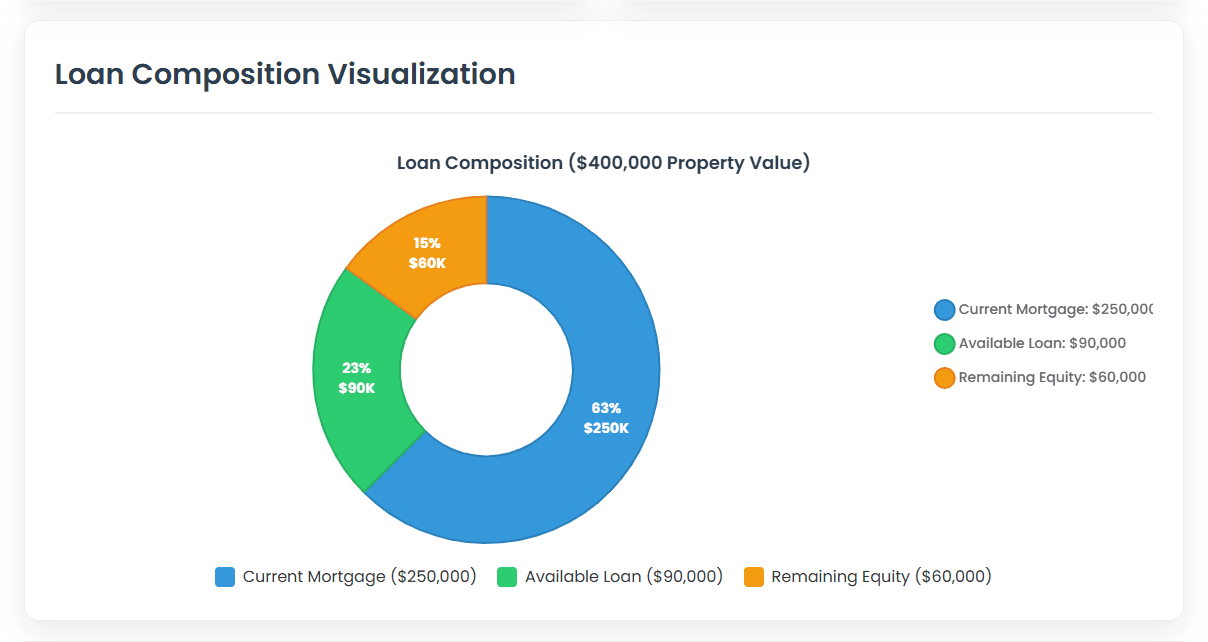

Your Home Equity (The Foundation)

This is king. Most lenders want you to keep at least 15%-20% skin in the game after getting your second loan. That means your Combined Loan-To-Value ratio (CLTV) – that's your first mortgage balance plus the new second loan amount, divided by your home’s value – usually needs to be 80% or 85% max. Quick example: Home worth $400k? First mortgage balance $250k? You might be able to borrow up to $90k ($400k x 85% = $340k - $250k = $90k). More home equity equals smoother sailing for easy second mortgage loans.

Your Credit Score (The Trust Meter)

This tells lenders how reliably you’ve paid debts. Yes, some second mortgage lenders might say yes with scores dipping towards 620. But let’s be real – snagging the best rates and truly easy second mortgage loans terms? You’ll want a score comfortably above 680, ideally 700+. Your credit score directly fuels how "easy" and affordable this gets.

Debt-to-Income Ratio - DTI (The Affordability Gauge)

Can you actually handle another payment? Your DTI is your total monthly debts divided by your gross monthly income. Lenders typically draw a line around 43%. Lower is always better. Calculate yours: Add up all minimum monthly debt payments (car, credit cards, student loans, existing mortgage), divide by your monthly pre-tax income, multiply by 100. That’s your debt-to-income ratio. Hitting that loan requirements target is crucial.

Proof of Stable Income (The Paycheck Proof)

Lenders need confidence the money to repay them is coming in reliably. Be ready to show recent pay stubs, W-2s, and maybe tax returns. If you’re self-employed, brace yourself for more paperwork – profit/loss statements, business tax returns. Solid proof of income is non-negotiable for any second mortgage application.

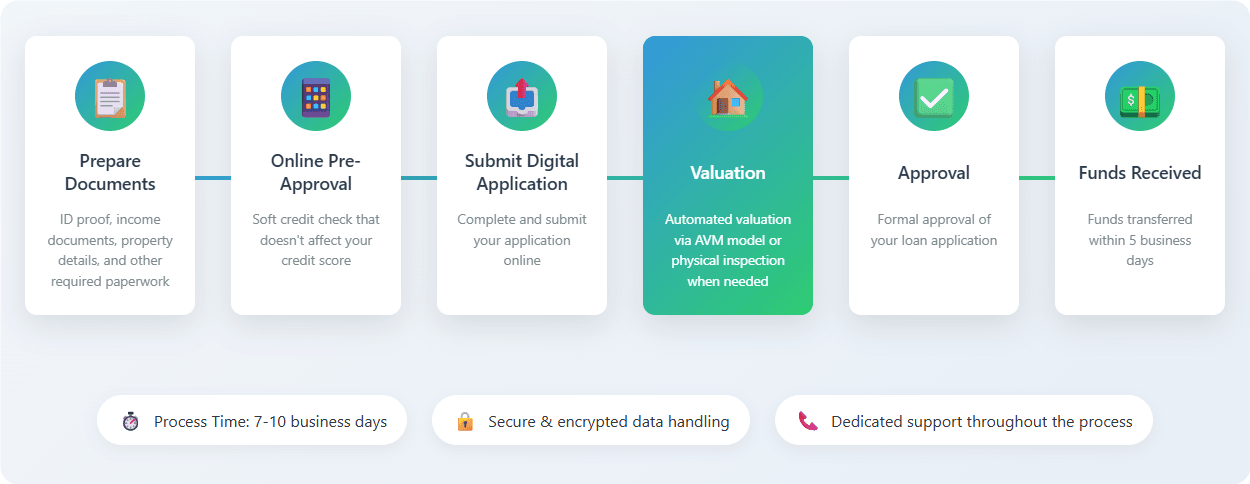

Making "Easy" a Reality: How to Speed Up Your Second Mortgage Application

Want that fast home equity loan? Don't just wish for it, prep for it! The smoother your second mortgage application, the quicker the cash lands.

Your Pre-Application Checklist (Get This Done Yesterday!)

Gather this before you even talk to a lender:

- ID & Social Security: Driver’s license, passport, SSN card.

- Income Proof: Recent pay stubs (last 30 days), W-2s/1099s (last 2 years), tax returns (last 2 years), bank statements (last 2 months).

- Mortgage Info: Latest statement showing your first mortgage balance and payment history.

- House Details: Your homeowner's insurance policy and latest property tax bill.

- Asset Proof: Statements for savings, investments, retirement accounts.

Having this arsenal ready is the single biggest step towards a fast home equity loan. Seriously, it cuts days or even weeks off the process.

Decoding the Lender's "Easy" Button

What makes some lenders shout "easy second mortgage loans" from the rooftops?

- Online Pre-Qualification: Answer a few quick questions online for an instant, soft-credit-check estimate of what you might get. No commitment, just insight.

- Fully Digital Apps: Upload docs, e-sign everything from your couch. No printing, no scanning, no faxing (remember those?).

- AVM Magic: Automated Valuation Models use data to estimate your home value instantly, skipping the wait for a physical appraisal (in many cases).

- Blink-and-It's-There Funding: Some promise funds in your account within 5 business days after approval.

But here’s the fine print: these blazing-fast easy second mortgage loans lanes are often reserved for folks with stellar credit, high equity, and pristine finances. For everyone else, "easy" might still mean "simpler than the old way," but perhaps not instant.

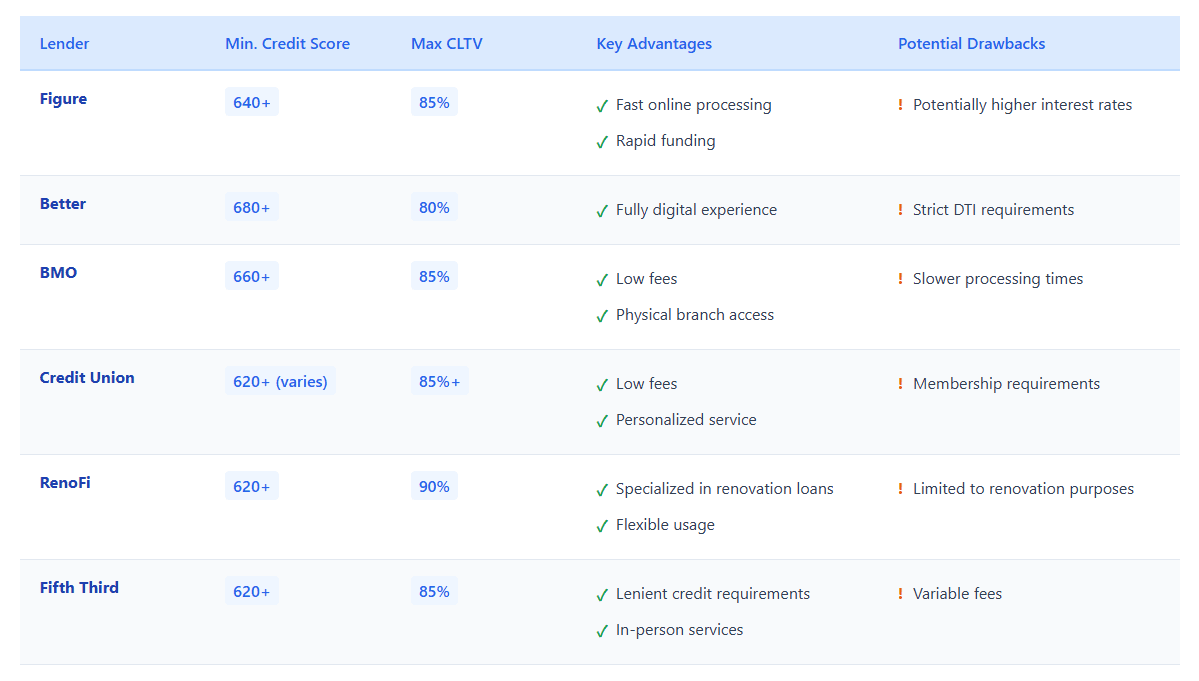

Finding Your Perfect Match: Top Lenders for Easy Second Mortgage Loans (2025 Edition)

Not all second mortgage lenders are created equal, especially when "easy" is your goal. Here’s a quick peek at who shines where:

Need Speed Demons?

Look at lenders like Figure or Better. They’ve built reputations on tech-driven, rapid processes aiming for that fast home equity loan experience.

Fee Phobic?

Banks like BMO or savvy credit unions (check out options like SCCU if you're eligible) often have competitive fee structures, keeping your upfront costs lower.

Credit History a Bit Bumpy?

RenoFi (specializing in renovation financing) or Fifth Third Bank might offer more flexible credit guidelines than the ultra-picky online players, making easy second mortgage loans more accessible even if your score isn't perfect.

Quick Lender Comparison Snapshot:

Don't Get Blinded by "Easy": The Real Risks of Second Mortgages

Let’s have a crucial heart-to-heart. That "easy" access comes with serious strings attached. Understanding this is part of making a smart decision.

The Big One: You Could Lose Your Home

This isn’t scare tactics; it’s reality. Your house is the collateral. If you default on your second mortgage, the lender absolutely has the legal right to initiate foreclosure, even though it’s a junior lien. Yes, the first mortgage gets paid off first from the sale proceeds, but if there’s not enough left, the second lender will pursue repayment, and foreclosure is their ultimate tool. Treating your second mortgage repayment as sacred is non-negotiable.

Spotting the Sharks: Predatory Lending Red Flags

Sadly, the hunt for easy second mortgage loans can attract unscrupulous players. Protect yourself:

- Sky-High Fees: Origination fees, closing costs, or "points" that seem way out of line with the market? Alarm bells.

- Abusive Prepayment Penalties: Trapping you with massive fees if you pay off the loan early? A major red flag.

- Pressure Cooker Sales Tactics: "Sign NOW or this deal disappears!" or discouraging you from reading the fine print? Run.

- Loan Flipping: Constantly pushing you to refinance into new loans, generating more fees for them? Bad news.

- Ignoring Your Ability to Repay: If they don’t seem to care about your income or DTI, be extremely wary.

Predatory lending preys on the vulnerable. If an offer feels too good to be true, especially for easy second mortgage loans, it almost certainly is.

Making "Easy" Work For You: The Smart Path Forward

So, where does this leave us? Truly easy second mortgage loans aren’t found in shortcuts or desperation. The real simplicity comes from being prepared, understanding your options, and choosing wisely. It means comparing offers, reading every line of the agreement (especially the fees and the APR!), and brutally honestly assessing if the payments fit your budget long-term. Your home is more than just an asset; it’s your sanctuary. Tapping its equity can be a powerful financial move for debt consolidation, investments, or emergencies, but only when done with eyes wide open. Prioritize your long-term financial health. Do the homework, ask the questions, and ensure that "easy" today doesn't become a burden tomorrow. That’s how you unlock the real power of your home equity safely.