How to Get Approved for a Second Mortgage: Key Requirements & Strategies

So you’re eyeing that kitchen renovation, your kid’s college fund, or maybe just breathing room from pesky debts. Your home’s equity seems like the golden ticket, but one question nags: "Is getting approved for a second mortgage actually doable for me?"

Here’s the raw truth: It hinges on four bedrock pillars lenders scrutinize like hawk-eyed bouncers at an exclusive club – your Credit Score, Debt-to-Income Ratio (DTI), Home Equity, and rock-solid Income. Nail these, and the velvet rope lifts. Stumble, and… well, rejection stings. But don’t sweat it yet. Whether it’s hard depends entirely on your financial fingerprint. Stick with me, a grizzled veteran of a thousand loan files, and I’ll show you exactly how lenders size you up and – crucially – how to tip the risk assessment scales in your favor. Let’s get you past the gatekeepers.

People Also Read

- Quick Second Mortgage Loan in 2025: Fast Home Equity Loans & HELOCs Explained

- 2nd Mortgage Rates 2025: The Complete Guide to Saving Money

- Second-Time Home Buyer Loans: Your Smarter Path to the Perfect Upgrade

- Do I Need 20% Down to Buy a Second Home

- Second-Time Home Buyer Mortgages: Requirements, Programs & Strategies

The Core 4: What Lenders Demand for Your Second Mortgage

Forget fluff. Loan officers live and die by these metrics. Master them.

1.1 Credit Score: Your Financial Handshake

Think of your credit score (aim for 680+, though 700+ opens better doors) as your first impression. It whispers (or shouts) your reliability. Lenders dissect your report:

Payment History (35% weight): Late payments? Major red flags. Even one 30-day late can hurt.

Credit Inquiries: Too many recent hard pulls? Looks desperate. Space them out.

Credit Age & Mix: Older, diverse accounts (credit cards, auto loan) boost trust.

Quick Boost Tactics (Do These NOW!):

Become a Ghost: Pay down revolving debt (credit cards) to keep utilization under 30%. Maxed cards scream risk.

Error Patrol: Dispute ANY inaccuracy on your reports (Experian, Equifax, TransUnion). Errors are common!

Become an Authorized User: Piggyback on a trusted person’s stellar, old credit card (if they allow it).

1.2 Debt-to-Income Ratio (DTI): Your Budget's Tightrope Walk

Your DTI ratio is the cold math of what you owe vs. what you earn. Lenders typically cap total DTI at 43-45%, including both mortgages. Calculate it:

(Total Monthly Debt Payments + New 2nd Mortgage Payment) / Gross Monthly Income = DTI%

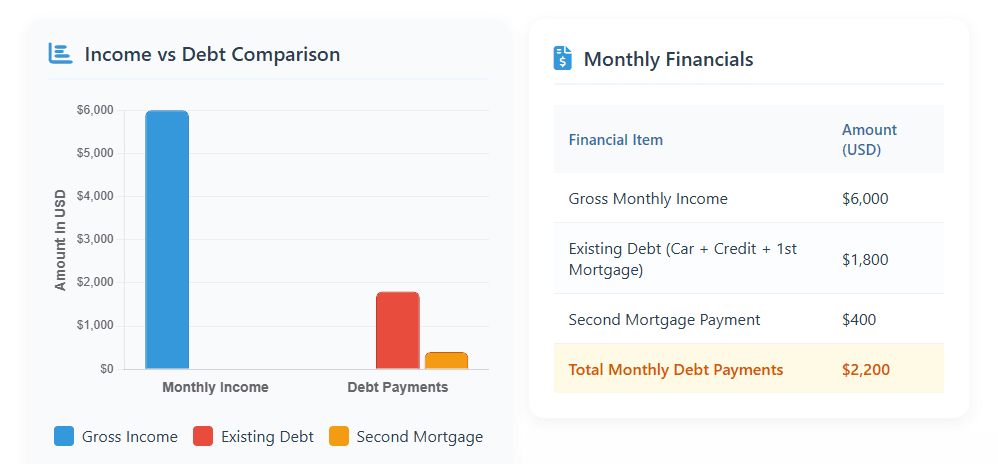

Example: You earn $6,000/month.

Current Debts (Car, Credit Cards, 1st Mortgage): $1,800

Proposed 2nd Mortgage Payment: $400

Total Payments: $2,200

DTI: $2,200 / $6,000 = 36.7% (Approved!)

Slash Your DTI:

Kill Small Debts: Pay off credit cards or small loans. Fewer payments = lower DTI.

Boost Income (Seriously): Side hustle? Overtime? Document it! Every extra dollar helps.

Avoid New Debt: Don’t finance that car before applying!

1.3 Home Equity & LTV: Your Property's Muscle

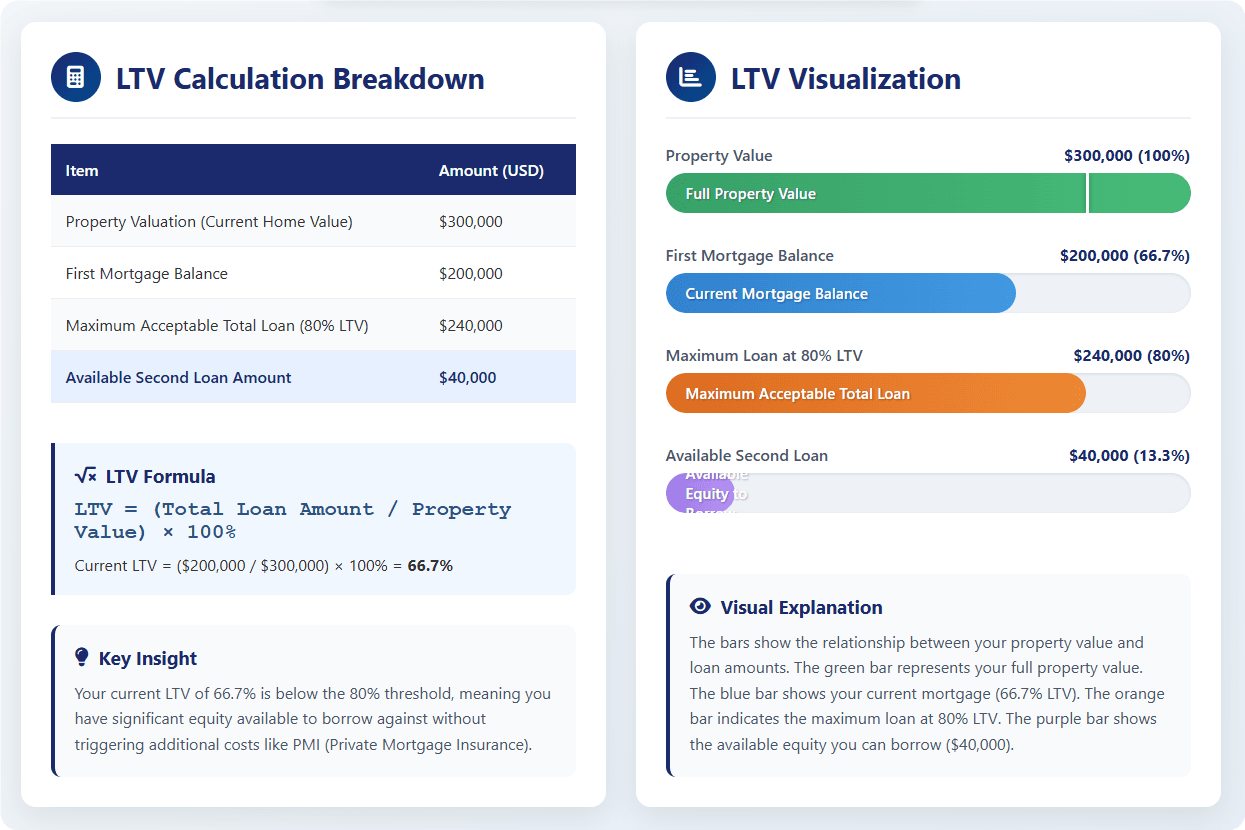

Home equity is your skin in the game. Most lenders demand 15-20% equity left AFTER the second mortgage. This is measured by Loan-to-Value (LTV):

(First Mortgage Balance + Proposed 2nd Mortgage Amount) / Home's Current Value = Total LTV%

Target: Keep Total LTV under 80-85% (some go to 90% for stellar borrowers). A $300k home with a $200k first mortgage? To keep LTV at 80%, your max combined loans would be $240k. So, your max second mortgage is roughly $40k.

The Appraisal Wildcard: That online estimate? A rough guess. The lender’s appraisal rules. If it comes in low, your equity shrinks – and your potential loan with it. Get a professional opinion before banking on Zillow.

1.4 Stable Income & Paper Trail: Proving You Can Pay

Lenders need proof the money keeps coming. Prepare for income verification paperwork:

W2 Employees: Last 2 years W-2s, 30 days of pay stubs, 2 months bank statements.

Self-Employed/Freelancers: 2 years personal and business tax returns (all schedules!), profit/loss statements, 6-12 months bank statements. Tougher, but doable.

Reserves Matter: Having 2-6 months of mortgage payments (for all loans) sitting in your savings (reserves) is golden, especially for investment properties or higher DTI. Shows you can weather storms.

Is Getting a Second Mortgage Actually Hard? The Honest Scoop

2.1 The Difficulty Meter: What Really Moves the Needle

Compared to your first mortgage? Yes, the bar is often higher. Lenders see this as additional risk. Key factors:

Your Property Type:

Primary Home: Easiest. Lenders feel you'll fight hardest to keep it.

Second/Vacation Home: Harder. Seen as less essential.

Investment Property: Toughest. Strictest rules, highest rates/fees.

Loan Purpose: Using funds for home improvements (which boosts value)? Lenders like that. Debt consolidation? They get wary – prove you’ve fixed the spending habits!

2.2 Why Applications Get Denied (And How to Bounce Back)

Hear "no"? These are the usual suspects:

Credit Score Too Low: <620 is often an auto-reject. See Section 1.1 fixes!

Insufficient Equity/LTV Too High: Your home hasn't appreciated enough, or you want too much.

DTI Exploded: Too much other debt piled on.

The Seasoning Surprise: Many lenders require you've owned the home and paid the first mortgage for 6-12 months (seasoning period) before tapping equity. No shortcuts here – time is needed.

Your Recovery Plan:

Get the SPECIFIC reason (lender must provide it).

Attack the Weakness: Boost credit, pay down debt, wait for seasoning/appreciation.

Reapply in 3-6 months with documented improvement.

2.3 Boosting Your Odds: Be the Borrower They Want

Get PRE-APPROVED: This isn't just a guess. It’s a lender reviewing your docs early, giving conditional approval. Shows sellers you’re serious and reveals your budget. Non-negotiable.

Shop Lenders LIKE A PRO: Don’t just compare rates! Ask:

What’s your minimum credit score for a second mortgage?

What max LTV/CLTV do you allow?

What are ALL the fees? (Origination, appraisal, title, etc.)

How do you treat bonuses/commission income?

Polish Your Application: Complete docs, accurate info, explain any blips (e.g., "This 2020 late payment was due to medical emergency, resolved").

Getting It Done: Your Roadmap & Clever Alternatives

3.1 Your Step-by-Step Approval Journey

Self-Check: Use a second mortgage calculator (like this one: [Link to Calculator]) – estimate payments, rates, fees. Know your numbers!

Pre-Approval: Submit basic docs. Get your spending limit.

Formal Application & Docs: Lender dives deep. Provide EVERYTHING.

Appraisal: Lender orders it. Cross fingers it hits value!

Underwriting: The deep dive. Respond quickly to any requests.

Closing: Sign the mountain of papers. Pay closing costs (2-5% of loan – title fees, appraisal, origination, escrow, etc.). Negotiate! Some fees (like origination) can be haggled or offset by lender credits.

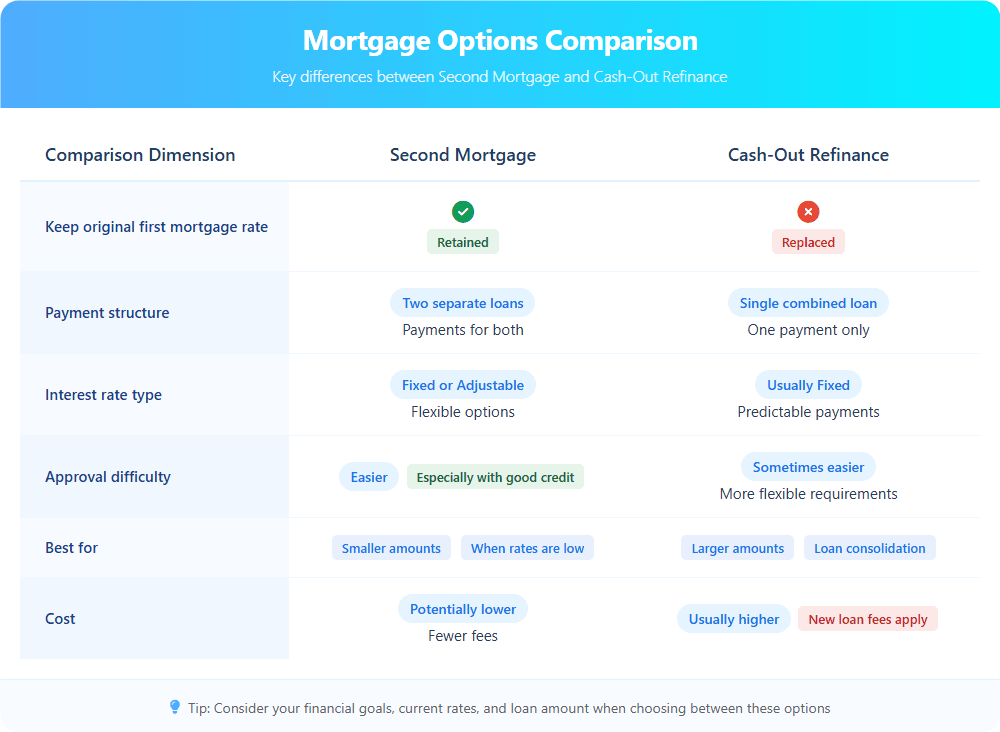

3.2 Second Mortgage vs. Cash-Out Refi: The Smackdown

Second Mortgage (Home Equity Loan/HELOC):

Easier Approval? Often YES if your first mortgage has a killer low rate you don't want to lose. You keep that intact.

Good For: One-time lump sums (Home Equity Loan) or flexible access (HELOC).

Downside: Two payments. HELOC rates are usually variable.

Cash-Out Refinance:

Easier Approval? Maybe if you have lower credit or need higher LTV. Combines everything into one new loan.

Good For: Simplifying payments, locking a fixed rate on all your debt.

Downside: You lose your original low first mortgage rate. Higher upfront closing costs.

The Verdict: Protecting a stellar first mortgage rate? Second mortgage wins. Simplifying life or have so-so credit? Cash-out refi might be easier to get.

3.3 HELOCs: The Flexible Sibling

A HELOC (Home Equity Line of Credit) is a type of second mortgage, acting like a credit card against your equity.

Qualification Differences: Lenders often prioritize credit score (680-720+ common) and property value heavily for HELOCs. DTI is crucial, but the revolving nature makes score king.

Flexibility: Draw funds as needed during the "draw period" (e.g., 10 years), pay interest only.

Risk: Variable rates can rise. Temptation to overspend. After the draw period, repayment (often 20 years) starts – can be a payment shock.

Best For: Ongoing projects (renovations), emergency funds, savvy investors managing cash flow. Need a fixed lump sum? A traditional home equity loan (fixed rate, fixed term) is likely better.