![[Ultimate Guide] How to Look up NMLS License of Loan Officers?](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Flookup_nmls_loan_officer_banner_335180c78f.png&w=3840&q=75)

[Ultimate Guide] How to Look up NMLS License of Loan Officers?

Applying for a home loan is really a big decision and also involves quite a bunch of private files. According to National Mortgage Professional, the annual turnover rate for the mortgage industry is about 25%. Therefore, it's important to do an NMLS lookup and see whether your loan officer is valid and certified. Now, let's see how it works. Also, MyMortgageRates ensures that every loan officer nearby is certified and professional.

What is NMLS?

The Nationwide Multistate Licensing System and Registry (NMLS) is the national online platform state regulators use to manage licensing, registration, and renewal for mortgage companies, branches, and mortgage loan originators (MLOs). NMLS began in 2008 through an effort by the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators to make licensing consistent across states and to reduce fraud.

Today hundreds of thousands of industry users rely on NMLS to maintain their license or registration. NMLS assigns a permanent NMLS ID to each company, branch, and individual so regulators and consumers can follow a professional as they move between firms or states. For consumers, the free NMLS Consumer Access site lets anyone verify whether a loan officer is licensed, what states they're authorized to operate in, and whether there are reportable regulatory actions.

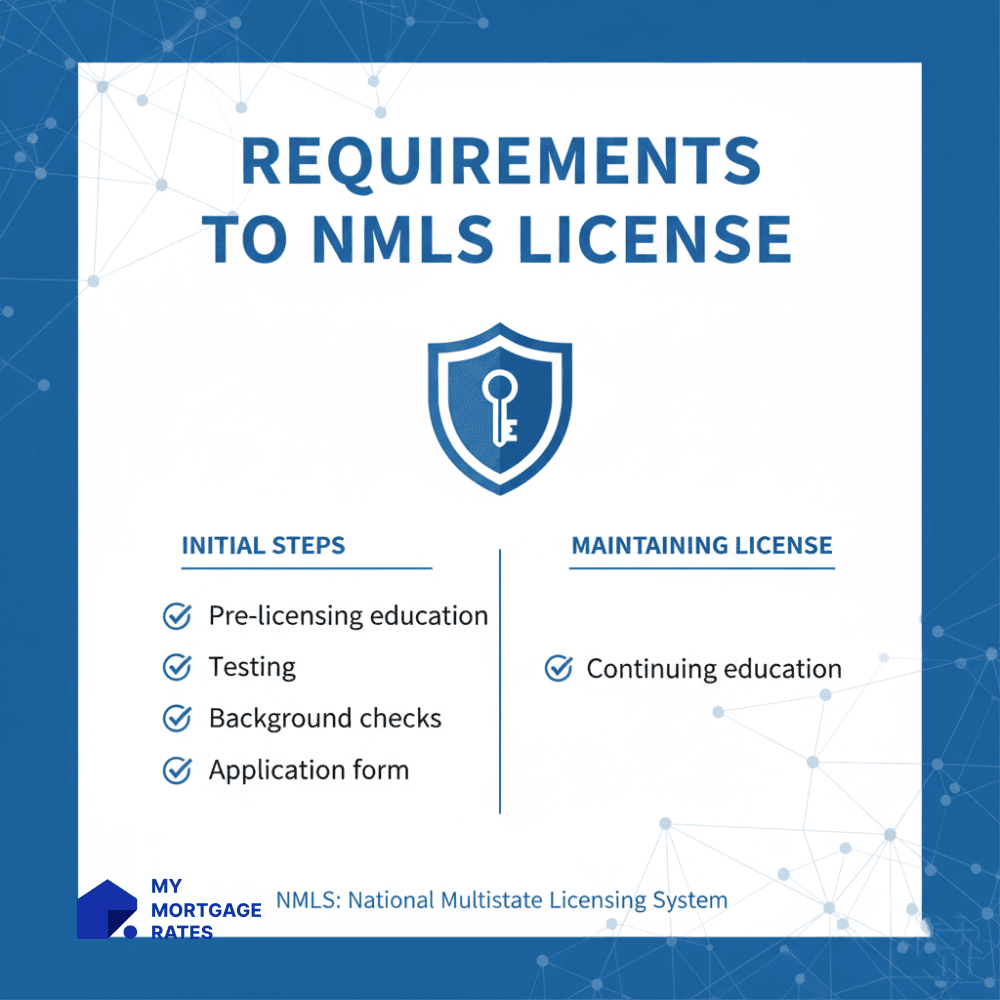

Requirements to NMLS License

If you want to be a state-licensed mortgage loan officer, you must meet federal and state requirements established by the SAFE Act and implemented through NMLS. Here are some requirements you should know.

-

Pre-licensing education: 20 hours of NMLS-approved pre-licensing courses, including federal law, ethics, nontraditional mortgage products, and elective topics.

-

Testing: Passing the national licensing exam and any state-specific tests required by the state regulator.

-

Background checks: FBI criminal background checks and authorization for a credit report are part of the application process.

-

Application form: Individual applicants use Form MU4 when applying for an individual license/registration through NMLS.

-

Continuing education: Even after licensing, it's not the end. Actually, most state-licensed MLOs must complete 8 hours of NMLS-approved continuing education annually, which include 3 hours federal law, 2 hours ethics, 2 hours nontraditional mortgages, plus 1 elective. States can add extra requirements.

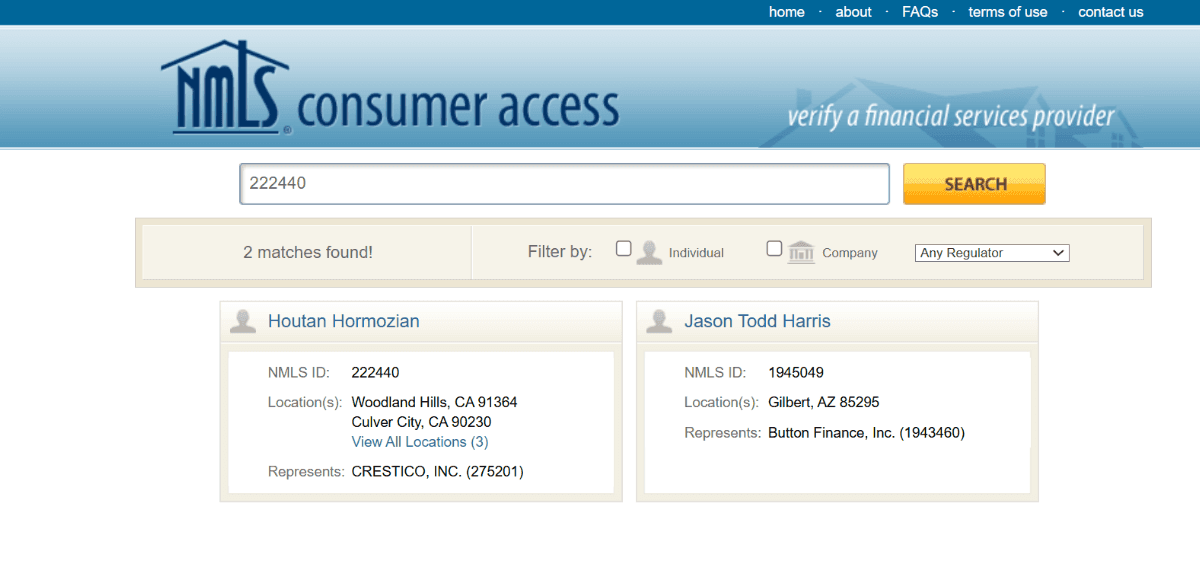

How to Look up a Loan Officer NMLS?

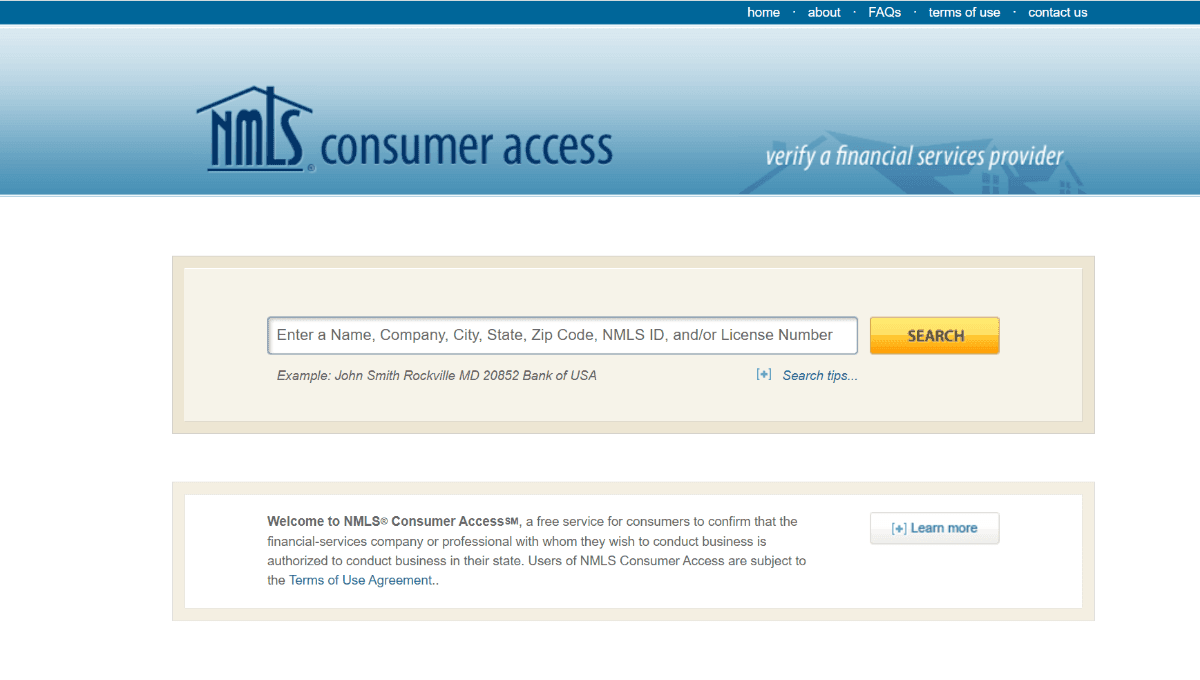

Actually, it cannot be easier for anyone to look up the NMLS ID number for free. NMLS Consumer Access makes it super simple. Here's the step-by-step guide for any first-time homebuyer.

STEP 1: Visit NMLS Consumer Access on your browser on desktop or mobile.

STEP 2: Just enter the NMLS ID in the SEARCH bar. Also, you can do NMLS lookup by name, company, city, state, zip code, or license number.

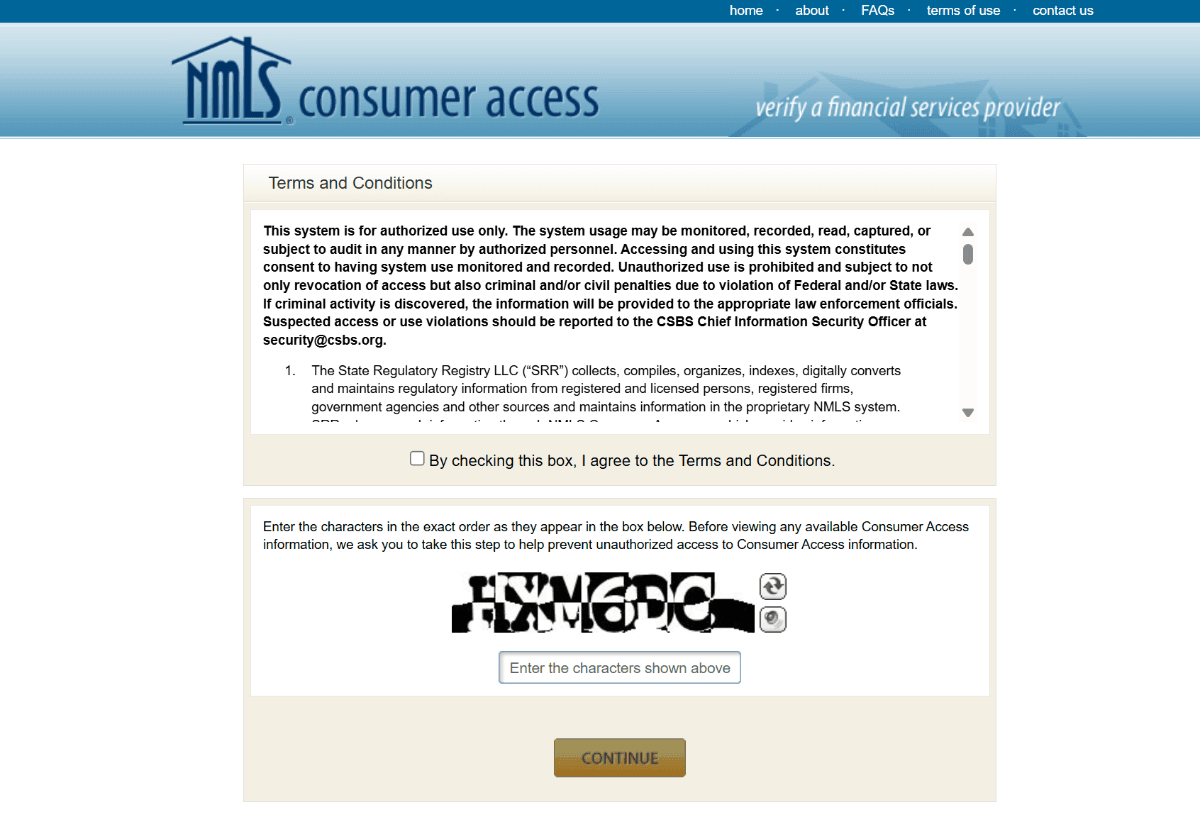

STEP 3: Check the box to agree to the Terms and Conditions, and enter the code to continue.

STEP 4: Check out the results that match your query. Then, choose the loan officer you want to look up.

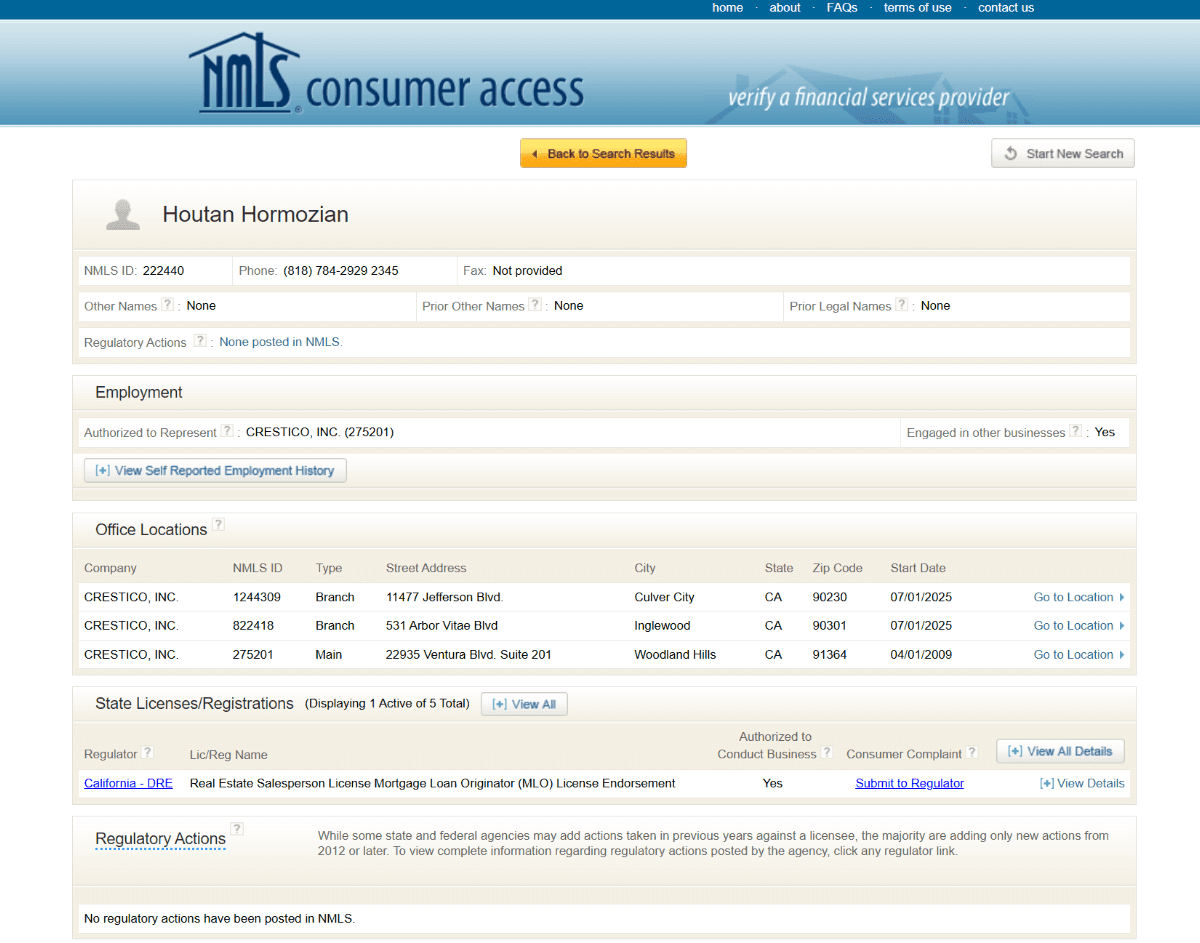

STEP 5: Take a look at the loan officer NMLS lookup page and learn about his employment, officer locations, state licenses, and regulatory actions.

Why Homebuyers Should Know About NMLS?

NMLS lookup protects homebuyers by confirming they're working with a licensed, accountable professional. The public record shows whether a mortgage originator is licensed in your state and flags reportable disciplinary actions, which helps you avoid unlicensed or problematic operators.

The SAFE Act and state rules require education, testing, and ongoing CE for licensed MLOs, so a valid NMLS record is a basic signal of regulatory oversight. Verifying license status only takes a few minutes, but can save you from scams and misrepresentation.

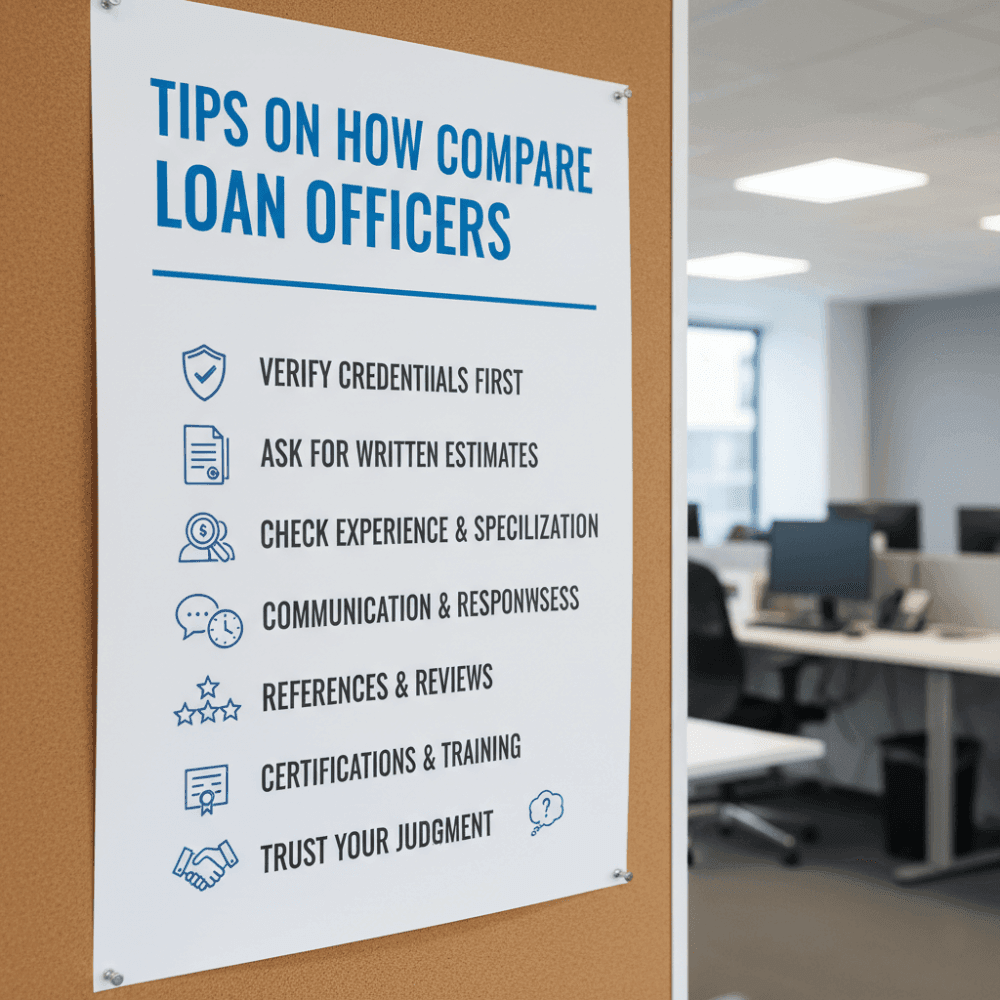

Tips on How to Compare Loan Officers

Before you get a loan, the headache is to pick a reliable loan officer. When comparing loan officers, keep these tips in mind.

-

Verify credentials first: Confirm each officer's NMLS ID and authorized state licenses.

-

Ask for written estimates: Get Loan Estimates for the same loan product and terms so you compare apples to apples.

-

Check experience & specialization: Some officers focus on first-time buyers, others on refinances or VA/FHA loans. Ask about recent closings in your market.

-

Communication & responsiveness: Track how quickly they return calls, explain fees, and provide timelines.

-

References & reviews: Ask for client references and scan reviews. Patterns are more telling than one or two comments. Also check BBB and state regulator complaint history.

-

Certifications & training: Extra credentials like advanced mortgage designations, can be helpful, but confirm that practical experience matters most.

-

Trust your judgment: Good rapport and clear explanations are as important as rate differences.

FAQs About NMLS Lookup

Q1. How do you know if you have a good loan officer?

A good loan officer is transparent about costs and timelines, answers your questions clearly, and provides written estimates. They proactively update you, explain loan options in plain language, and don't pressure you into quick decisions. Verify their NMLS record and look for consistent positive feedback from past clients.

Q2. What is an MLO?

An MLO (Mortgage Loan Originator) is the licensed professional who helps borrowers apply for mortgages, evaluates options, gathers documentation, and guides loans through underwriting and closing. MLOs must be licensed or registered through NMLS in the states where they originate loans.

Q3. Is a MLO the same as a loan officer?

In everyday talk, they mean the same thing. They are a person who helps you get a loan.

Legally, though, MLO refers specifically to those who originate residential mortgage loans under the SAFE Act and are state-licensed or federally-registered via NMLS. A loan officer can be a mortgage originator, but it can also refer to bank officers who handle consumer or commercial loans and aren't always governed by the MLO/NMLS rules. To learn more info, take a look at this post: Mortgage Loan Originator vs Loan Officer: Differences and Similarities

Q4. What makes you get rejected for a loan?

If you're worried about being rejected for a home loan, you might as well take a look at these common denial reasons here. Also, always check specific lender overlays. Individual lenders often set stricter requirements than agency minimums.

-

Low credit score or damaged credit history. Requirements depend on loan type and lender. For conventional loans, lenders often look for a minimum credit score of around 620. FHA loans may accept lower scores. 580 for a 3.5% down payment, 500–579 may be possible with a larger down payment.

-

High debt-to-income ratio (DTI).

-

Unstable employment or income history.

-

Insufficient or undocumented down payment funds.

-

Property appraisal below the purchase price or property failing standards.

Q5. What are the signs of a loan scammer?

To identify a loan scammer, you can pay attention to these signs.

-

Promises of guaranteed approval regardless of credit.

-

Requests for upfront fees before paperwork or verified approval.

-

Pressure tactics demanding immediate action.

-

Lack of verifiable licensing (no NMLS ID), only a P.O. Box, or only a messaging-app contact.

-

Requests for payment via unconventional methods (gift cards, cryptocurrency, etc.). If in doubt, verify the person's NMLS record and check regulator complaints before proceeding.

Conclusion

NMLS Consumer Access is a quick, free way for borrowers to confirm a loan officer's credentials, the states where they're authorized, and any reportable regulatory actions. The SAFE Act and NMLS set baseline requirements like pre-licensing education, testing, background checks, and annual continuing education, to help protect consumers.

Always verify the NMLS ID, compare written estimates, and confirm the loan officer's licensing history before you sign. A few minutes of verification can prevent big problems later. Where to find a reliable loan officer with a verified NMLS ID? MyMortgageRates got you covered.