![[Must-Read] What is a Mortgage Loan Originator: Definition, Duties, FAQs](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fwhat_is_a_mortgage_loan_originator_banner_120352fc6e.png&w=3840&q=75)

[Must-Read] What is a Mortgage Loan Originator: Definition, Duties, FAQs

What is a mortgage loan originator? Since it involves quite a bunch of roles in mortgage, that's easy for first-time buyers to be puzzled with them. Now, let's make it clear the role of an MLO, learning about the types, requirements, job responsibilities, average salary, and FAQs here.

People Also Read

- [Detailed Guide] What is a HELOC? All You Should Know Here

- How Much Mortgage Can I Afford? Know Your Affordability

- 6 Top Loan Origination Systems to Streamline Workflow in 2025

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- How to Calculate Early Payoff of Mortgage? Formula and Penalty

What is the Role of a Mortgage Loan Originator?

A mortgage loan originator (MLO) is the person who helps borrowers from the very first conversation through to closing. They take your loan application, review your finances, explain loan options and rates, run basic affordability checks, and coordinate with appraisers, processors, and underwriters so the loan can close. They're the primary point of contact who guides you through paperwork, timelines, and lender requirements, and helps translate lending jargon into plain English.

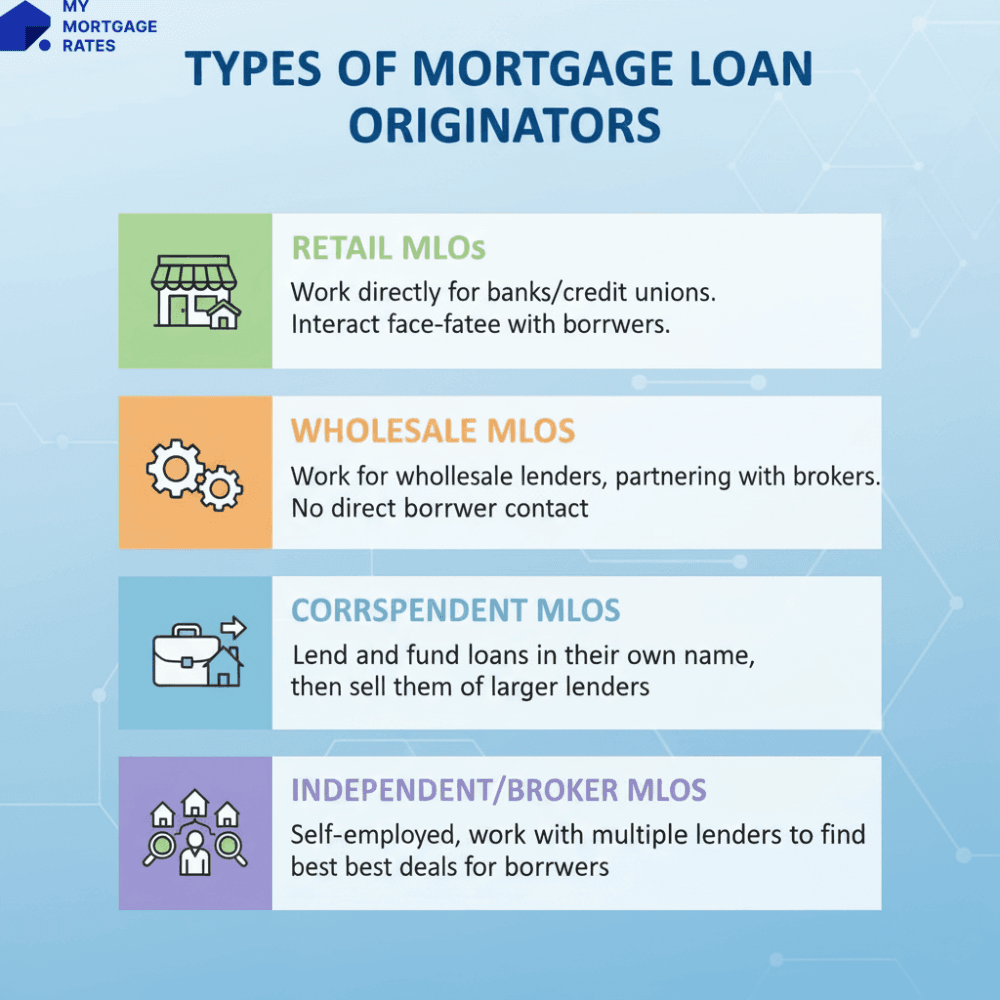

Types of Mortgage Loan Originators

Why MLOs tend to be confusing is that they work in several business models. There are indeed different types of mortgage loan originators. Each type has its benefits. Retail offers brand and process stability. Brokers/wholesalers can provide broader product choice and competitive pricing. Correspondent MLOs can balance speed with flexibility.

-

Retail MLOs/Loan officers: employed by banks, credit unions, or mortgage companies. They mainly offer the employer's products and often have an in-branch client flow.

-

Wholesale MLOs: work with brokers and wholesale lenders. They supply loan products that brokers shop for clients.

-

Correspondent MLOs: a correspondent lender funds loans initially and often sells them to investors later. Correspondent MLOs handle origination and early processing.

-

Independent/broker MLOs: operate through a mortgage broker business and can present multiple lender options.

Requirements to Become an MLO

What are the requirements of a mortgage loan originator? Under the SAFE Act implemented through NMLS, there are requirements that include as following.

-

Complete 20 hours of NMLS-approved pre-licensing education. This is the standard national pre-licensing package.

-

Pass the SAFE MLO Test. This is a national component and, where applicable, state components. Testing is administered through Prometric.

-

Submit fingerprints for an FBI criminal background check and authorize a credit report. Most states require both as part of licensing.

-

File an application via NMLS and obtain a state license or federal registration for certain depository employees.

States can add extra rules like additional forms, net-worth, or bonding for certain businesses, timing windows for renewal, etc. Many candidates check both NMLS and the state regulator where they plan to work. Also, convictions for crimes involving dishonesty, fraud, money laundering, or other serious financial offenses are commonly disqualifying or trigger extra review in many states, but the final decision is state-by-state, according to DFPI.

Job Duties: What Does a Mortgage Loan Originator Do?

So, what are the responsibilities for being a mortgage loan originator? Here are some jobs that an MLO does.

-

Take loan applications and collect supporting docs, including pay stubs, tax returns, and bank statements.

-

Run preliminary qualification checks, like DTI, credit review, and loan-to-value estimates.

-

Explain loan programs, interest rates, points, and the Loan Estimate/Closing Disclosure.

-

Submit completed packages to underwriting and follow up on documentation requests.

-

Coordinate with real estate agents, title companies, and closing departments to keep the transaction on schedule.

-

Generate and manage pipeline via referrals, marketing, seminars, and online leads.

Salary: How Much Do Loan Originators Make?

Compensation varies a lot by employer type, market and whether pay includes commissions or bonuses. A solid, authoritative baseline from the U.S. Bureau of Labor Statistics shows the median annual wage for loan officers was about $74,180 (May 2024). That median reflects base pay across all loan officers (bank employees, brokers, etc.), and individual pay can be well below or well above that number depending on commissions and local market conditions.

Many MLOs earn a significant portion of total pay from commissions, bonuses or fees tied to loan volume, so top producers in big metro markets often report much higher total compensation.

Tips to Compare Mortgage Loan Originators

If you're comparing MLOs, here are some practical tips for you. Also, you can directly contact loan officers near you on MyMortgageRates for more info.

-

Verify their license and complaint history on NMLS Consumer Access.

-

Ask how long they've worked in your market and for what types of loans, including FHA, VA, jumbo, investment.

-

Request sample Loan Estimates for your file profile and compare all fees like origination, points, third-party fees, not only headline rates.

-

Check technology and client portals for document upload and status tracking.

-

Request client references with similar credit/income profiles.

-

Watch for red flags: pressure to sign, refusal to put numbers in writing, or unclear fee breakdowns.

Mortgage Loan Originator vs Loan Officer

"Loan officer" is commonly used in daily conversation, while **"**mortgage loan originator (MLO)" is the regulatory term used in the SAFE Act/NMLS that covers anyone who takes a residential mortgage application or offers/negotiates terms for compensation.

Loan officers are typically employees of banks or lenders, who is often limited to that employer's products, while independent MLOs or broker-affiliated originators may have access to many lenders. Both categories must meet licensing/registration and compliance rules. To learn more differences, you can check out this post: Mortgage Loan Originator vs Loan Officer.

Mortgage Loan Originator vs Mortgage Broker

A mortgage broker is a business that shops multiple lenders for a borrower. Brokers employ or work with MLOs. An MLO is the licensed individual who interacts with the borrower and completes the application. They can be employed by a bank, by a broker, or by a correspondent lender. Brokers can offer more lender choices. direct lenders can sometimes close faster and offer in-house servicing.

FAQs About Mortgage Loan Originators

Q1. What is a mortgage loan origination fee?

An origination fee is the lender's charge for creating and processing your loan. It's usually a percentage of the loan amount, commonly 0.5% to 1% and is disclosed on your Loan Estimate and Closing Disclosure. Borrowers can sometimes negotiate the fee or accept a higher rate in exchange for a lower upfront fee.

Q2. What is a mortgage loan originator license?

An MLO license issued via NMLS and state regulators shows the originator completed required education, passed the SAFE test, and cleared background and credit checks. Licensed originators get a unique NMLS ID that should appear on loan paperwork and public NMLS records. Renewal and continuing education are required annually.

Q3. Is loan origination the same as underwriting?

No. Loan origination is client-facing work: taking applications, advising borrowers, assembling files and submitting to underwriting. Underwriting is the lender's risk assessment step: underwriters independently verify income/assets, review appraisal and credit, and make the approval decision based on investor guidelines.

Q4. What are the disadvantages of being an MLO?

There are some main downsides of being an MLO, like income volatility (commission cycles), long/irregular hours to meet clients' schedules, heavy regulatory burden, and stress when loans fall apart in underwriting. Technology is also automating parts of origination, so new originators must differentiate with relationships and the best loan origination software.

Q5. What is the average age of a mortgage loan originator?

There's no single published national "average age" for MLOs. Industry trends and BLS projections show the occupation is relatively mature with many experienced professionals in their 40s--50s. Licensing costs, income variability and relationship-driven business models mean many originators enter as second careers. For planning and hiring, expect a mix of seasoned originators and some younger entrants.

Conclusion

MLOs are the bridge between borrowers and lenders. They explain options, assemble files, and shepherd loans to closing while following strict regulatory rules. The role rewards strong communication and sales skills, but it also requires continuing education, licensing upkeep, and careful compliance. For borrowers, the best outcome comes from comparing originators on transparency, product access, and proven track record, not just the lowest advertised rate. If you're a new MLO, you may consider Zeitro as a helpful free LOS to get started.