Best FHA 203k Loan Lenders in 2025: Compare Rates & Get Approved Fast

If you're looking to buy a fixer-upper and finance renovations with an FHA 203k loan, choosing the right lender is the most critical step in the process. Unlike conventional mortgages, FHA 203k loan lenders must navigate complex renovation guidelines, contractor approvals, and strict HUD compliance—meaning not all lenders are equipped to handle these loans efficiently. As a mortgage advisor with over a decade of experience in government-backed loans, I’ve seen borrowers lose thousands due to delays, hidden fees, or outright denials from inexperienced lenders. In this guide, I’ll break down exactly how to identify top-tier FHA 203k loan lenders, avoid common pitfalls, and secure the best terms for your home renovation project.

What Makes FHA 203k Loan Lenders Different?

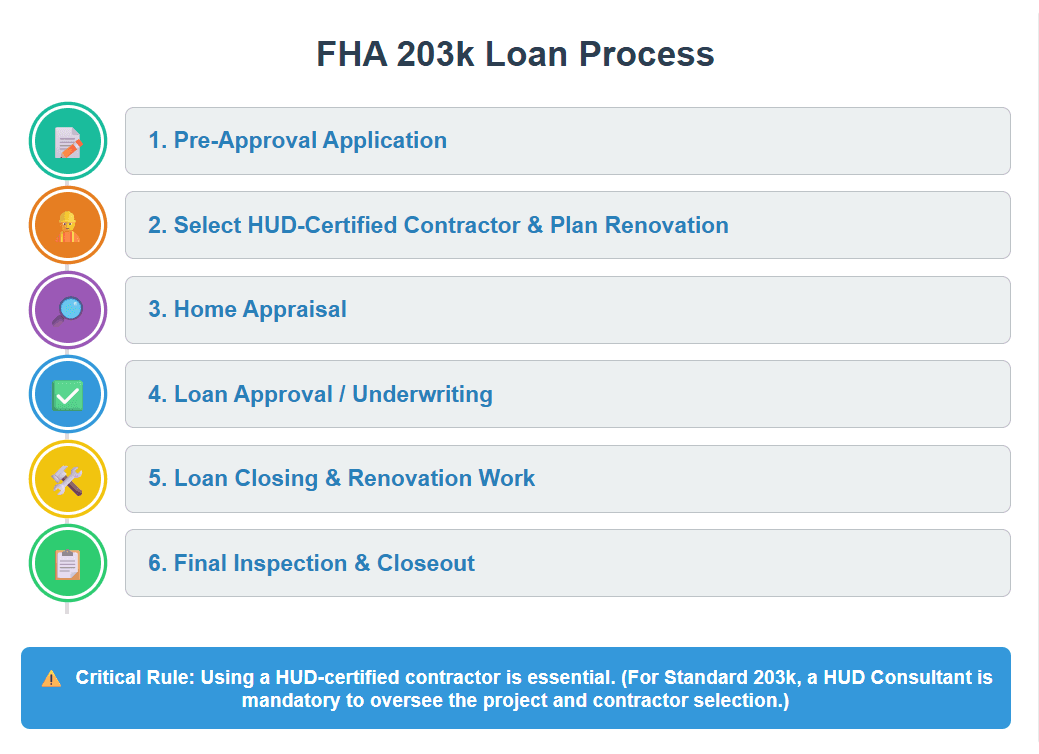

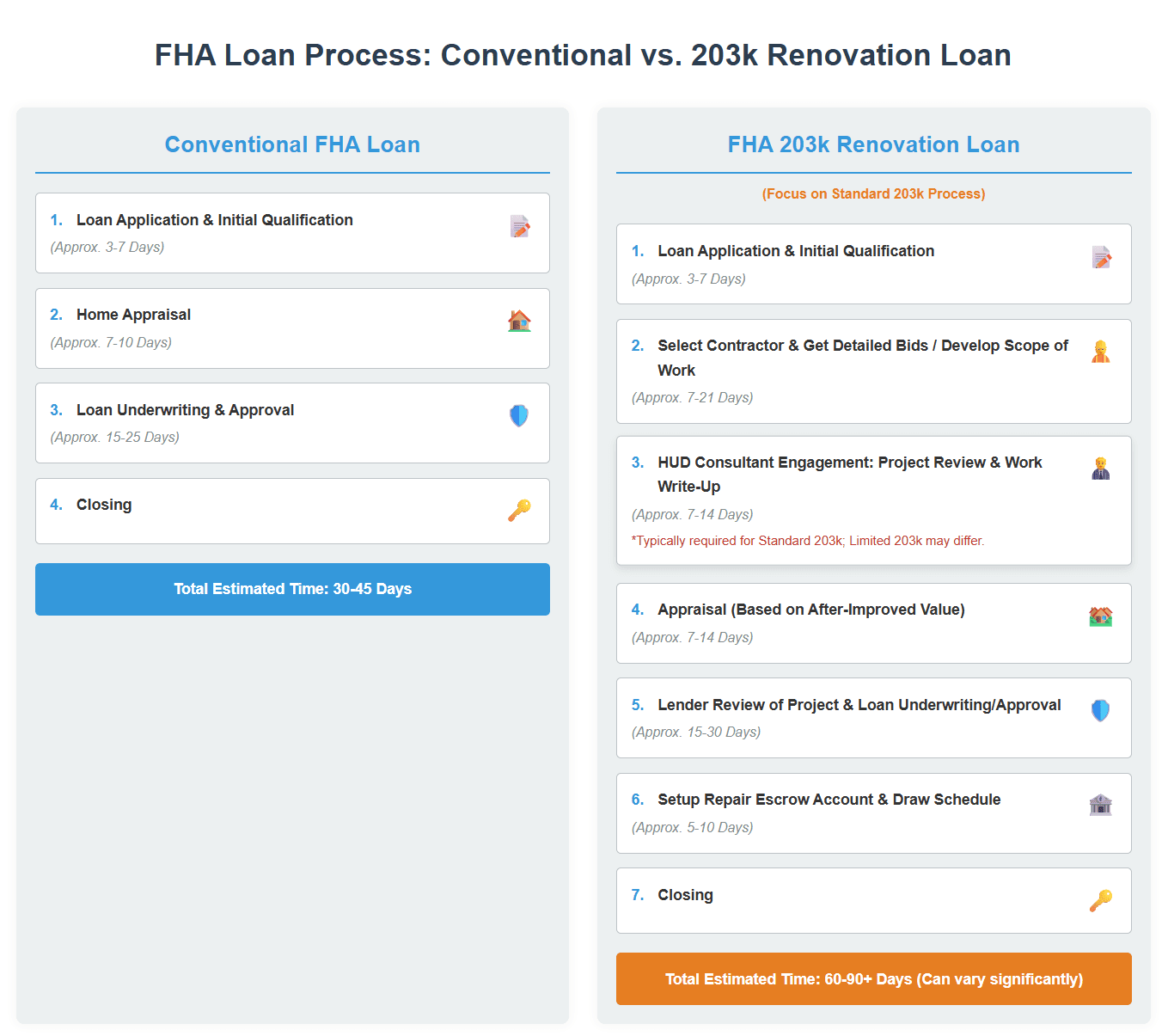

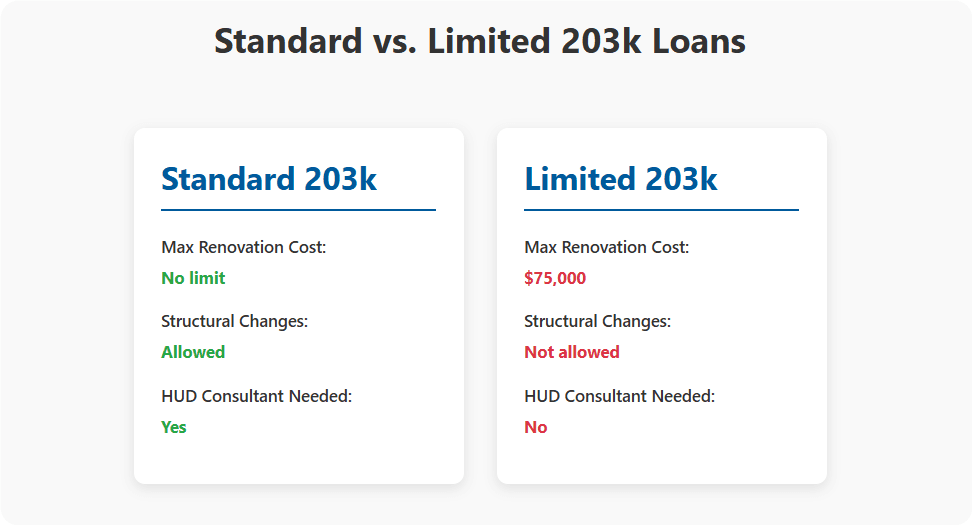

Not every mortgage lender offers FHA 203k loans, and even among those that do, expertise varies widely. Traditional FHA Loan lenders focus on move-in-ready homes, but FHA 203k loan lenders must also underwrite renovation costs, verify contractor credentials, and oversee draw schedules for phased funding. The best lenders have dedicated 203k loan specialists who understand HUD’s strict repair requirements, especially for Standard 203k loans involving structural changes.

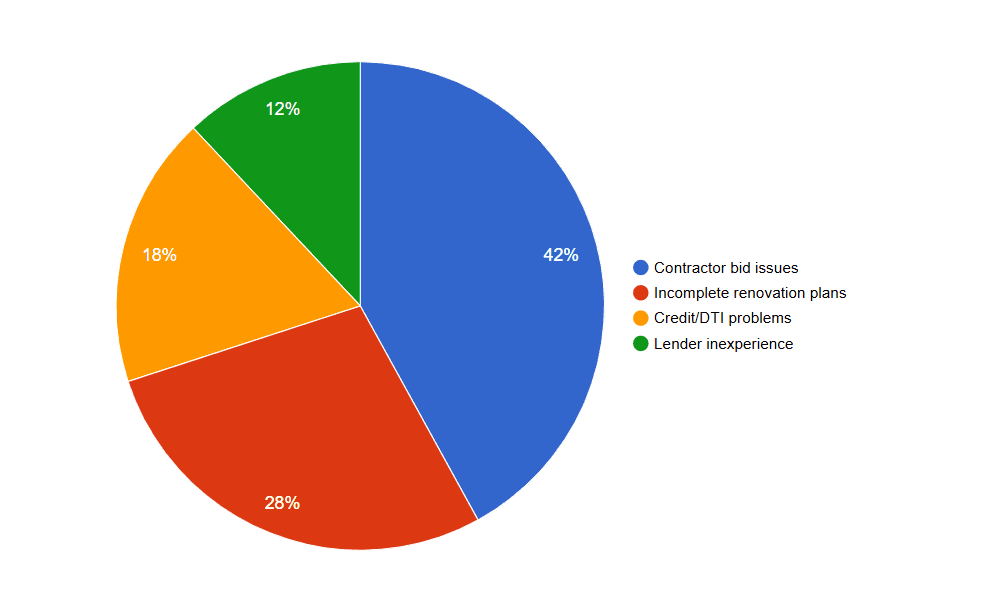

A common mistake borrowers make is assuming all FHA lenders are the same—unfortunately, working with a lender inexperienced in 203k loans can lead to underwriting delays, last-minute denials, or even cost overruns if renovation funds aren’t released on time.

How to Choose the Best FHA 203k Loan Lender

When evaluating FHA 203k loan lenders, you need to look beyond interest rates and fees—experience and efficiency matter just as much. Start by asking potential lenders:

Key Questions to Ask:

- "How many 203k loans have you closed in the past year?" (Aim for lenders with 50+ closings annually—they’ll have smoother processes.)

- "Do you work with HUD consultants in my area?" (Standard 203k loans require a HUD consultant to oversee renovations.)

- "What’s your average underwriting timeline?" (Ideally under 30 days; delays often happen when lenders lack 203k expertise.)

Additionally, check online reviews for red flags like "203k loan denied last minute" or "funds delayed for months." Some lenders advertise FHA 203k loans but outsource underwriting to third parties, causing communication breakdowns. Stick with lenders who handle the entire process in-house.

Top 5 FHA 203k Loan Lenders in 2025

Based on industry reputation, closing speed, and borrower feedback, these lenders excel in FHA 203k loans:

- New American Funding – Best for highly rated mobile app.

- CrossCountry Mortgage – Best for down payment assistance.

- MyMortgageRate – Best for access to a network of trusted FHA 203k lenders.

- Flagstar – Best for FHA loans overall.

- Guild Mortgage – Best for borrowers with nontraditional credit.

Pro Tip:

Smaller regional lenders sometimes offer better terms than big banks—always compare at least three FHA 203k loan lenders before committing.

Red Flags to Avoid When Selecting a 203k Lender

Not all FHA 203k loan lenders operate ethically. Watch for these warning signs:

- "We don’t handle Standard 203k loans." (Indicates limited expertise—Limited 203k is simpler but restricts renovation scope.)

- "You don’t need a contractor yet." (A major red flag—HUD requires contractor bids before approval.)

- Vague fee structures. (Some lenders hide extra charges like "processing fees" or "consultant markups.")

I’ve seen borrowers get stuck with 203k loan denials after months of processing because their lender failed to properly vet the contractor or property. Always verify lender credentials through the NMLS Consumer Access database before applying.

How to Speed Up Approval With an FHA 203k Loan Lender

Since FHA 203k loans take longer to close than conventional mortgages (typically 45–60 days), efficiency is key. To avoid delays:

- Get pre-approved early—Lenders will check credit, DTI, and employment upfront.

- Secure contractor bids before applying—HUD requires detailed renovation estimates.

- Choose a lender with in-house underwriting—Third-party processors add weeks to timelines.

If your lender takes more than two weeks to issue initial disclosures, consider switching—this signals inefficiency.

Final Thoughts: Is an FHA 203k Loan Lender Right for You?

FHA 203k loan lenders provide a unique opportunity to finance both home purchase and renovations in one mortgage—but only if you choose the right lender. Avoid big banks that treat 203k loans as an afterthought, and instead seek out specialists with a proven track record. If you’re serious about a fixer-upper home, start by comparing multiple FHA 203k loan lenders, asking detailed questions, and reading third-party reviews.

Next Step:

Connect with our vetted FHA 203k loan specialists today! Get personalized rate quotes and a free renovation plan review.

People Also Read

- FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

- FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

- Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You