Can You Put 20% Down on an FHA Loan? Everything Homebuyers Need to Know About FHA Down Payments

FHA Loan Basics and Homebuyer Qualifications

For many Americans stepping into the world of homeownership, FHA loans open doors that might otherwise stay closed. The Federal Housing Administration (FHA) stands behind these loans, giving a much-needed boost to buyers with modest savings or lower credit scores. Unlike conventional mortgages, FHA loans are designed with flexibility in mind, making homeownership accessible to a wider range of buyers.

With an FHA loan, you can put down as little as 3.5%—a big advantage for first-time buyers or anyone who’s found it tough to save up a large down payment. FHA loans are specifically meant for those who may not qualify for traditional financing but have shown they can manage their money responsibly.

How Much Down Payment Do You Need for an FHA Loan? From Minimum to 20%+

What is the minimum you can put down on an FHA loan?

The minimum down payment for an FHA loan is 3.5% of the purchase price—so long as your credit score is at least 580. This low threshold is one of the main reasons first-time buyers and families with limited savings turn to FHA loans. If your credit score falls between 500 and 579, you’re still eligible, but you’ll need to put down at least 10%. This flexibility makes FHA loans a valuable option for those who don’t fit the typical mold for a conventional loan.

Can you put more than 3.5% down on an FHA loan?

Absolutely. While FHA loans are popular for their low down payment, there’s no rule stopping you from putting more down—5%, 10%, or even 20% if you wish. In fact, some buyers choose to put down a larger sum to reduce their loan balance or simply because they’re in a position to do so.

The upside to a bigger down payment is lower monthly payments and less interest paid over the years. Plus, if you’re able to put down at least 10%, your FHA mortgage insurance premium (MIP) will only last 11 years instead of the full loan term. Even so, FHA loans still require mortgage insurance, regardless of your down payment. Still, a bigger initial investment can save you money and give you more financial breathing room down the road.

In the world of home buying, a 20% down payment is often seen as the gold standard. With conventional loans, putting 20% down lets you skip private mortgage insurance (PMI), lowers your loan amount, reduces your monthly payments, and often earns you a better rate from your lender.

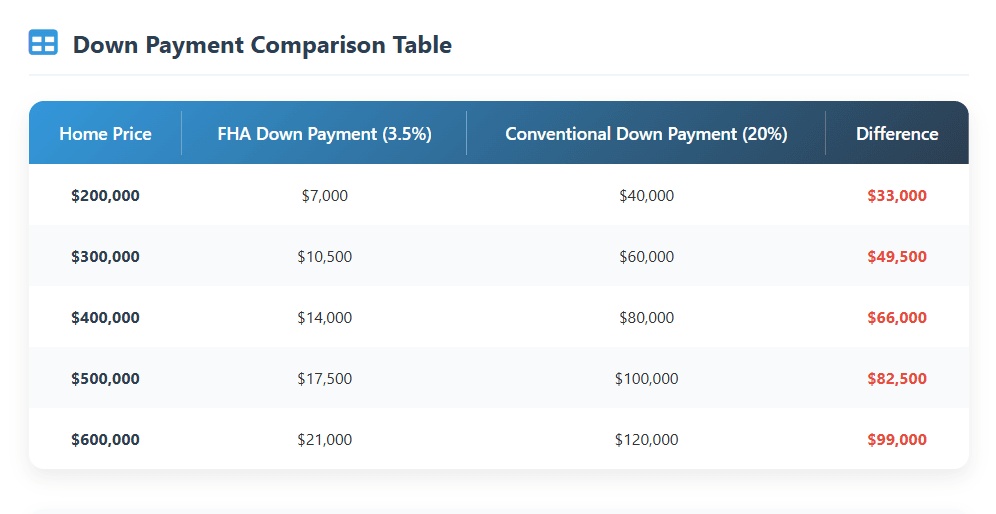

Tip: See the table below to compare the impact of a 3.5% down payment versus 20% down on an FHA loan.

Is it worth putting 20% down to avoid PMI?

For conventional loans, making a 20% down payment is a proven way to avoid PMI. Reach that threshold, and you’ll cut out the extra monthly insurance cost, keeping more money in your pocket every month. On top of that, lenders usually offer better rates and terms to borrowers who can put more money down. In short, if your goal is to skip PMI and lower your overall home costs, aiming for 20% down on a conventional loan is often the smart move. While you’re free to put down more than 20%, the real financial break comes once PMI is removed—further down payment mainly trims your loan size and interest.

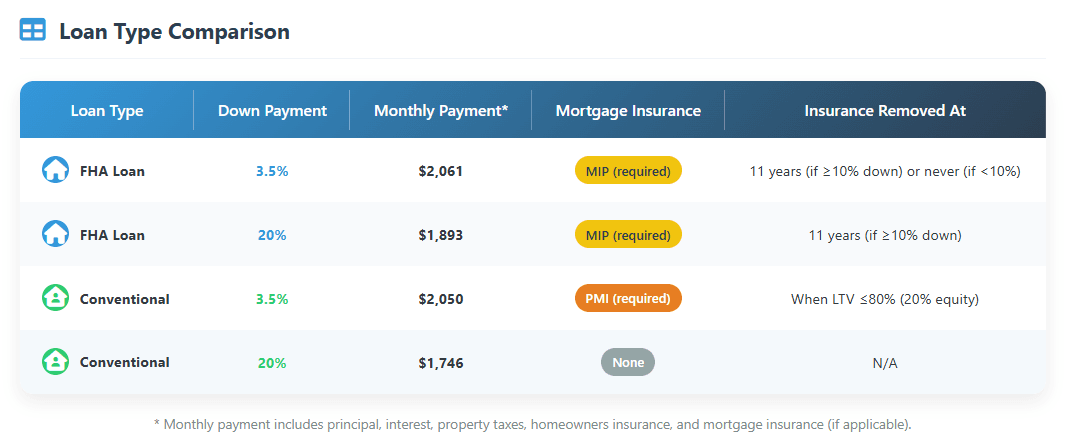

FHA mortgage insurance with 20% down

Now, here’s the key difference with FHA loans: No matter how much you put down—even 20% or more—you’ll still need to pay FHA’s mortgage insurance premiums (MIP). That includes an upfront premium at closing and ongoing monthly payments. If you put down at least 10%, your monthly MIP will end after 11 years; otherwise, it stays for the life of your loan. So, while a big down payment helps reduce your loan and monthly payment, FHA buyers can’t avoid insurance the way conventional borrowers can. This is a crucial point to consider when choosing your loan path.

In summary, putting 20% or more down is a major advantage for conventional buyers—PMI disappears and long-term costs drop. For FHA borrowers, insurance sticks around, no matter the down payment, so make sure to compare both options and talk things through with your lender to decide what’s best for your situation.

Does a Bigger Down Payment Lower FHA Insurance? The Truth About MIP and Monthly Payments

Many homebuyers hope that a large down payment will help them dodge mortgage insurance. With FHA loans, though, the rules are different: regardless of how much you put down, mortgage insurance (MIP) is still part of the deal. This unique feature of FHA loans has a big impact on your monthly payment and the total cost of owning your home.

1. Higher Down Payment Doesn’t Eliminate Insurance

No matter if you put down 20% or more, FHA loans require you to pay both an upfront and monthly mortgage insurance premium. The only relief is for buyers who put at least 10% down—your monthly MIP can drop off after 11 years. For everyone else, it sticks around for the entire life of the loan. By comparison, with a conventional mortgage, once you hit 20% equity, PMI is gone, and your payment drops accordingly.

2. How MIP Affects Monthly Payments

FHA borrowers have to budget for MIP in addition to their principal and interest payments. This insurance is calculated as a percentage of your loan balance and is paid monthly—regardless of your down payment size. For example, even if you buy a $300,000 home and put down 20%, you’ll still have MIP tacked onto your monthly bill—sometimes adding hundreds each month. That’s why FHA monthly payments are usually higher than conventional loans, even when rates are similar.

3. Why FHA Monthly Payments Are Typically Higher

The structure of FHA mortgage insurance is the main reason. With a conventional loan, PMI is temporary and disappears once you build enough equity. With FHA loans, you’re looking at MIP for at least 11 years (if you put down 10% or more), and for many, it never goes away. Plus, since FHA loans are designed to be more accessible, they often serve buyers with lower credit scores, which can mean slightly higher rates and, in turn, higher monthly payments.

(Note: The monthly payment example is for illustration only, based on a $300,000 loan with a 30-year term and similar rates. Your actual payment will vary.)

What are the Upsides and Downsides to an FHA Loan? FHA Loan Pros and Cons Explained

FHA loans are a mainstay for buyers who might not qualify for a conventional mortgage. But like any financial product, they have their strengths and trade-offs. Here’s a clear look at what you gain—and what to watch out for—with FHA financing:

Main Upsides of FHA Loans

Low Down Payment Requirement (3.5%/10%): FHA loans make homeownership more attainable, especially for those who haven’t saved a big nest egg. The 3.5% minimum is a game-changer for many.

Flexible Credit Standards: FHA welcomes buyers who’ve had past credit bumps, including bankruptcies or lower scores. That flexibility opens the door for more families to own homes.

Gift Fund Flexibility: You’re allowed to use gift money from family, friends, or certain organizations for your down payment and closing costs—another major plus for buyers without deep savings.

Competitive Interest Rates: With government backing, FHA loans often have rates as good as, or sometimes better than, conventional mortgages for similar borrowers.

Main Downsides of FHA Loans

Mandatory Mortgage Insurance (MIP) for the Life of the Loan: Every FHA borrower pays both upfront and ongoing insurance. If your down payment is under 10%, you’ll pay MIP as long as you have the loan; at 10% or more, it ends after 11 years.

Stricter Property Standards: FHA has high expectations for a home’s safety and condition, which can mean extra repairs or delays if the property doesn’t measure up.

Potentially Higher Long-Term Costs: FHA insurance fees can add up, making these loans more expensive over time—especially once you’re able to drop PMI from a conventional loan.

Loan Limitations: FHA loans come with maximum amounts, which can be lower than the price of many homes in expensive areas. That can narrow your options compared to a conventional mortgage.

FHA Loan Process and Credit Requirements

If you’re thinking about buying a home with FHA financing, knowing the process ahead of time will set you up for success. FHA loans are popular with first-time buyers and those with imperfect credit, but there are a few unique steps along the way. Here’s what to expect from start to finish:

Step 1: Preapproval It all starts with choosing a lender and getting preapproved. Your credit score plays a starring role here. For the lowest 3.5% down payment, you’ll need a FICO score of 580 or above. Scores between 500 and 579 mean you’ll need to put at least 10% down. Lenders also check your income, job history, and debts—steady employment and manageable debts help your case and could land you a better rate.

Step 2: Home Shopping and Offer With preapproval in your pocket, you can go house hunting. Once you make an offer and it’s accepted, the sales contract heads to your lender to kick off the official loan process.

Step 3: FHA Appraisal The lender will order an FHA appraisal—not just to assess value, but also to confirm the home meets FHA safety and habitability standards. If any issues are flagged, they’ll need fixing before closing. This extra step is unique to FHA loans and can sometimes add time or cost.

Step 4: Loan Processing and Underwriting Next, the lender dives deeper into your finances—reviewing your credit, employment, debts, and where your down payment comes from.

- Credit: Higher scores can mean lower rates and easier approval.

- Down Payment: The more you put down, the smaller your loan and the lower your payment. If you put 10% down or more, MIP drops off after 11 years; otherwise, it’s for the life of the loan.

- Monthly Payment: Your monthly bill includes principal, interest, taxes, insurance, and MIP—all standard with FHA.

Step 5: Closing Once you’re cleared to close, you’ll sign paperwork, pay your down payment and closing costs, and the lender will fund your loan. Congratulations—you’re officially a homeowner.

Making the Right Loan Choice for Your Needs

How do you know which loan is right for you? By now, you’ve got a clearer understanding of the ins and outs of FHA loans and how they compare with conventional options. Every buyer’s situation is unique—your credit, your savings, and your long-term goals all play a role in the best loan for you. FHA loans offer valuable flexibility and help many buyers get their foot in the door, but don’t forget to factor in mortgage insurance and monthly payment obligations.

If you’ve looked at the numbers, compared FHA and conventional loans, and still aren’t sure which way to go, don’t hesitate to reach out to one of our mortgage experts. We’re here to help you make the best, most informed decision for your home purchase—so you can buy with confidence.

People Also Read

- FHA Upfront Mortgage Insurance (UFMIP) Explained (2025): Cost, Payment, and Rules

- FHA Monthly Mortgage Insurance Rate (MIP) in 2025: Costs & Calculation

- How to Remove MIP from Your FHA Loan:Rules,Refinancing,Strategies

- Current FHA UFMIP Rate 2025 Explained: Upfront Mortgage Insurance, MIP Removal & Refund Guide

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You