AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

For borrowers navigating the mortgage process, finding a reliable lender can be overwhelming. Online lenders have disrupted the industry by making it easier to shop for rates without visiting branches. AmeriSave is an established online mortgage lender that markets a technology-first application experience and a broad set of loan products. However, many people may be unfamiliar with it and want to know more about AmeriSave.

This AmeriSave Mortgage review explains its history and scale, the mortgage types it advertises, independent pros/cons reported by industry reviewers, customer sentiment on major review sites, a comparison with Rocket Mortgage, and why local loan-officer marketplaces, like MyMortgageRates, may be a useful alternative.

People Also Read

- All-to-Know: How Do Mortgage Rates Impact Affordability?

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- How to Calculate Early Payoff of Mortgage? Formula and Penalty

- 6 Best Loan Origination Software for Mortgage in 2025 [Never Miss]

What is AmeriSave Mortgage?

AmeriSave Mortgage Corporation was founded in 2002 and is headquartered in the Atlanta/Sandy Springs area. Patrick Markert is the company's CEO. The company is a consumer-direct, technology-driven mortgage lender that emphasizes online applications, an online borrower portal, and digital document workflows. AmeriSave has grown quickly since its launch.

The company reporting and press releases state the firm funded dozens of billions in loan volume during recent high-originations years. AmeriSave reported $36 billion funded in 2021 and roughly $115 billion total since its founding, per company releases. AmeriSave positions itself as a privately-held, national online lender that operates via consumer-direct, retail and third-party originator channels.

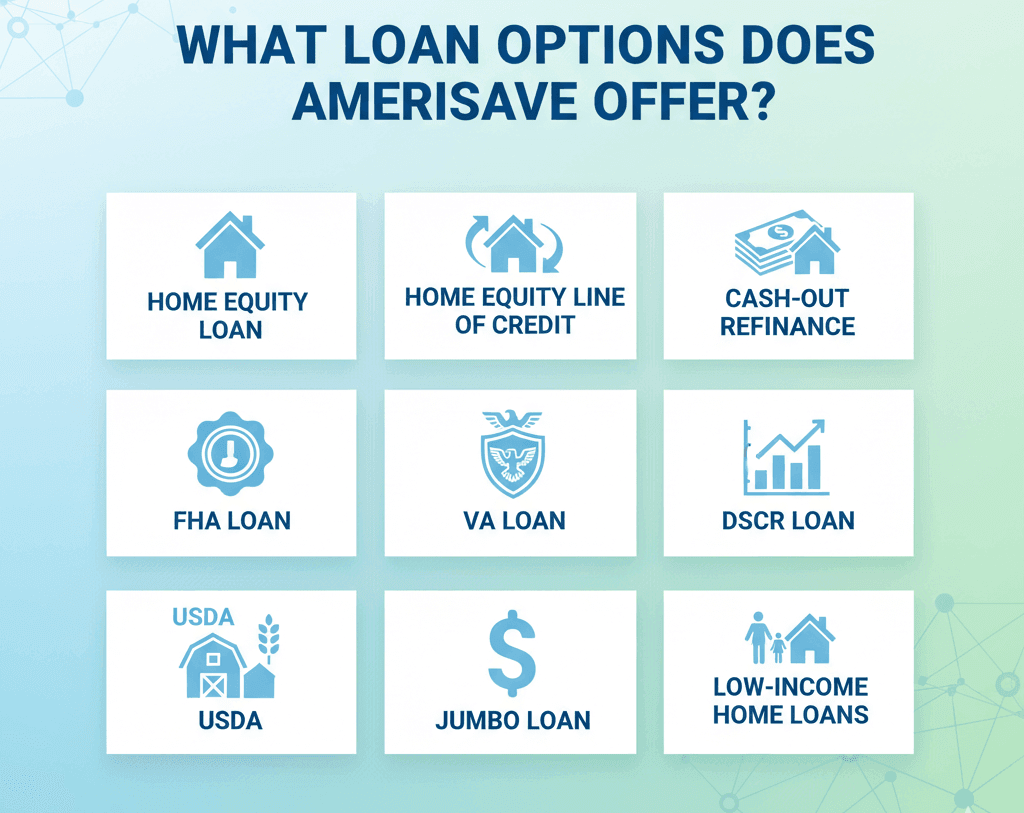

What Loan Options Does AmeriSave Offer?

AmeriSave advertises a broad set of purchase and refinance products on its site, including conventional fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA, VA, USDA, jumbo loans, home equity loans, HELOCs, DSCR (investor) products and cash-out refinances.

Their public loan pages list DSCR (a non-QM investor product), HELOCs, and home equity loans alongside the more common government-backed and conventional programs. AmeriSave supports both standard (QM) products and some non-QM/investor products (DSCR), though its Non-QM inventory is narrower than specialized non-QM lenders.

-

Home Equity Loan: AmeriSave advertises home equity (closed-end) loans as lump-sum products for renovations, debt consolidation, etc.. terms and availability depend on property and borrower profile.

-

Home Equity Line of Credit (HELOC): AmeriSave lists HELOCs (revolving credit lines secured by home equity). Terms (draw period and repayment) vary by product. borrowers should confirm draw period and post-draw repayment structure with their LO. Try this HELOC Calculator to calculate your estimated loan amount amd compare different scenarios.

-

Cash-Out Finance: Cash-out refinancing is offered across several product types. AmeriSave's site shows cash-out refinance as an option for borrowers who want equity access. LTV, seasoning, and underwriting rules depend on the loan type.

-

Federal Housing Administration (FHA) Loan: AmeriSave offers FHA purchase and refinance products. Public pages describe FHA options with typical FHA down-payment and insurance structures. exact score and down payment thresholds depend on program and underwriting.

-

U.S. Department of Veterans Affairs (VA) Loan: AmeriSave lists VA purchase and refinance programs, including IRRRL/VA streamline and VA cash-out. VA program credit and entitlement rules apply.

-

DSCR Loan: AmeriSave advertises DSCR loans (Debt Service Coverage Ratio) for investors. these underwrite to property cash flow and are commonly categorized as non-QM investor products.

-

USDA Loan: AmeriSave includes USDA loan information. Program availability depends on the property location being in a USDA-eligible rural area and other USDA program rules. Some independent reviews have previously reported inconsistent availability for certain USDA products.

-

Jumbo Loan: AmeriSave lists jumbo loan options for higher-balance mortgages. terms, max loan sizes and credit requirements vary by product and investor overlays

-

Low-Income Home Loans: AmeriSave supports government-backed programs (FHA, USDA) that are commonly used by lower-income buyers. For specific down-payment assistance programs or state/local affordability options, borrowers should ask a loan officer nearby for local programs. AmeriSave's national product platform is not itself a state assistance administrator.

Pros and Cons of AmeriSave

AmeriSave's strengths are its digital application flow, broad product menu, and promotional buydown options. The most common drawbacks cited by independent reviewers are price, transparency concerns, and occasional communication problems. To learn more its Pros and Cons, take a look below.

Advantages:

-

Technology-forward online application and borrower portal (MyAmeriSave).

-

Wide product mix includes conventional, FHA, VA, USDA (where available), jumbo, home equity, HELOC, and some investor (DSCR) products.

-

Temporary buydown program like "Lock & Drop"/1% first-year buydown) that reduces early payments for qualifying loans.

-

Publicly stated no-origination-fee messaging for many conventional and some government products.

Disadvantages:

-

Multiple independent reviews point to origination/closing costs and rates that can be higher than some competitors on a borrowed sample. Transparency about total closing costs has been flagged.

-

Mixed customer service reports. Reviewers and user comments show a range of experiences. Some fast/clear, others reporting communication gaps during processing.

-

Limited non-QM inventory compared with specialist non-QM lenders. DSCR exists, but AmeriSave is not primarily a non-QM specialist.

-

Not licensed in every state. Notably, it has a limited presence in New York.

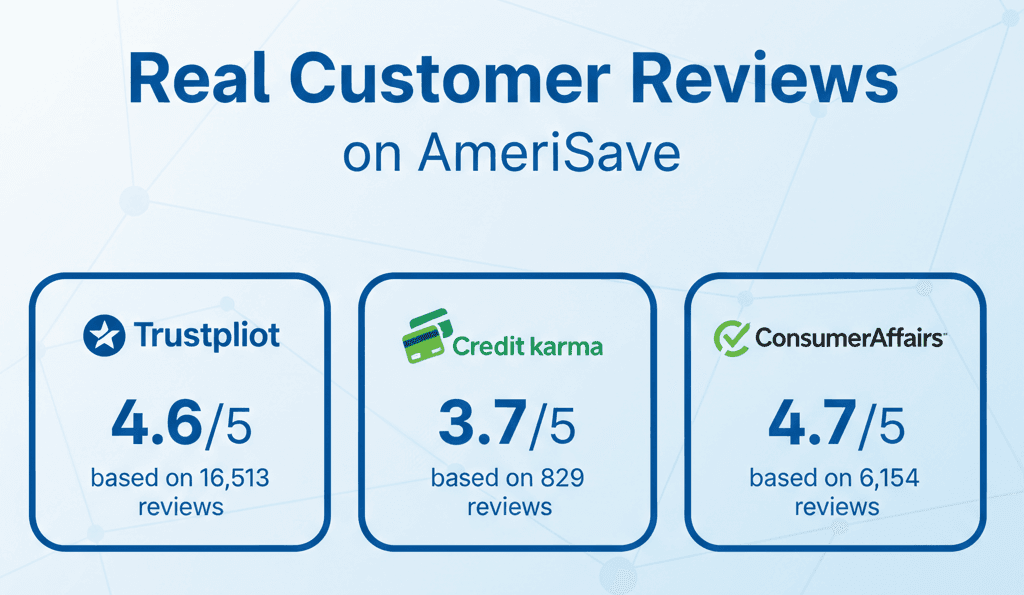

Real Customer Reviews on AmeriSave

Below are current platform ratings and a representative sample of user comments taken from each review site. I included short verbatim excerpts (≤25 words) and short paraphrases for longer posts to comply with quote limits while keeping the reviews faithful to the original sentiment.

Here are AmeriSave ratings on different platforms at the time of check:

-

Trustpilot: 4.6/5 based on 16,513 reviews.

-

Credit Karma 3.7/5 based on 829 reviews.

-

ConsumerAffairs: 4.7/5 based on 6,154 reviews.

Trustpilot

-

Kris: Amerisave and staff helped me get my dream home in a short amount of time. Process was very smooth and assuring. My loan processor Alfredo was extremely helpful and patient. I strongly suggest and recommend amerisave mortgage!

-

Tammy Cummings: Everything went smoothly except when we needed a loan officer the evening of the notary. We had a number of questions that needed answered but we ended up looking up the terms on Google for our understanding before we could actually sign.

-

Agnes Piano: The process was easy but the cheque that included in the contract to pay off my credit cards still hasn't been sent after a week of closing of my loan! That's the main reason why I tooked this loan anyway! I'm kinda disappointed!!!

Credit Karma

-

They won't leave me alone. They called me a week ago (about 3 times, but I was working and couldn't answer) They called again and I told them I wasn't interested. Later that day they called me again. The next day twice. The next morning they called again and I asked them to leave me alone. However they've called me every day at roughly 845 and 230. I gave up telling them I'm not interested because they apparently don't care and resorted to blocking them, but apparently they have multiple phone numbers they call from. We'll see if they keep calling from more numbers. I'm so over it. Leave me alone.

-

Thank you, Antwan for giving us such great service. You & Heidi made this experience so easy. We were able to close our refi in about 2 weeks. You kept us updated, and always called us back if we had any questions. This is our 2nd loan from Amerisave, and we're glad that we had another great experience, like our first loan.

-

At first everything had been running smoothly for the cash out loan on my home. During the process it had gotten very complicated, with a lot of additonal requirements and supervisor involvement. In the end I was able to close within 60 days.

ConsumerAffairs

-

Nathan: AmeriSave Mortgage's service was exceptional. Although the rates they offered were about 100 basis points higher than what other institutions provided, the expertise and assistance from the loan officer made all the difference in my decision.The knowledge exhibited by my loan officer during the application process was impressive and played a significant role in my choice to proceed with AmeriSave. However, while the service was commendable, there are a couple of areas for improvement. The registration process on their website could be streamlined, and the ability to make automated payments online would be advantageous. Despite the higher interest rates, my experience with AmeriSave was positive due to their standout service quality.

-

Maria: My experience was not good, first it took another lender offering me a lower rate to get a lower rate. All this digital communication is for the birds. I was so lost on what to expect and they did not explain it. Did not and still don't know… I did have one good guy Matt, but Mike was not very helpful. I told him I didn't put my bank information on paper I signed because I already did online. And he did not answer me no more. So I messaged Matt and will see if he can help me get my money the way I said. Will update later …. but my next mortgage company will be …???

-

Edgar: AmeriSave Mortgage's reps were very helpful for me and they guide me through the process. They were very patient with me about my loan. However, AmeriSave was very strict with the requirements, especially the underwriting. At first, it was smooth, but at the last part, AmeriSave looked for a lot of paperwork. Even my employer got a bit upset. AmeriSave started it for verification of employment, which is a normal process. But they looked for a lot of income-wise. But I already submitted my income tax return. Fortunately, my loan got approved eventually.

AmeriSave vs Rocket Mortgage

What are the differences between AmeriSave Mortgage and Rocket Mortgage? Here is a breakdown of history, loan types, rating, and special offers. Let's dive in.

History

-

Rocket Mortgage (built from Quicken Loans) is substantially larger: recent filings and press reports show Rocket's annual closed loan origination volumes measured in tens of billions per year, for example, Rocket reported roughly $75–100B+ closed loan volume in recent annual reports and quarters. Rocket is widely cited as the largest retail mortgage lender in the U.S.

-

AmeriSave is a much smaller private online lender by comparison, while AmeriSave reported ~$36B in 2021 and company totals since founding in the low-to-mid-hundreds of billions historically per corporate disclosures.

Loan types

-

Rocket Mortgage has a large product set including conventional 15/30, ARMs, FHA, VA, jumbo, HELOC alternatives depending on servicing, deep jumbo capacity, and many in-house programs.

-

AmeriSave offers broad online menu like conventional, FHA, VA, USDA, where available, jumbo, HELOC, home equity, DSCR. but less scale on jumbo securitization and fewer wholesale/non-QM specialist products compared with large national players. AmeriSave does offer DSCR (investor/non-QM) products but is not a top non-QM specialist.

Ratings & reviews

-

Rocket generally appears across major aggregated lists as one of the top originators by volume and receives generally strong editorial coverage for customer experience.

-

AmeriSave's editorial scores are solid but reviewers flag higher fees and some transparency issues

Special offers

-

AmeriSave: "Lock & Drop"/1% first-year buydown program and other cost credits that can reduce early payments.

-

Rocket: has historically offered various promotional buydowns and product innovations. as a much larger lender, it often has a wider array of promotional and first-time buyer programs.

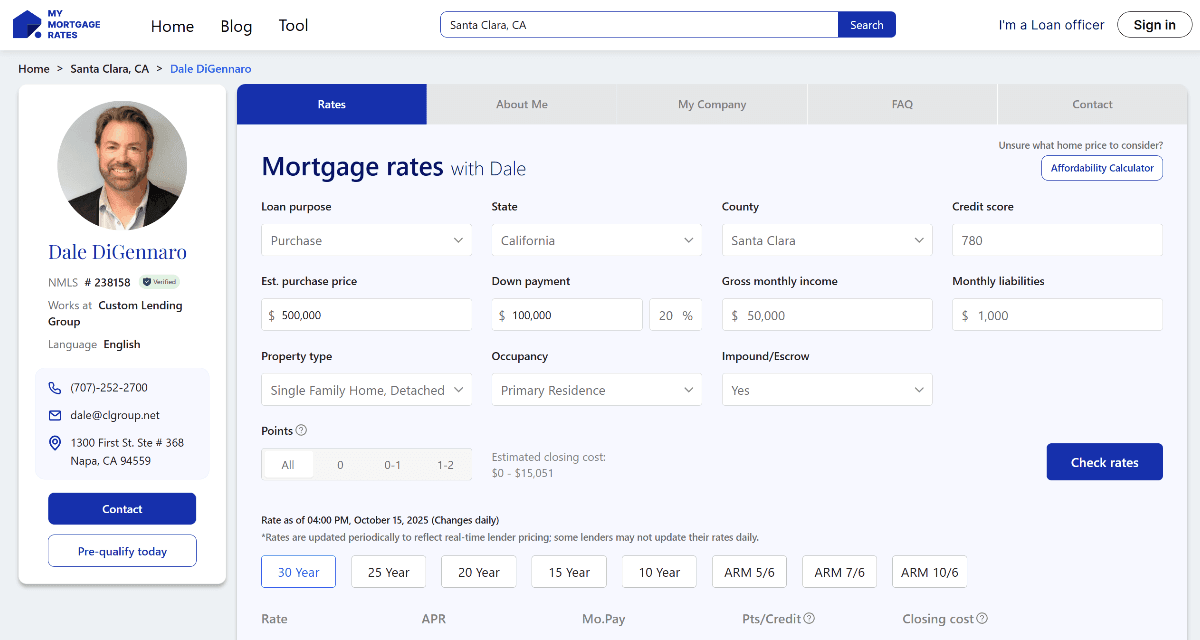

MyMortgageRates: Best Alternative to AmeriSave

MyMortgageRates is a marketplace developed by Zeitro that connects borrowers with local, verified loan officers. It's designed to solve two common problems: borrowers don't always know which loan officer to contact, and loan officers often lack high-quality, local lead channels. The site helps borrowers find loan officers nearby by specialty and enables loan officers to showcase their credentials and capture leads.

Key Features of MyMortgageRates:

-

All-in-one marketplace: compare personalized rates from many lenders, contact local loan officers, and track loan progress.

-

All property types: single-family, townhouse, condo, multi-family and manufactured homes.

-

Top loan officers: filter by specialty (Conventional, FHA, VA, USDA, Non-QM/DSCR).

-

Personalized real-time rates from a large lender network.

-

Easy search by location, loan type, or loan officer credentials. Privacy and security are emphasized.

Why choose MyMortgageRates over digital-only lenders?

Digital lenders are fast, but local loan officers add market knowledge, program flexibility and personal guidance through complex transactions. MyMortgageRates aims to blend digital efficiency with local expertise to help borrowers find the best path for their needs.

FAQs About AmeriSave

Is AmeriSave Mortgage a legit company?

Yes. AmeriSave Mortgage Corporation is a legitimately registered mortgage lender (NMLS #1168) that has been operating since 2002 and publishes licensing and consumer contact information on its website. It has a long operational history and public press material documenting funded loan volume. it has also faced regulatory enforcement historically (a CFPB enforcement action in 2014 was resolved with remedies). Always verify licensing for your state on NMLS Consumer Access.

What credit score do you need for AmeriSave?

Minimum credit scores vary by loan type and investor overlays. AmeriSave's public pages indicate conventional loans often require minimums near 620, FHA programs commonly accept scores down to ~600 (where allowed by FHA guidelines), and some VA or special programs can consider lower scores depending on circumstances. For DSCR/non-QM products, underwriting uses different measures (property cash flow rather than standard Fannie/Freddie rules). Always ask a loan officer for program-specific guidance.

Is AmeriSave's mortgage closing down?

No public evidence indicates AmeriSave has closed down as of this check. AmeriSave continues to market loan products and publish borrower resources. That said, the mortgage industry can change fast (channels open/close, wholesale divisions change), so confirm the lender's status through corporate news and state licensing pages before publishing.

Is AmeriSave a broker or a lender?

AmeriSave is a direct lender. it underwrites and funds loans and holds NMLS licensing as a mortgage originator. AmeriSave also has offered third-party/wholesale programs in the past (AWMS), but its primary consumer channel is direct lending

Conclusion

AmeriSave is a mature, technology-centric online lender with a wide product menu that includes conventional, government, home-equity and some investor (DSCR) products. Independent reviewers praise its digital tools and promotional buydown offers but often flag pricing, fee transparency and occasional service/communication variations.

For borrowers who prioritize speed and a fully online workflow, AmeriSave is a reasonable option. But prudent shoppers should compare quotes from multiple lenders to ensure they get the best combination of rate, fees, and service for their situation. You can also ask the loan officers near you for the best rates for reference.