Rocket Mortgage Reviews 2025: Learn All About it with Real Ratings

Rocket Mortgage has established itself as a leading force in the U.S. mortgage lending landscape, particularly for borrowers seeking a fully digital experience. This comprehensive Rocket Mortgages review examines what the platform offers, its strengths and limitations, and how it compares to alternatives in the marketplace. Now, let's go on reading for more!

People Also Read

- All-to-Know: How Do Mortgage Rates Impact Affordability?

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- How to Calculate Early Payoff of Mortgage? Formula and Penalty

- 6 Best Loan Origination Software for Mortgage in 2025 [Never Miss]

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

About Rocket Mortgage

Rocket Mortgage started as an online, digital-first mortgage platform created inside the Quicken Loans organization and has grown into the mortgage division of Rocket Companies. The brand launched its fully digital Rocket Mortgage platform in 2015 to streamline approvals and closings, and the parent company (Rocket Companies) went public in 2020. Rocket markets itself as a tech-forward lender that emphasizes digital applications, verified approval letters, and eClosings.

The company says over 1 million clients have completed digital closings, and it has closed more than $1.8 trillion in loans since 1985. Rocket reports a very high net client retention rate, about 97% over the most recently reported 12-month period. Note that Rocket is one of the largest online mortgage lenders and has a large national footprint, but headcount and other operational figures change over time. The company reported roughly ~14k employees in recent filings.

Types of Mortgage Loans Rocket Mortgage Provides

Rocket Mortgage offers a broad range of loan products for purchase and refinance. Below, I list the main loan types, typical borrower requirements, and quick notes on rates/availability. For specifics (current rates, exact underwriting rules and regional availability), link to the lender's product pages and recent lender reviews. Rates change daily.

Conventional Loans

Fixed- and adjustable-rate conventional mortgages conforming to Fannie Mae/Freddie Mac limits and conforming/jumbo for higher balances.

Typical requirements: credit scores usually ~620+ for standard conventional loans. down payment options start at 3% for certain programs (HomeReady/Home Possible), but 5--20% is common.

FHA Loans

Government-insured loans with lower minimum down payments and lower credit score thresholds.

Typical requirements: FHA loans commonly accept scores as low as 580 for automated approvals (manual underwriting may allow lower), and require mortgage insurance. Rocket originates FHA loans and is an active FHA lender.

VA Loans

VA purchase/refinance programs for eligible veterans, active-duty service members, and certain spouses. Rocket offers VA purchase loans, cash-out, and streamline (IRRRL) refinance options.

Typical requirements: VA rules apply (certificate of eligibility, lender credit requirements). Some Rocket VA offerings allow very low or 0% down.

Jumbo Loans

Loans above conforming limits, which may vary by county. Rocket offers jumbo financing for higher-priced properties.

Typical requirements: higher credit score and reserves are usually required. terms and rates differ by loan size and borrower profile.

Home Equity Loans

Rocket offers home equity loans (fixed-rate second mortgages/lump sum).

Important note: Rocket does not currently offer USDA loans, and Rocket's HELOC availability is limited. Rocket promotes home equity loans but historically has stated it does not offer HELOCs. Please check the product pages for the latest. Always confirm with Rocket for current HELOC availability.

Pros and Cons of Rocket Mortgage

Rocket Mortgage's strengths are its digital platform, speed for some borrowers, and broad product menu. Common criticisms are pricing with rates and fees and occasional customer-service or servicing issues reported by customers and consumer sites. The bullets below synthesize expert reviews and broad consumer feedback.

Pros

-

Fast, digital application and borrower portal. strong online tools and a mobile app.

-

Large product menu for most borrower types (Conventional, FHA, VA, jumbo, home-equity).

-

Verified Approval Letter option helps offers stand out (income/assets/credit verified early).

-

Special affordability programs (ONE+, RentRewards, BorrowSmart, HomeReady/HomePossible credits).

Cons

-

Some reviewers and rate aggregators find Rocket's APRs and fees above average at times. not always the cheapest option.

-

Customer service/operations: mixed reviews exist. many positive experiences, but also a meaningful number of complaints, like long hold times, and servicing transfers.

-

Does not always offer niche products, for example, Rocket has historically not offered USDA loans.

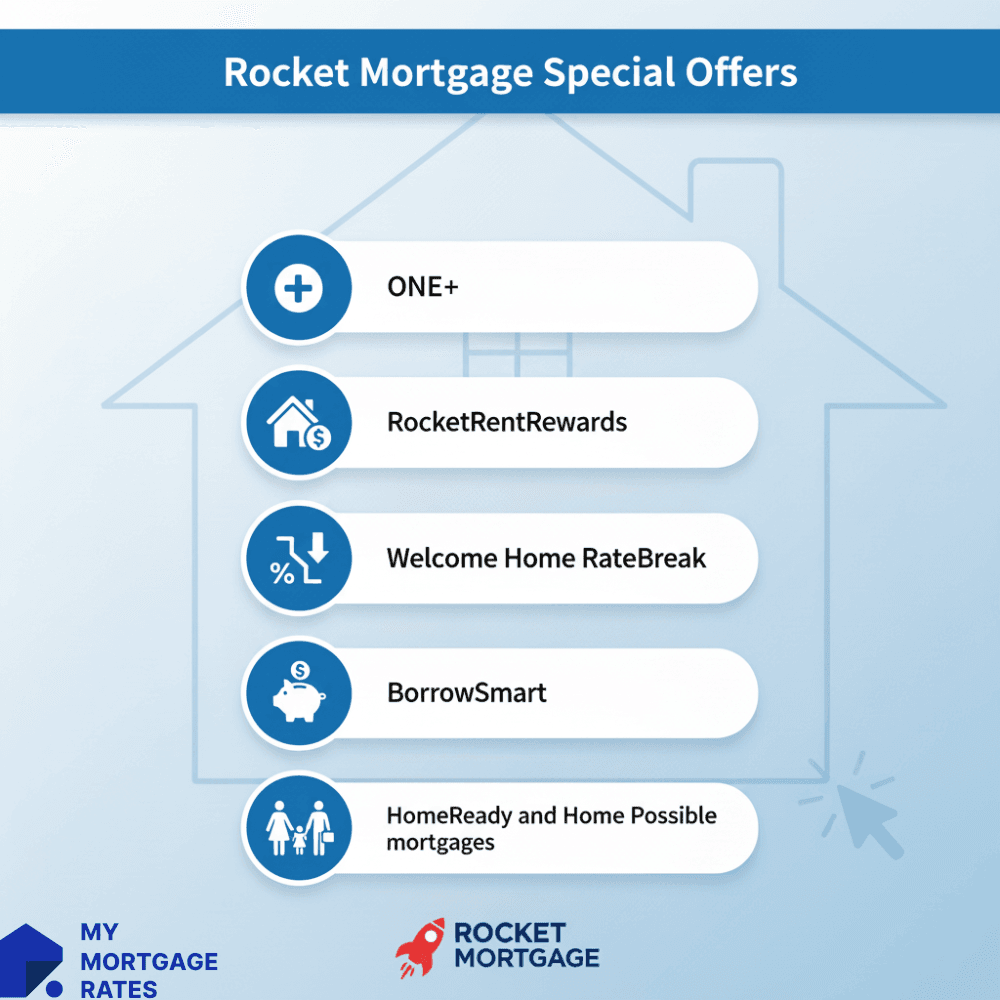

Does Rocket Mortgage Offer Any Discounts?

Rocket runs several programs and special product features. Below, I describe each briefly.

ONE+

ONE+ is Rocket's low-down-payment option: borrowers may put 1% down, and Rocket contributes a 2% grant, effectively creating ~3% total equity at close for eligible borrowers. program rules apply.

RocketRentRewards

RentRewards gives renters credit toward closing costs. Rocket advertises up to 10% of annual rent as a closing credit for qualifying renters who apply and convert. Terms apply.

Welcome Home RateBreak

Welcome Home RateBreak is a promotional product that temporarily reduces the borrower's rate for the first years, intended to improve affordability for qualifying buyers. Terms and availability vary.

BorrowSmart

BorrowSmart (Freddie Mac/BorrowSmart access programs) describes down-payment assistance/credits available when Rocket participates in such programs. Rocket references BorrowSmart access and other partner affordability tools to help low/moderate income buyers.

HomeReady and Home Possible mortgages

Rocket offers access to Fannie Mae HomeReady and Freddie Mac Home Possible programs (3% down options) and mentions credits that can help reduce out-of-pocket costs for eligible borrowers. These are agency programs with income and property limits.

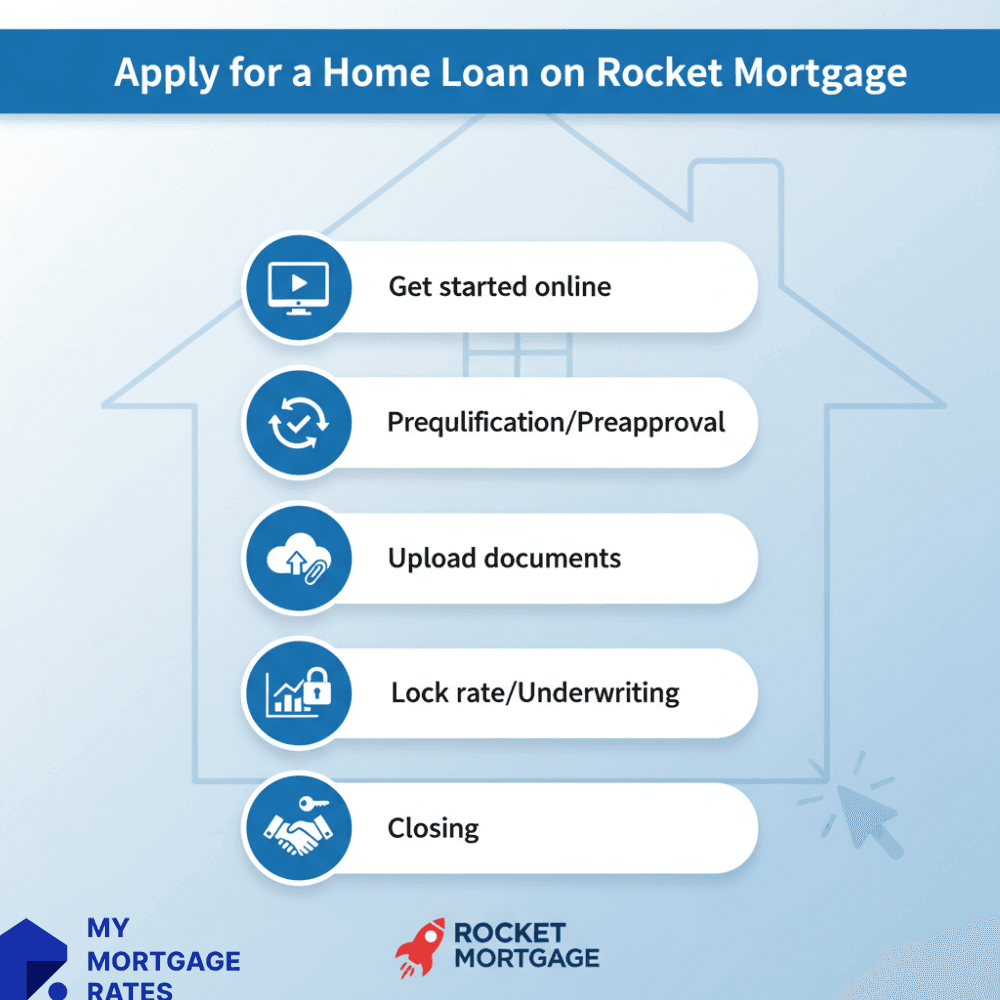

How to Apply for a Home Loan on Rocket Mortgage?

Based on Rocket's process and lender reviews, here's the typical flow:

-

Get started online. Create an account on Rocket's site or app and provide basic information (property, income, assets).

-

Prequalification/Preapproval. Rocket can provide a soft-credit prequal or a Verified Approval Letter (VAL) if income/assets/credit are verified. VALs can strengthen offers.

-

Upload documents. pay stubs, bank statements, ID, and other documentation. Rocket's portal is used for upload and tracking.

-

Lock rate/underwriting. Once documentation is reviewed, you can lock a rate. Underwriting may request additional items. Rocket says underwriting and closing timelines vary. Underwriting typically takes 30--45 days, though it can be shorter for simple files.

-

Closing. Rocket offers eClosings/hybrid closings in many states. Digital closing experiences for many borrowers. Verify closing steps with your Rocket rep.

Real Customer Reviews on Rocket Mortgage

Next, I give the current public ratings and representative customer feedback from each platform.

Trustpilot

Rating: about 4.6/5 with ~38k reviews on Trustpilot.

Three representative customer snippets:

-

"Nikki was phenomenal from start to finish."

-

"Very quick and easy."

-

"Great experience. Extremely communicative through the entire process."

Credit Karma

Rating: Credit Karma shows lender reviews and editorial coverage. Third-party aggregators report around 4.0/5 on Credit Karma.

Three representative customer comments:

-

Many borrowers praise the online application and transparency, "easy application," and good status tracking.

-

Some borrowers report higher than expected closing costs or fees and note the importance of reading the loan estimate carefully.

-

Several reviews praise specific loan officers by name (good communication and support). Experiences vary by local rep.

Zillow

Rating: Rocket's Zillow lender profile contains user reviews. The number of reviews for Rocket on Zillow is small compared with Trustpilot. Aggregated sources put Zillow lender/customer ratings for mortgage lenders in the mid-4.0 range when available.

Three representative customer comments:

-

"Very professional. hand-held us through the whole process."

-

"Helpful and responsive loan officer, smoothed a complicated closing."

-

"Mixed experiences. Some customers report excellent service, others note delays or communication issues."

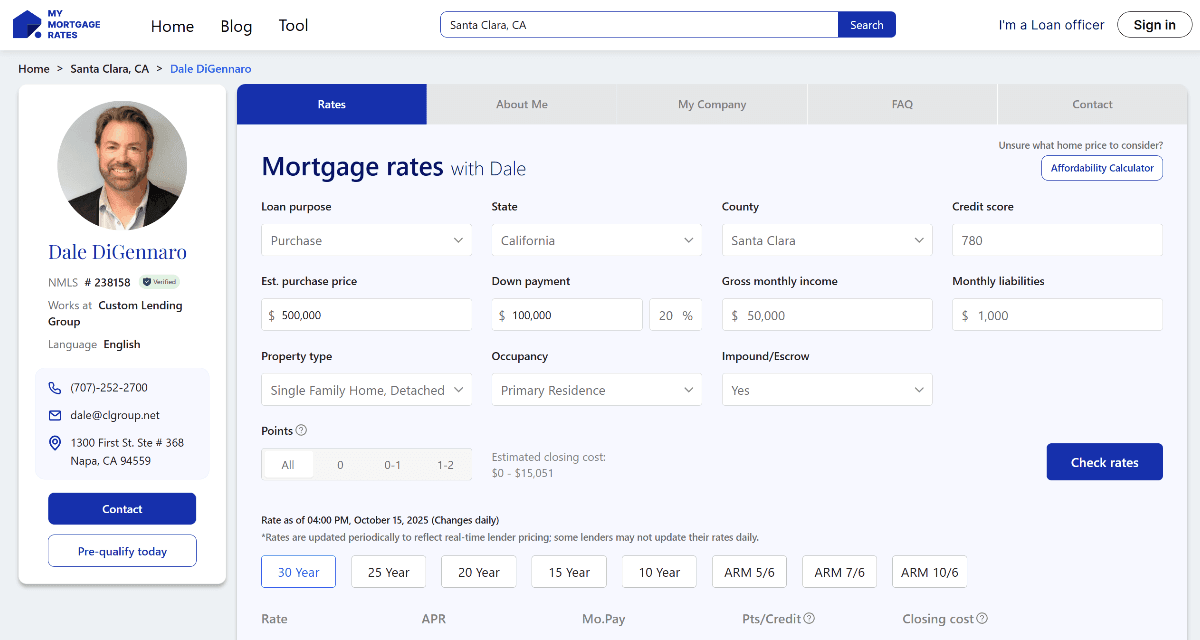

MyMortgageRates: Alternative to Rocket Mortgage

MyMortgageRates by Zeitro is a U.S. marketplace that connects borrowers with local, vetted loan officers. It helps borrowers find a loan officer quickly and lets loan officers showcase their expertise and capture leads for free. MyMortgageRates solves two common industry problems: borrowers don't know which MLO to contact, and many loan officers lack reliable lead channels.

Here are some brilliant features to explore:

-

All-in-One Platform: rate quotes, connect with loan officers, and loan progress tracking.

-

All Property Types: single-family, townhouse, multi-family, condo, manufactured home.

-

Top Loan Officers Around: find experts in Conventional, FHA, VA, USDA, and Non-QM (profiled by specialty).

-

Personalized Rates: real-time mortgage rate comparisons from 100+ lenders.

-

Transparent and Intuitive: simple search by location or loan type, privacy-forward security.

FAQs About Rocket Mortgage

Q1. Is Rocket Mortgage a good company to go with?

It depends on priorities. Rocket is strong on digital tools, verified approvals, and national reach. Many borrowers report smooth experiences. But review sites and rate trackers show Rocket is sometimes not the cheapest option. Compare rates and fees and read recent reviews for your state.

Q2. What bank is behind Rocket Mortgage?

Rocket Mortgage is the mortgage lending division of Rocket Companies, Inc. It grew out of Quicken Loans, the business reorganization and branding to Rocket Companies was completed in recent years. Rocket Companies is the public parent company.

Q3. What credit score is needed for Rocket Mortgage?

Minimums vary by loan type: FHA loans can accept ~580 in many cases. Conventional loans typically expect ~620+. VA rules differ. Exact eligibility depends on the loan program, DTIs, and underwriting.

Q4. What area does Rocket Mortgage cover?

Rocket operates nationwide in the U.S., though specific product availability depends on state rules and local licensing. Rocket offers hybrid/digital eClosings, but requirements vary by state.

Q5. Does Rocket Mortgage charge any fees?

Yes. Like most lenders, Rocket discloses origination fees, third-party fees, appraisal, and closing costs on the Loan Estimate. Fees vary by loan type and borrower profile. Compare the Loan Estimate when shopping.

Q6. Does Rocket Mortgage pay closing costs?

Rocket runs programs and credits, such as RentRewards, and ONE+ incentives, that may reduce borrower out-of-pocket costs in certain cases, but the cover vs. pay depends on program rules. Rocket also provides occasional promotional rate/credit programs. Always check program terms.

Conclusion

Rocket Mortgage has reshaped U.S. mortgage lending with its digital-first approach. Its intuitive online experience, wide range of loan products, and generally strong customer ratings help explain why it's one of the largest retail mortgage lenders in the country.

For borrowers who prioritize speed, convenience, and access to diverse loan programs---especially first-time buyers and those with non-traditional credit---Rocket Mortgage can deliver clear value. Its assistance programs, faster processing options, and digital closing capabilities make the process simpler for borrowers comfortable with a tech-forward experience.

That said, there are meaningful trade-offs. Rocket's rates and fees can be higher than market averages, which may negate the convenience benefit for rate-sensitive borrowers. Limited availability of certain products (for example, USDA loans and HELOCs at times) reduces options for specific borrowers. And the platform's standardized, digital processes occasionally lead to communication gaps that frustrate people seeking highly personalized guidance.

The right lender depends on individual priorities. Borrowers who value efficiency and a digital experience often find Rocket Mortgage a good fit. Those who want a close personal relationship with their loan officer, need specialty loan products, or are focused on getting the lowest possible rate should comparison-shop --- including using services like MyMortgageRates to connect with local loan officers.

In every case, get multiple rate quotes, review the full fee structure, and choose the loan product that best matches your financial situation. Rocket Mortgage deserves consideration in a serious shopping process, but it should not be the only option evaluated for this important financial decision.