Better Mortgage Reviews: Pros, Cons, and Everything to Know

When searching for the right mortgage lender, many borrowers turn to online communities for real-world experiences. A Reddit discussion asks whether Better Mortgage is worth it compared with other lenders. That thread captures the exact buyer intent this review answers: what Better does well, where it falls short, and when borrowers should include it in their rate-shopping. If you want to learn more about it, let's dive into this in-depth Better Mortgage review.

People Also Read

- Rocket Mortgage Reviews 2025: Learn All About it with Real Ratings

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- 6 Top Loan Origination Systems to Streamline Workflow in 2025

- Must-Read: How Long is a Mortgage Preapproval Good for?

- Detailed Guide: How to Get Preapproved for a Mortgage Loan?

What is Better Mortgage?

Better Mortgage (Better) was founded in 2016 by Vishal Garg as a technology-first mortgage platform designed to compress the time and friction of traditional mortgage processes. The company invested in a digital origination stack (its Tinman platform) to automate document collection, underwriting checks, and disclosures and position itself as a direct digital lender.

Better went public via a business combination with Aurora Acquisition Corp in August 2023, reporting that it has funded over $100 billion in mortgage loans to date, figures the company highlights in its investor releases and homepage. Better's model emphasizes online applications, transparent rate displays, and integrated services rather than brick-and-mortar branches.

Products of Better Mortgage

Now, let's see what products Better Mortgage has, and which one do you fall into.

One Day Mortgage

Better's One Day Mortgage promises a binding commitment letter within 24 hours for qualifying borrowers who submit required documentation quickly after rate lock. The program is designed to speed up underwriting and help buyers compete when timing matters, for example, in multiple-offer situations. Eligibility requires rapid document uploads and meeting underwriting criteria. The company materials explain the qualification steps and limitations.

HELOC

Better offers Home Equity Lines of Credit (HELOCs) with online applications and automated valuation in many markets. The HELOC product page advertises fast decisions for qualifying borrowers in some circumstances approvals in a matter of days, and credit lines up to the company limits, specific draw minimums, availability and terms depend on property type, state rules and borrower profile. Always verify local availability and minimum draw rules on the HELOC product page.

Insurance

Better operates an insurance arm, known as Better Cover, that shops multiple carriers for homeowners, renters, and related policies. The insurance offering is positioned as a convenience for mortgage borrowers: surfacing competitive quotes, easing policy switches, and providing concierge support through claims and annual reviews. The insurance service is distributed through Better's insurance marketplace, Better Cover.

What Better Mortgage Offers

Moreover, what can you do through Better Mortgage? It offers a range of services in real estate. Let's walk them through one by one.

Buy a Home

Better's digital purchase workflow starts with a quick prequalification and allows borrowers to move to verified preapproval (document upload and a hard credit check) through a centralized dashboard. The platform integrates rate quotes, document management, and communications so borrowers can track step-by-step progress from application to closing.

Sell a Home

Better Real Estate connects borrowers to agents and offers coordinated workflows for customers who are buying and selling simultaneously. The goal is to reduce timing friction between sale proceeds and new purchase financing by aligning agents with Better's digital timelines and tools. Availability and the agent network vary by market.

Refinance

Better Mortgage offers rate-and-term and cash-out refinances, including streamlined options for government loans when eligible. The refinance process uses the same online tools as purchase loans, and the company advertises a faster average close time than industry averages in many cases. You may also check Better's refinance timeline for current statistics.

VA Loan

Better Mortgage supports VA purchase and refinance products and provides tools to help borrowers determine eligibility and required documentation (certificate of eligibility, entitlement, etc.). As with other lenders, specific credit score minimums are set by underwriting and may vary, VA rules don't mandate a single national minimum, so eligibility depends on Better's underwriting overlays.

Calculators

Better Mortgage also provides several borrower tools that are used widely on its site, including:

- Affordability calculator, estimates how much house a borrower can afford given income, debts and local taxes.

- Mortgage payment calculator, breaks monthly principal, interest, taxes, insurance and PMI into an estimate.

- Rent vs. Buy calculator, compares long-term financial outcomes for renting vs. buying.

What Special Offers Does Better Mortgage Offer?

Better has marketed several buyer-facing guarantees and programs. Two widely referenced offers are:

Better Agent Match

Better Agent Match pairs buyers with pre-screened agents who understand the company's digital process. Matched buyers may receive additional coordination benefits (agent support aligned to Better's timelines). Availability varies by market.

Better Price Guarantee

Better's Price Guarantee claims to match verified competitor loan estimates and, in some cases, provide a credit if it cannot beat the competitor's verified offer. Terms and eligibility rules apply. Borrowers must submit competitor written loan estimates within specified timeframes for the guarantee to apply. Read the program terms carefully before relying on the guarantee.

Pros and Cons of Better Mortgage

Better's digital approach produces meaningful benefits for many borrowers, but the model also introduces tradeoffs. There are some pros and cons you might learn before getting in touch with Better Mortgage.

Pros:

- Competitive pricing on many mortgage products, Better advertises low rates and often eliminates origination fees.

- Fast, digital workflow and document handling that can shorten time to commitment and closing. Its One Day Mortgage is built for speed when borrower documentation is complete.

- Integrated services with title, insurance shopping, and agent matching reduce coordination for buyers who prefer a single-platform experience.

- Useful online tools and calculators help buyers model affordability and payment scenarios before applying.

Cons:

- A digital-first model reduces in-person touchpoints. Some borrowers report frustration when they prefer face-to-face help. Review coverage shows mixed experiences on customer service responsiveness.

- High visibility and volume mean Better appears frequently in complaint databases. Consumers should check BBB and CFPB complaint histories while factoring in scale. BBB lists complaints. CFPB complaint records are publicly searchable.

- Some specialty products, such as construction loans, and certain USDA/bridge products, are not as widely offered as at full-service national banks or niche lenders, and availability changes over time

Real Customer Reviews on Better Mortgage

Better's review footprint is large and mixed: Trustpilot and company review pages show many positive accounts of fast closings and low rates, while complaint databases and review sites contain negative reports about communication or timing delays. You may check current review pages to get the latest reviews on Better Mortgage.

Trustpilot

Better Mortgage has a 4.0 out of 5.0 rating on Trustpilot, with many five-star reviews praising the streamlined process and some negative reviews focused on communication and delays.

"I was a skeptic and I believed HELOCs were not achievable unless you had a lot of money in your bank account. But, Better.com proved me wrong. They were very professional and friendly. Every step of the process they would explain what was needed and what they were doing. I give them 5 stars." - Douglas Stroman

"Highly Dependable. Couldn't recommend them enough." - Liana Gregory

"So many things went wrong. You guys messed up, your title company messed up, and their dispersement process messed up multiple times. Literally, EVERYTHING went wrong. I would highly recommend NOT using you guys. Not only that! But I was lied to! The sales guy quoted me $495, and the total cost to close was $1800. Horrible, horrible experience in every way. You guys nearly ruined my life. If a user is considering you guys, PLEASE dont use Better" - Michael Calhoun

Credit Karma

Better Mortgage has a 3.9 out of 5.0 rating on Credit Karma. It hosts borrower reviews describing both smooth online approvals and frustrated experiences with document follow-ups.

"The overall process was simple and straightforward. Everyone I dealt with was professional and understanding and responded quickly. It was by far the easiest mortgage transaction."

"Better Mortgage's lack of transparency and communication left a frustrating mark on my experience. Despite diligently completing all required tasks, the disheartening revelation that they couldn't fund the loan blindsided me. The absence of proactive communication compounded the issue; I found myself consistently reaching out for updates, a responsibility that should have rested on their shoulders. This ordeal not only reflects a lack of professionalism but also raises serious concerns about their commitment to customer satisfaction. A fundamental expectation when navigating the complexities of a mortgage process is transparent and regular communication, which sadly seemed amiss with Better Mortgage. For those in search of a reliable and customer-centric mortgage company, I strongly advise looking elsewhere. The unsettling experience with Better Mortgage serves as a cautionary tale. In the competitive landscape of mortgage providers, there are undoubtedly companies that prioritize transparent communication and customer care. Opting for such alternatives ensures a smoother and more respectful journey through the intricate process of securing a home loan."

"Process is fine, although there are a LOT of questions and to and fro. Actual mortgage seemed great but it's been sold on twice already within a year to two different companies, Colonial and then Planet Lemding with all the subsequent hassle of changing payments and updating insurance information each time as it seems they can't share that info."

Zillow

Better Mortgage has a 3.9 out of 5.0 rating on Zillow. Reviewers often mention rate competitiveness and online convenience, but service consistency varies.

"John Yacos and his incredible team helped my wife and I purchase our first home. He was very patient with us as we had so many questions. He knew all the answers and made sure we understood why those answers made sense. I would recommend NEO to anyone for a home purchase and tell each of the to ask for John and his team. Thank you for helping us into our beautiful home!"

"From the beginning I let the lender know I only been at my second job since October, 2023 and they made it sound like they make magic work cause I have good credit then at the last minute the underwriter made a different decision so I am so over it."

"My Credit Scores are over 800 each and "Better" dropped the ball, never responded to my initial inquiry. I know they must have received my information since weeks later they started sending me boilerplate advertising emails, but no phone calls or anything specific to me. I'm disappointed, but sometimes these things happen."

Better Mortgage vs Rocket Mortgage

Some borrowers wonder how Better Mortgage compares to Rocket Mortgage, so let's figure out their differences here.

-

History & scale: Rocket Mortgage, founded as Quicken Loans, is the largest retail mortgage originator in the U.S., with decades of scale and a large brick-and-digital footprint. Better is a newer, digital-first lender founded in 2016 that scaled quickly and went public via a SPAC in August 2023. Better emphasizes automation and an end-to-end online experience.

-

Loan types: Rocket offers a broad suite of products like conventional, FHA, VA, jumbo, construction, bridge, etc. Better covers core purchase and refinance products, sucha as conventional, FHA, VA, jumbo, HELOC and cash-out refinances, but may not offer the same breadth of specialty or construction products that Rocket or some regional lenders list.

-

Customer satisfaction & special offers: Rocket often scores higher on long-standing customer satisfaction benchmarks (e.g., J.D. Power) and has a deep retail and service network. Better competes on low fees (no origination in many products), faster online turn times on eligible files and programs such as One Day Mortgage and Price Guarantee.

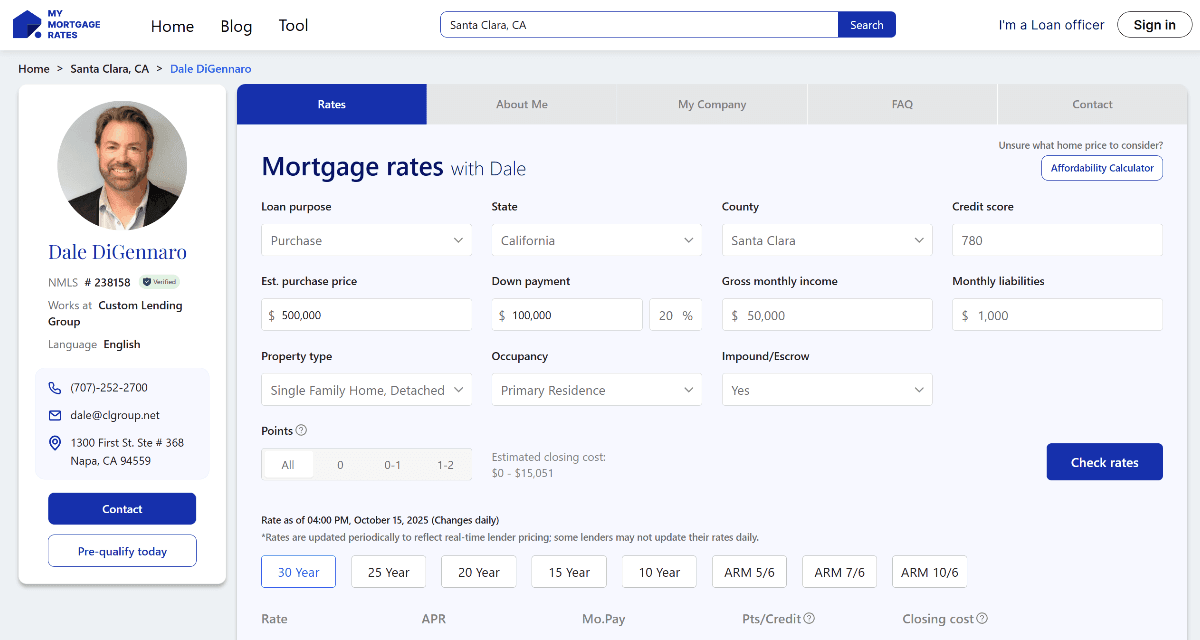

MyMortgageRates: Best Alternative to Better Mortgage

If a borrower wants the speed of digital quotes but also wants to shop with local loan officers, MyMortgageRates by Zeitro is presented as a marketplace connecting borrowers with nearby loan officers. The platform lets loan officers create a free personal profile, get organic search exposure, and receive leads, which can be attractive for borrowers who prefer working with a local MLO while still comparing rates across lenders. This marketplace approach is complementary to direct lenders like Better and helps borrowers compare personalized offers from multiple human loan officers.

FAQs About Better Mortgage

Q1. What types of loan does Better Mortgage offer?

Better provides conventional fixed and adjustable loans, FHA, VA, jumbo loans, HELOCs, and both rate-and-term and cash-out refinances. Availability of certain specialty products like construction, and USDA, is more limited compared with some full-service lenders.

Q2. Why is a Better Mortgage so much cheaper?

Better reduces costs through digital automation, fewer physical branches, and streamlined origination that lowers overhead. The firm's business model aims to pass savings to borrowers, for example, often no origination fee, though final costs depend on third-party fees and local closing charges.

Q3. Who is the owner of Better Mortgage?

Better was founded by Vishal Garg (CEO). The company completed a business combination and became publicly traded in August 2023, see the company press release for SPAC details.

Q4. How much are Better Mortgage closing costs?

Closing costs vary by loan amount, property, and local fees. Federal data and industry reviews show Better's third-party closing costs are comparable with digital lenders. Better has published typical closing-cost estimates on its website and in investor materials.

Q5. What credit score do you need for a Better Mortgage?

Minimum credit score requirements depend on the product: conventional loans typically have higher minimums than government programs. Lenders set overlays, and each case is evaluated holistically. Better's product pages and preapproval flow show the credit bands they prefer for each program. There is no single industry-wide cutoff posted by Better for every product.

Conclusion

Better Mortgage is a strong option for digitally comfortable borrowers who prioritize speed, transparency and competitive pricing. The company's One Day Mortgage and integrated services offer real advantages for qualified customers who can provide documents promptly. That said, the tradeoffs are real: reduced face-to-face service, a visible complaint record, which should be viewed in the context of large origination volume, and narrower specialty product coverage vs. some traditional lenders.

Please always rate-shop to get written loan estimates from at least three lenders, read program fine print (One Day eligibility, Price Guarantee rules), and check current review and complaint data (BBB/CFPB/Trustpilot) before choosing a lender. If you want the convenience of a digital lender but also desire local human guidance, consider using a marketplace such as MyMortgageRates to compare local loan officers near you and offers before locking.