Mortgage Origination Fee: What Is It? Everything You Should Know

If you're a first-time home buyer, you may not know what an origination fee is on a loan. Therefore, you can check here to learn all the things about the mortgage origination fee: the history, how it is determined, how to calculate, and any lingering questions in your mind. Now, let's take a look.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- Rocket Mortgage Reviews 2025: Learn All About it with Real Ratings

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- 6 Best Mortgage CRM for Brokers, Lenders, MLOs in 2025

What is an Origination Fee on a Loan?

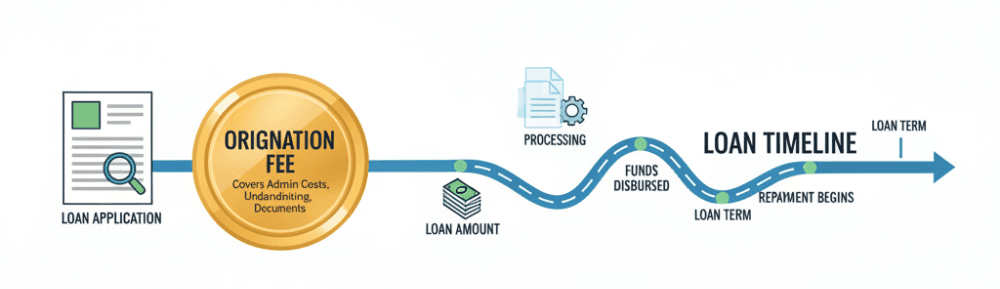

So, what is a loan origination fee? This is an upfront charge that a lender may assess your origination fee to cover the cost of creating and processing a loan.

- For mortgages, this typically includes lender underwriting, processing, and related administrative work.

- For personal loans, it covers similar processing and risk-assessment costs.

On mortgage loans, you'll see origination charges, which are paid to the creditor or mortgage broker, listed on the Loan Estimate and later on the Closing Disclosure. The Loan Estimate must be provided within three business days of application, and it breaks closing costs into categories so borrowers can see which charges are paid to the lender during loan origination and which are third-party costs.

History of Origination Fees

Origination fees first showed up as mortgage markets standardized and lenders looked for a transparent way to recover processing costs. Over the decades, disclosure rules have evolved. Most recently, under the TILA-RESPA Integrated Disclosure (TRID) framework, lenders are required to show origination charges and other closing costs in a standardized Loan Estimate and Closing Disclosure. Therefore, borrowers can compare offers more easily. The CFPB/TRID rules also create tolerance rules that limit how much certain fees may change between the Loan Estimate and the Closing Disclosure.

What is an Origination Fee on a Personal Loan?

If you want to get a personal loan, you should know that personal-loan origination fees are similar in intent. However, they are usually higher in percentage because unsecured personal loans carry more credit risk for lenders.

Typical ranges for personal-loan origination fees are about 1% to 8% of the loan amount for mainstream personal lenders, though some subprime products can charge more and some prime lenders charge no origination fee at all. Many online lenders and credit unions offer no-fee options as a competitive feature. You should always check whether the fee is deducted from the proceeds (common) or paid at closing. Also, you can ask a loan officer near you on MyMortgageRates to have a further talk.

How Origination Fees Are Determined

After learning what a loan origination fee is, you may wonder how it's determined. Actually, there are several factors that can affect your origination fees:

- Credit risk. Higher credit quality usually yields lower fees.

- Loan type and product. FHA/VA programs may have different fee practices.

- Loan size and term. Percentage fees are proportional, but some lenders use flat fees for certain ranges.

- Market competition and lender business model. Some lenders waive origination fees to advertise "no-fee" mortgages and recoup with slightly different rates or by selling other services.

Since origination fees are negotiable in many situations, you should shop with multiple lenders or ask for credits/waivers to compare the fees. Next, let's see how much are loan origination fees.

How Much are Loan Origination Fees?

Now, let's get to know the average loan origination fee and check out the example.

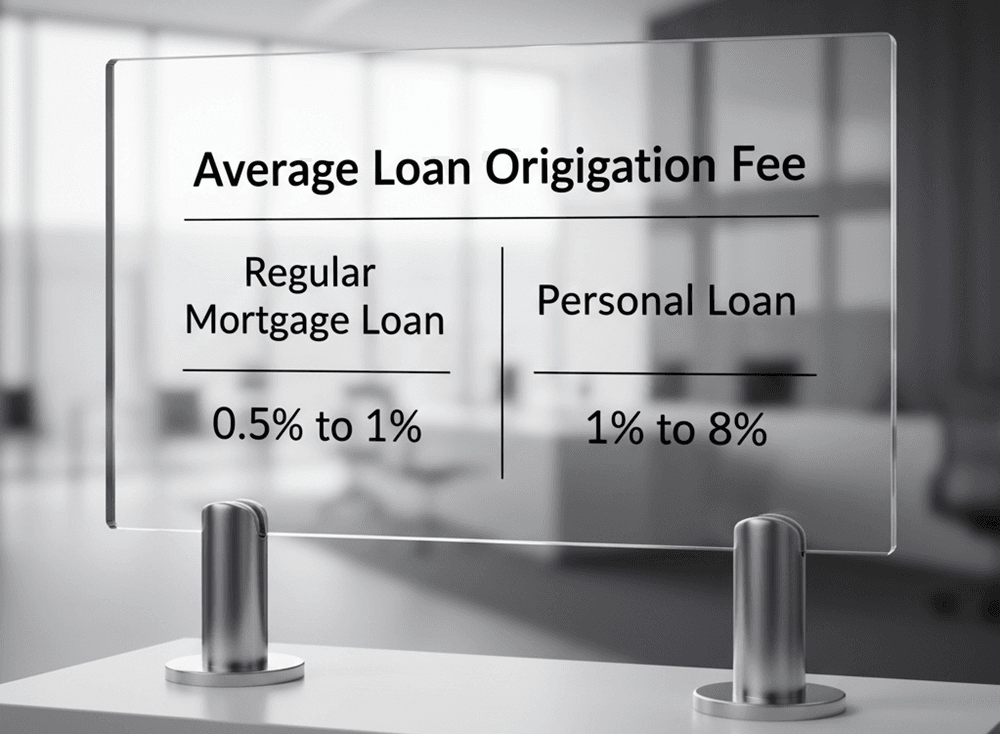

Average Loan Origination Fee

For a regular mortgage loan, the range of the average loan origination fee is about 0.5% to 1% of the loan amount, so $1,500–$3,000 on a $300,000 mortgage is typical. Some lenders charge slightly less. Others charge more. But 0.5–1% is the standard ballpark used by consumer guides.

For personal loans, the fee commonly ranges from 1% to 8%, and certain lenders or poor-credit products can go higher. You should always compare the APR, not just the upfront fee, because APR captures the loan's total cost.

Loan Origination Example

There are examples of a regular loan and a personal loan.

- If you borrow $400,000 and your lender charges a 0.75% origination fee, the origination charge is $3,000 (0.0075 × $400,000).

- For personal loans, a 4% origination fee on a $25,000 loan would be $1,000 and is often deducted from the loan proceeds, so you receive $24,000 but repay $25,000 plus interest.

Note: the Loan Estimate separates Origination fees from third-party fees, for example, appraisal, title, and recording fees. Do not assume all items shown at closing are part of the origination fee. Many are third-party costs placed in different sections of the disclosure.

How to Calculate Loan Origination Fee?

The calculation of the loan origination fee is easy. You just multiply the loan amount by the lender's origination percentage. You can check out the examples above. If a lender uses a flat fee instead of a percentage, use the flat dollar amount the lender discloses. When comparing lenders, add origination fees into the APR calculation or use the APR and total closing costs to compare offers apples-to-apples.

Loan Origination Fees vs. Points

Some people may fix up the origination fee with points. Here are the differences for your reference.

- Origination fees (origination points) pay the lender for processing the loan. These are generally not the same as discount points.

- Discount points are prepaid interest you can buy to reduce the mortgage interest rate. They may be tax-deductible if they meet IRS rules for mortgage points. In contrast, origination points are usually treated as lender compensation and are generally not deductible as mortgage interest, according to Investopedia.

FAQs About Mortgage Origination Fee

If you have any questions, you should get to learn more FAQs below.

Q1. What is a typical loan origination fee?

A typical mortgage origination fee is 0.5%–1% of the loan amount. However, you should know that personal loan fees are commonly 1%–8% but vary widely. Therefore, keep in mind to shop lenders and compare APRs as well as upfront fees.

Q2. Are loan origination fees tax-deductible?

Actually, origination fees are not automatically tax-deductible.

- Discount points (prepaid interest) can be deductible if they meet IRS rules.

- Origination fees that are clearly lender compensation are usually not deductible as mortgage interest.

You should refer to IRS Topic 504 and Publication 936, and consult a tax advisor for your situation.

Q3. Can I get personal loans with no origination fee?

Yes. Some lenders, like credit unions and certain online lenders, may offer personal loans with no origination fee. If you want to apply for a personal loan, you gotta compare interest rates and APRs. This is because a no-fee loan with a higher APR can cost more over time than a loan with a small origination fee and a lower rate.

Q4. How to avoid loan origination fees?

There are options you can consider to save on loan origination fees.

- Negotiating with the lender.

- Seek lender credits (higher rate in exchange for credit).

- Use a lender that advertises no-fee products.

- Ask a seller for concessions in a purchase transaction.

- Use relationship discounts from banks where you already hold accounts.

Q5. Can an origination fee be refunded?

Generally, you cannot refund an origination fee after closing, because the lender has performed the processing work. If you withdraw before closing, it may vary depending on refund policies. Some lenders retain application fees or portions to cover costs already incurred. Before you pay for it, you might as well read your loan agreement and ask the lender or loan officer for their refund policy.

Q6. Is a 10% origination fee high?

Yes. 10% is extremely high for mortgage origination and would be an outlier for personal loans as well. It should trigger careful scrutiny. For mortgages, such a large fee could indicate a non-standard product or predatory pricing. Typical mortgage origination fees are much lower (0.5–1%). For personal loans, very high origination fees sometimes appear in subprime or very short-term products, but you should compare alternatives.

Conclusion

All in all, origination fees are a standard charge of lending, but they are negotiable, variable by lender and product, and only one part of the total loan cost. As for first-time homebuyers, you should compare multiple lenders, and focus on APR and total closing costs rather than a single line item. Also, ask for the refund policy. If you have any questions, just get in touch with loan professionals near you on MyMortgageRates.