6 Best Mortgage CRM for Brokers, Lenders, MLOs in 2025

When I first entered the mortgage industry three years ago I tracked leads in spreadsheets, toggled between half a dozen point tools, and lost borrowers because follow-ups slipped. After piloting and using a dozen mortgage CRMs across live loan files, I found platforms that truly moved the needle on time-to-close, application completion, and borrower experience. The mortgage CRM market, based on WideGuyReports, was valued at USD $9.16 billion in 2024 and is forecast to grow to USD $12.18 billion by 2031, highlighting how central these tools have become for originators and lenders.

I evaluated each platform using at least 10 live loan files across broker and lender environments during Q1 2025. I tested time spent per loan file, application completion rate, LOS/AUS sync reliability, and marketing/lead conversion behavior. Now, you may check out which 6 tools finally stands out as the best mortgage CRMs.

People Also Read

- Rocket Mortgage Reviews 2025: Learn All About it with Real Ratings

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- [Ultimate Guide] Where to Find a Loan Officer Near Me?

- Mortgage Broker vs Loan Officer: Learn All the Differences Here

- Mortgage Loan Originator vs Loan Officer: Differences and Similarities

What is CRM in Mortgage?

A Mortgage CRM (Customer Relationship Management) is software built or customized for mortgage professionals to manage borrower relationships, track loan pipelines, and automate repetitive tasks through origination and post-close stages. Unlike generic CRMs, mortgage CRMs understand mortgage-specific workflows, digital 1003 applications, AUS integrations, DTI/DTI calculations, loan milestone tracking, and compliance documentation, so they act as a single command center for originations and loan servicing teams.

Benefits: Why Do You Need the Best Mortgage CRM?

If you just became a loan officer, broker, or lender, it could be a great help to find the right loan origination software that improves your efficiency and closes more loans. There are more benefits, like:

-

Dramatically increased productivity: centralize documents, calls, and tasks so originators spend more time selling and less time admin.

-

Higher lead conversion: automated follow-ups, lead scoring, and prioritized tasks keep more leads active.

-

Improved compliance and auditability: built-in audit trails, DNC/TCPA handling, and secure storage reduce regulatory risk.

-

Seamless integrations: LOS, pricing engines, credit pulls, and marketing stacks reduce duplicate entry and costly errors.

-

Better borrower experience: milestone notifications, a borrower portal, and branded intake increase completion rates and referrals.

-

Data-driven decisions: reporting, and ML/AI features surface the best lead sources and friction points.

#1 Zeitro - Best CRM System for Anyone

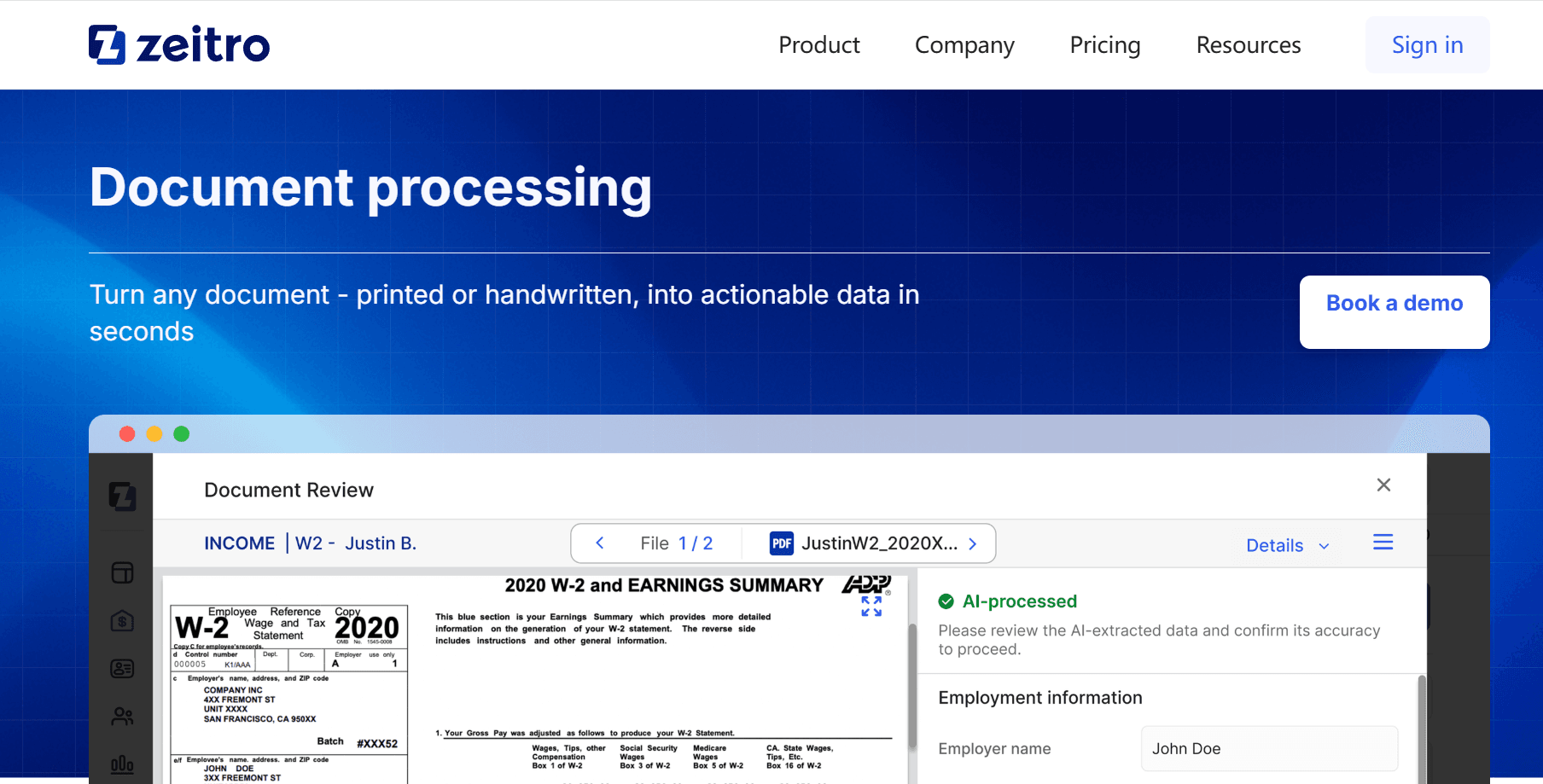

Zeitro positions itself as an affordable, AI-first mortgage CRM built specifically for originators, brokers, and small lenders. This best mortgage CRM platform combines a digital 1003, OCR document intake, real-time pricing, GuidelineGPT (natural-language guideline lookup), and an AI scenario assistant to help loan officers qualify borrowers and navigate underwriting rules faster.

Zeitro claims measurable efficiency gains of 7+ hours saved per loan and 2.5× faster pre-qualification. In practice, Zeitro's strengths are quick setup, a low-cost/free entry plan that lowers adoption friction for solos, and built-in LOS export (FNM 3.4) that helps move completed applications downstream. The system also includes GrowthHub microsites and credit integrations for lead capture and follow-up. Anyway, Zeitro is worth testing if you want AI assistance and low upfront cost while keeping origination workflows tightly integrated.

Features:

-

Scenario AI: An AI chat assistant for loan officers that navigates complex borrower scenarios with speed and confidence, providing clear, source-backed answers across multiple programs in seconds with full citation transparency

-

GuidelineGPT: Instant access to FHA, VA, Fannie Mae, Freddie Mac, and USDA guidelines through natural language queries, eliminating manual PDF searches

-

Pricing Engine: Real-time rate quotes with powerful integrations for conventional, Non-QM, and private lending scenarios, with smart overlay adjustments

-

Digital 1003 Application: Self-service pre-qualification with automated DTI calculation and seamless FNM 3.4 format exports

-

AI Document Processing: OCR-powered document collection and verification that automatically organizes borrower documents for underwriters

-

GrowthHub: Personal branded microsite builder with SEO optimization, rate calculators, and lead generation tools

-

CRM & Pipeline Management: Built-in contact management, mortgage call reports, and loan tracking capabilities

-

Credit Reporting: Integrated real-time credit checks for accurate pre-approval results

Pros:

-

Extremely affordable pricing with a generous free tier

-

AI-powered tools significantly reduce manual guideline research

-

Quick implementation without extensive training requirements

-

Supports all loan types, including non-traditional lending

-

Built-in compliance features and automated condition collection

Cons:

-

Newer platform with smaller user community compared to established competitors

-

Free plan limits GuidelineGPT to 5 queries daily and 10 lifetime FNM exports

#2 Shape - Best Mortgage CRM for Professionals

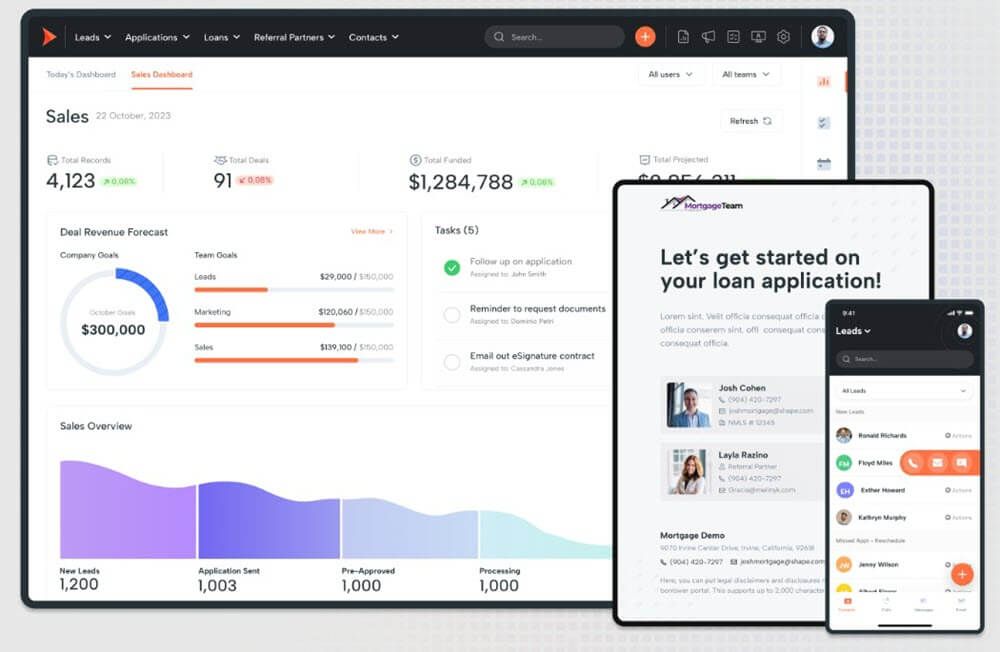

Shape targets mortgage teams that need a single platform for lead capture, prioritized outreach, marketing, and realtor/referral partner management. It emphasizes AI-trained mortgage workflows that automatically score and distribute leads, plus a large library of CRO-optimized landing pages and marketing templates maintained by Shape's team.

Built-in two-way SMS/MMS, a compliant dialer with call recording, and ShapeAI call summarization allow loan officers to engage prospects across channels while preserving compliance records. Shape also provides pre-built campaigns for every loan stage, co-branding tools for Realtor partners, and native LOS connectors (examples include Encompass and LendingPad) to keep loan data synchronized.

Pricing is typically quote-based, which can be higher than simple point solutions, and the feature set can be overwhelming for solo producers. Where Shape shines is in centralized marketing execution and referral management: teams that rely heavily on agent relationships will find the realtor nurture tools and co-branded assets especially valuable. Consider Shape if you want to consolidate marketing, lead follow-up, and partner relationship management into one mortgage-specific platform.

Features:

-

AI-Powered Lead Management: Advanced lead distribution logic with smart prioritization and built-in duplicate management to surface hot prospects

-

Comprehensive Marketing Toolkit: Thousands of pre-designed templates, social posts, flyers, and automated drip campaigns for every loan stage

-

Unified Communication Suite: Two-way SMS/MMS with media support, compliant dialer with recording, and bulk email capabilities

-

Built-in Point of Sale: Document collection and 1003 application portal with direct LOS synchronization

-

Realtor Partner Management: Dedicated tools to nurture, track, and manage referral relationships with co-marketing features

-

Call Recording & AI Insights: Automatic transcription and ShapeAI scoring/summarization for coaching and compliance

-

Live Call Monitoring: Heads Up Display allowing managers to listen to calls without interruption for quality assurance

-

AI Assistants: Automated outreach, qualification, and appointment scheduling handling text and call interactions

-

Integrated Task & Calendar: Workflow checklists with Google/Outlook calendar synchronization

-

Actionable Reporting: Performance tracking including lead conversion rates, CPA, CAC, ROI, and marketing effectiveness

Pros:

-

Truly all-in-one platform reducing need for multiple subscriptions

-

AI specifically trained for mortgage industry use cases

-

Extensive pre-built marketing materials and campaigns

-

Strong realtor relationship management capabilities

-

Native LOS integrations eliminate double data entry

-

Mobile app provides full functionality on-the-go

Cons:

-

Pricing not publicly disclosed (requires contact for quote)

-

Potentially overwhelming feature set for solo producers

-

May require significant setup time to leverage all capabilities

-

Learning curve steeper than simpler platforms

#3 Salesforce - Best CRM for Mortgage Lenders

Salesforce Financial Services Cloud is the enterprise choice for banks, credit unions, and large non-bank lenders that need scale, customization, and deep integrations. Built on Salesforce's extensible platform, it offers 360° borrower profiles, industry data models, workflow automation, and advanced analytics. The product supports digital lending modules and a broad ecosystem of third-party apps for pricing, underwriting, and compliance. Typical seat pricing for Sales or Service editions starts near $325/user/month, with Digital Lending and heavy customization adding separate, often material, costs, confirm pricing with Salesforce for accurate quotes.

Strengths include enterprise reliability, robust security/compliance controls, and the ability to centralize cross-department workflows (originations, servicing, collections). Downsides are complexity, longer implementation timelines, and the need for technical or consulting resources to customize and optimize the system. For organizations that require strict governance, multi-branch consistency, and advanced reporting, Salesforce offers unmatched flexibility, but it's best deployed when you have the budget and implementation capacity to match.

Features:

-

360-Degree Borrower Views: Single unified platform showing all financial holdings, loan history, and borrower interactions

-

Industry-Specific Data Models: Pre-built mortgage workflows and data structures based on Sales Cloud Enterprise or Service Cloud Enterprise foundations

-

Digital Lending Module: Complete loan application platform with Product Catalog, Salesforce Pricing, and Underwriter Console

-

Financial Goals & Plans: Actionable segmentation tools and customer financial planning capabilities

-

Service Process Studio: Customization tools allowing service teams to tailor workflows without extensive coding

-

Performance Management: Comprehensive analytics, reporting, and team performance tracking integrated with Salesforce ecosystem

-

Collections & Financial Recovery: Automated outreach, promise-to-pay tracking, and collections assistance (includes 200 Collections Credits)

-

Risk & Compliance Management: AI-powered risk assessment, monitoring, and regulatory compliance reporting

-

Slack Integration: Native collaboration tools for seamless team communication

-

Data Cloud Connection: Integration with Salesforce Data Cloud for advanced analytics and intelligence

Pros:

-

Enterprise-grade reliability and scalability

-

Extensive customization and integration capabilities

-

Robust compliance and security features

-

Comprehensive ecosystem of add-ons and third-party apps

-

Strong support infrastructure including Premier and Signature success plans

-

Powerful reporting and analytics capabilities

Cons:

-

Significantly higher cost starting at $325/user/month

-

Requires Salesforce expertise for setup and optimization

-

Can be overly complex for small teams or solo producers

-

Digital Lending module adds substantial cost ($520,000/org/year)

-

Implementation timeline typically longer than simpler platforms

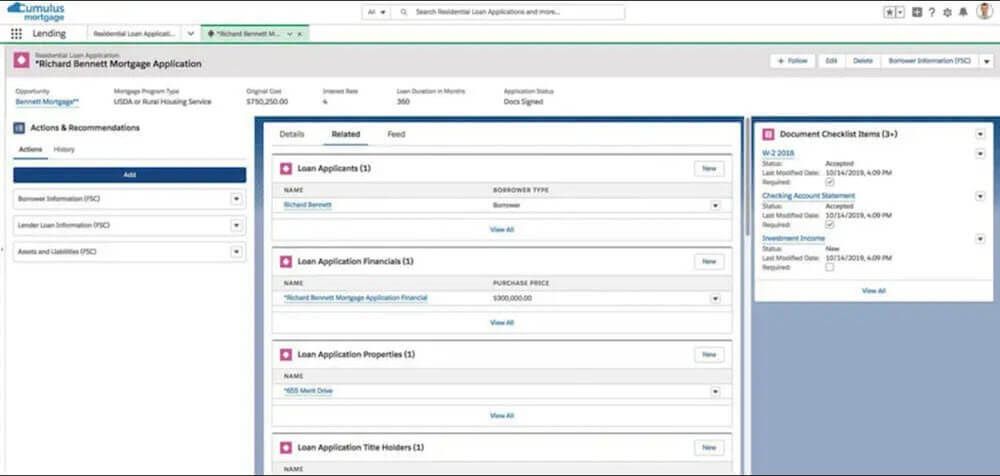

#4 Jungo - Best CRM for Mortgage Loan Officers

Jungo wraps mortgage-specific features into a Salesforce-based package tailored for loan officers and small teams who want enterprise reliability without building from scratch. It includes automated lead capture and distribution from major sources, a post-close Concierge program for retention and referrals, Reffinity for realtor relationship tracking, and PrintPub for creating co-branded marketing materials. Jungo's public pricing, around $119/user/month billed annually, makes Salesforce technology accessible to smaller teams, though a one-time setup fee and certain add-ons (SMS, LOS sync) may increase initial costs.

The platform's advantages are its mortgage-tailored workflows, strong post-close nurture automation, and deep LOS/Pricing integrations that reduce duplicate data entry. The tradeoffs: it inherits Salesforce's learning curve, and some advanced capabilities require higher-tier plans or professional services. For loan officers who want the scalability and reliability of Salesforce but prefer an out-of-the-box mortgage setup, Jungo is a pragmatic middle ground.

Features:

-

Salesforce Foundation: Enterprise-grade CRM reliability with mortgage-specific customizations built on proven Salesforce platform

-

Automated Lead Management: Captures and distributes leads from 1,400+ integrated sources with intelligent segmentation

-

Database Management: Tools to segment contacts, remove duplicates, and improve conversion rates

-

Concierge Program: Automated post-close marketing delivering personalized gifts and cards to increase referrals

-

Reffinity Partner Management: Dedicated realtor relationship tools with pipeline tracking and automated reporting

-

PrintPub Marketing Creator: Easy creation of co-branded flyers, rate sheets, and EDDM postcards without design expertise

-

LOS Sync: Bidirectional integration with major platforms eliminating manual data entry and auto-syncing loan information

-

Jungo SMS: Modern one-on-one or mass text messaging directly from CRM

-

Loan Milestone Automation: Automated email updates to clients and partners as loans progress through stages

-

Single Property Websites: Quick mobile-friendly, SEO-optimized property pages with lead capture

-

Product & Pricing Integration: Real-time mortgage quotes through Mortech/Optimal Blue integration

-

Mobile App: Full CRM access via Salesforce Mobile App for on-the-go pipeline management

Pros:

-

Salesforce reliability at accessible pricing for loan officers

-

Strong post-close marketing automation through Concierge Program

-

Excellent realtor relationship management via Reffinity

-

Easy marketing material creation with PrintPub

-

Comprehensive LOS integrations reduce duplicate work

-

Proven track record with established user community

Cons:

-

$249 one-time setup fee required for all plans

-

Basic plan limited---SMS requires Professional plan upgrade

-

LOS Sync only included with Enterprise plan (contact for quote)

-

Some advanced features require additional paid add-ons

-

Salesforce learning curve may challenge less tech-savvy users

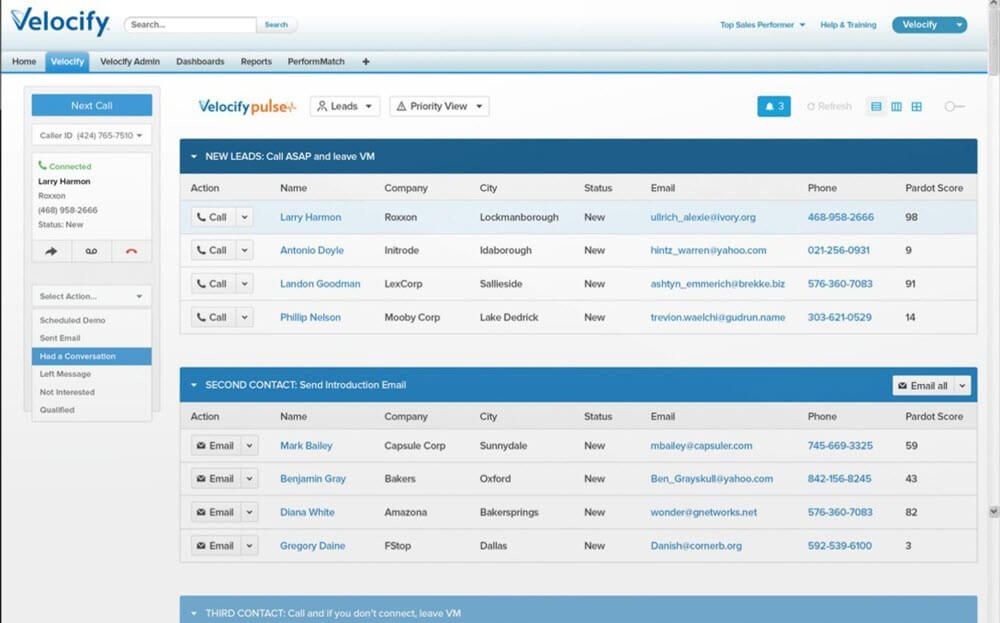

#5 Velocify - Best CRM for Mortgage Lead Management

Velocify is engineered around lead ingestion, prioritization, and the science of speed-to-contact. As part of ICE Mortgage Technology, Velocify excels at aggregating leads from hundreds to thousands of sources, applying routing rules, and using prioritization algorithms to surface hot prospects immediately. Vendor materials highlight sizable conversion uplifts (vendor-reported), reflecting how automation and optimized call workflows can dramatically improve early-stage conversion.

Key features include advanced lead distribution rules, automated reassignment of unworked leads, multi-channel follow-up sequences, and the Dial-IQ mortgage dialer with real-time reporting for coaching. Velocify is best for high-volume operations that measure success in velocity and conversion rather than deep origination automation. Downsides: pricing is typically custom and aimed at larger shops, and it may feel narrowly focused for teams that also want full borrower lifecycle management (origination → post-close) in a single product. Use Velocify when lead volume and first-contact speed are your top business constraints.

Features:

-

1,400+ Lead Source Integrations: Automatically retrieves and consolidates mortgage leads from vast array of sources

-

Intelligent Lead Distribution: Automated routing of new leads and reassignment of unworked leads based on customizable rules

-

Smart Prioritization: Algorithms that surface high-value opportunities requiring immediate attention

-

Customized Sales Workflows: Tailored process automation matching your unique sales methodology

-

Multi-Channel Marketing Automation: Automated campaigns across email, SMS, and other channels (LeadManager Essentials)

-

Application & Document Follow-up: Automated tracking and nudging for abandoned applications and missing documents

-

Milestone Updates: Automated borrower communication as loans progress through stages

-

Velocify Dial-IQ: Mortgage-specific sales dialer designed to maximize call volume and conversation quality

-

Real-time Reporting: Immediate performance insights for coaching and optimization

-

Salesforce Integration: Velocify Pulse transforms Salesforce into a powerful mortgage sales platform

-

Customer Nurturing: Automated long-term relationship building with reduced manual effort

Pros:

-

Industry-leading lead conversion improvement (up to 400%)

-

Unmatched lead source integration breadth

-

Specialized focus on sales process optimization

-

Powerful automation reduces manual follow-up work

-

Real-time analytics enable quick course corrections

-

Part of comprehensive ICE Mortgage Technology ecosystem

Cons:

-

Pricing not publicly disclosed

-

May require integration with separate LOS for full workflow

-

Best suited for high-volume lead operations

-

Can be overkill for brokers with primarily referral-based business

-

Learning curve to maximize sophisticated automation features

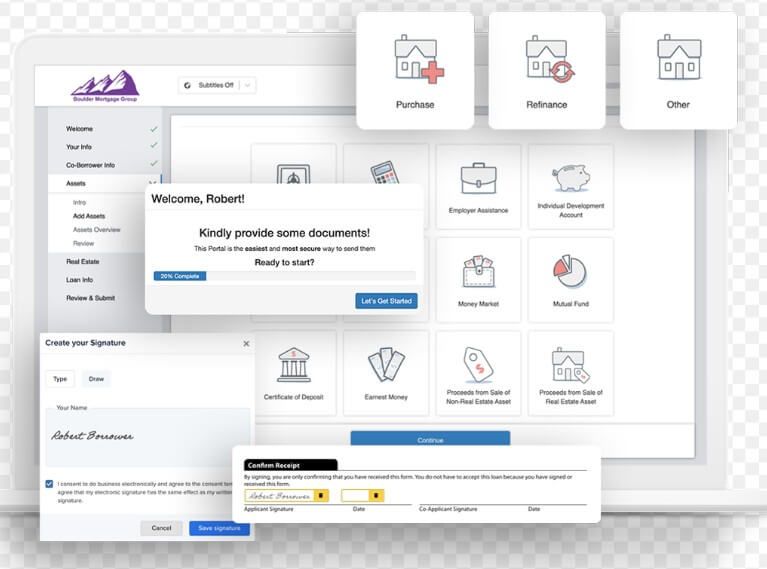

#6 Floify - Best Mortgage CRM for Automation

Floify focuses on borrower-facing point-of-sale and end-to-end origination automation: configurable 1003 intake, secure document collection, branded borrower portals, and milestone-based communications. It supports broker and lender editions, and its Dual AUS feature enables side-by-side comparisons of Fannie Mae DO® and Freddie Mac LPA℠ results in broker workflows, saving time on AUS decisioning. Floify integrates with pricing engines, credit vendors, LOS systems, and direct channels such as UWM for efficient data flow.

The platform's strength is reducing origination friction, automated nudges, pre-populated disclosures, and configurable workflows help lift application completion rates and shorten time-to-clear conditions. Limitations include a primary focus on origination rather than enterprise-grade CRM contact management, meaning many teams pair Floify with a dedicated CRM for long-term relationship nurturing. For brokers and lenders prioritizing a smooth borrower experience and faster AUS comparisons, Floify delivers high ROI on origination automation.

Features:

-

Dynamic Custom Applications: Fully configurable loan applications adaptable to any loan type or scenario

-

Dual AUS Integration: Side-by-side comparison of Fannie Mae DO® and Freddie Mac LPA℠ results for optimal loan selection (broker edition)

-

Automated Communication Suite: Configurable milestone-based emails and SMS with branding customization

-

50+ Platform Integrations: Seamless connections including credit, pricing, LOS (LendingPad), and CRM (Jungo, Surefire)

-

LenderPrice Integration: Real-time product and pricing access with auto-sync of borrower 1003 data for instant quotes

-

UWM Direct Integration: Effortless loan and 1003 data sync with United Wholesale Mortgage portal

-

Document Management: Secure, encrypted storage with easy access via DocsBar or Floify integration

-

Mortgage Call Reports: Automated NMLS reporting with pre-populated MCR spreadsheet and comprehensive RAW DATA pipeline reports

-

Borrower Portal: Single secure location for borrowers to interact with their loan from application through close

-

Custom Branding: Extensive white-labeling and personalization options

-

Compliance Tools: Built-in governance and security features for regulatory compliance

-

API & Webhooks: Advanced customization capabilities for unique workflow requirements

Pros:

-

Purpose-built for automation from ground up

-

Exceptional borrower experience drives higher completion rates

-

Dual AUS comparison saves brokers significant analysis time

-

Extensive integration ecosystem reduces tool switching

-

Highly configurable to match specific workflows

-

Strong compliance and security features

-

Dedicated lender and broker editions optimize for each use case

Cons:

-

Pricing not publicly disclosed

-

Primarily focused on origination rather than full pipeline CRM

-

May require separate CRM for comprehensive contact management

-

Some advanced features require technical expertise to configure

-

Best results require investment in initial setup and training

How to Choose the Best Mortgage CRM?

Loan origination is really complex and labor-intensive, but how to choose the best mortgage CRM to help yourself? There are some aspects you can consider.

1. Mortgage-Specific Features

Choose software with native support for digital 1003, AUS integration, loan milestone tracking, and DTI calculations. Ask vendors about roadmap items that address real mortgage pain points, not generic sales automation.

2. Compliance & Security

Verify audit trails, SOC 2 or similar attestations, encryption standards, and marketing consent (TCPA/DNC) controls. Never compromise security, breaches are catastrophic.

3. Automation & Marketing

Assess drip libraries, co-branded content, SMS/email capabilities, and marketing templates. Test real workflows during a trial to ensure the automation behaves as promised.

4. Lead & Contact Management

Check lead source integrations, duplicate detection, lead scoring, and routing rules. Speed-to-contact and smart prioritization matter more when volume is high.

5. Pipeline Tracking

Look for visual pipeline views, days-in-stage metrics, alerts for at-risk files, and reporting that supports forecasting.

6. Scalability & Usability

Pick a platform your team will actually use. Run demos with daily users and test mobile apps. Consider future growth: user seats, branches, API access, and total cost of ownership.

7. Integration Capabilities

Verify native LOS, pricing engine, credit bureau, and accounting integrations. Native connectors reduce middleware costs and synchronization errors.

Conclusion

The best mortgage CRM depends on your business model: team size, lead volume, and whether you prioritize origination automation, lead conversion, or enterprise controls.

-

Zeitro offers a strong, low-cost, AI-first entry for solos and small teams (vendor-reported improvements should be validated in a pilot).

-

Shape and Floify excel for marketing and origination automation respectively.

-

Jungo and Salesforce serve different points on the Salesforce adoption curve.

-

Velocify is unmatched for high-volume lead routing and speed-to-contact.

You might as well test platforms with real loan files, measure time saved and completion rates, and require vendor-provided references or pilots before committing.