Where to Buy Mortgage Leads? Tips on How to Get Warm Leads

The mortgage industry remains large and competitive. Buying and generating the right leads, rather than just more leads, is now the core discipline for successful mortgage loan originators. So, how to generate leads? You may learn where to buy mortgage leads here to get more loan closes!

People Also Read

- Mortgage Loan Originator vs Loan Officer: Differences and Similarities

- Mortgage Broker vs Loan Officer: Learn All the Differences Here

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- Rocket Mortgage Reviews 2025: Learn All About it with Real Ratings

Mortgage Lead Generation Statistics 2025 to Know

Before we go any further, let's take a look at some statistics in the first place. How's the potential of the mortgage market? What's the conversion rate and ROI of mortgage leads? You have to know them!

Market Potential

The mortgage market is large and cyclical. Total U.S. mortgage originations were about $1.8 trillion in 2024, and industry forecasts predicted a material increase in 2025. MBA projected ~$2.3 trillion in total originations for 2025. Those figures show renewed originations activity compared with the recent low points. Use MBA forecast reports for the authoritative monthly/quarterly updates.

What this means for loan officers? Higher origination volume usually translates into more borrower searches and higher paid-channel competition in growth regions, while certain niches like jumbo, VA, and Non-QM, remain attractive for specialized lead products.

Conversion Rate

Speaking of conversion rate, mortgage lead conversion rates vary widely by source and lead quality. Many industry benchmarks put overall conversion, from a lead to a closed loan, in the low single digits, which is commonly 2–5% for shared/lead-vendor leads based on GoodVibeSquad. Top performers and warm, personally-generated leads can be significantly higher. You may expect a big spread by channel and by how quickly leads are worked via top loan origination systems.

Also, marketing providers and lead platforms report that warm/search intent leads convert at materially higher rates than cold lists. Multiple vendor reports put warm-lead close rates in the high single digits to mid-teens. For example, 10–15%+ for very high intent search leads under ideal follow-up, while cold outbound lists frequently deliver sub-2% closes. Please note that these numbers vary by vendor and how conversion is defined.

Studies of InsideSales show leads contacted within minutes are far more likely to convert. Classic "speed to lead" data indicate large multiples. e.g., contacting within 5 minutes can dramatically increase qualification/connection rates vs. contacting hours later. Prioritize immediate outreach and multi-attempt follow-up.

ROI

ROI depends on channel & funnel efficiency. Paid channels give scale but typically lower close rates than highly-targeted organic or referral pipelines. Exclusive high-intent leads cost more but often deliver better ROI than cheap shared leads when factored by conversion and lifetime value. Vendor data suggests exclusive purchase leads often justify higher CPLs because of better close rates. Still, compute ROI using your average profit per funded loan, less acquisition cost and processing expense.

Aged leads are cheaper but require nurturing and automation. Some teams find that aged leads can deliver reasonable ROI if they have strong drip workflows. Others prefer fresher, exclusive leads to minimize chase time. Test both and track cost per funded loan, not just CPL.

How Much Does a Mortgage Lead Cost?

Lead pricing varies by exclusivity, freshness, targeting, and loan type. Here are some statistics for your reference.

Typical CPL ranges according to industry surveys & vendor tables are roughly $10–$250+, depending on product and exclusivity. Shared mass-market leads often fall on the lower end ($10–$50). Exclusive, purchase-ready, or niche (jumbo, VA, Non-QM) leads commonly range $100–$250+.

By Channel/Product (Approximate):

- Shared purchase leads: $10–$60

- Rate-table / comparison site leads (Bankrate, Zillow, etc.): $75–$250+ depending on filters, territory and exclusivity.

- Exclusive purchase-ready leads: $100–$300+ for premium lead products/live transfers.

- Niche product leads (jumbo, Reverse, VA): typically priced higher, reflecting lifetime value and lower supply.

Geography

Big-market metros have higher CPLs. Rural areas are usually cheaper. Always compare CPL to the expected funded loan value and conversion rate.

Best Mortgage Lead Generation Companies

One usual way to buy mortgage leads is through a mortgage lead generation company. Here are some popular ones that you can take a shot.

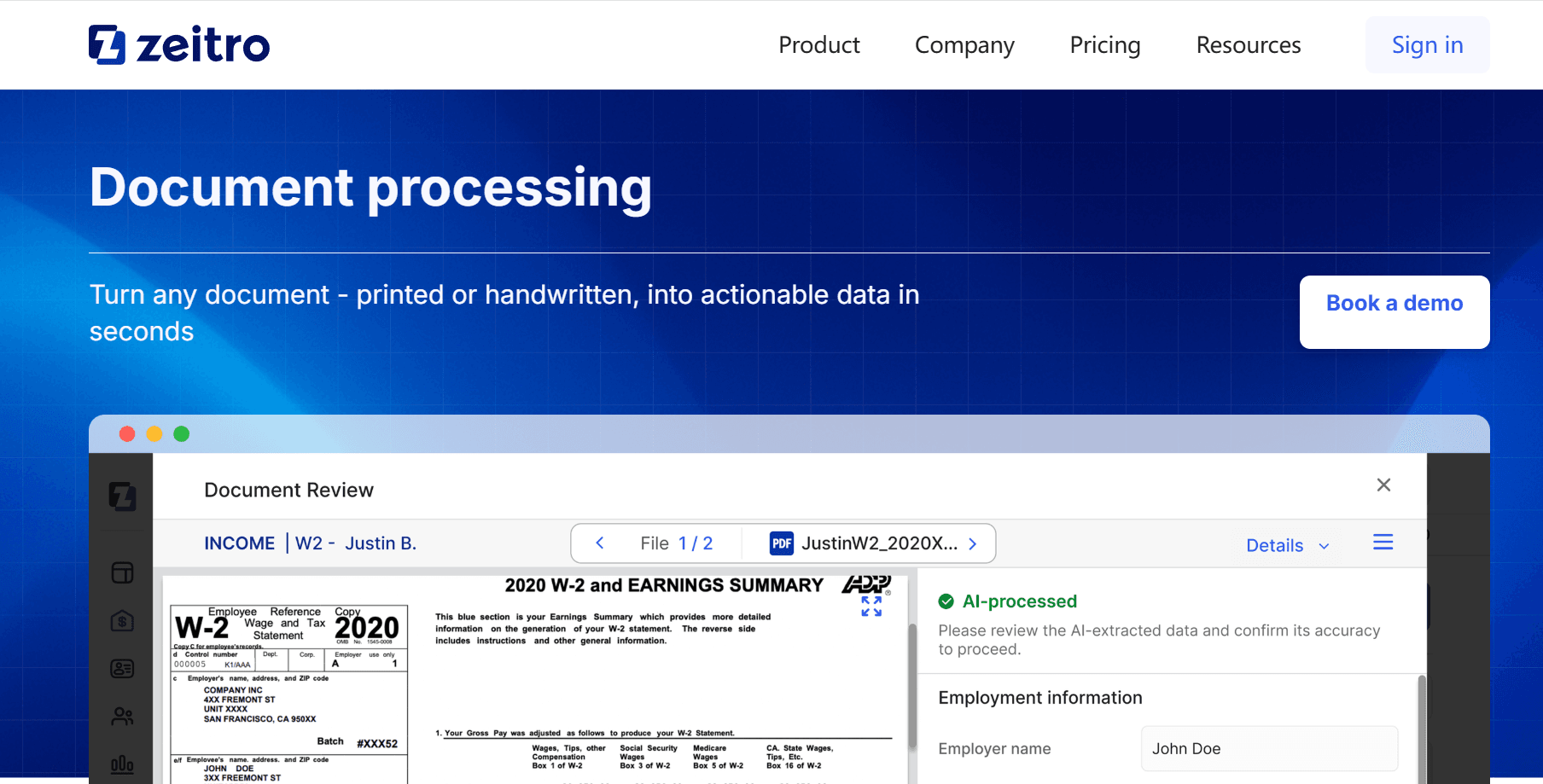

#1 Zeitro

Zeitro is a marketplace and marketing platform that helps loan officers build an online presence and capture organic search traffic. On Zeitro, loan officers can create a personalized public profile/landing page optimized for local mortgage search terms, which can be used as a searchable personal website and as a campaign landing page for paid ads. That approach emphasizes organic search (higher intent) and gives LO's control over branding, disclosures, and lead routing. Zeitro also offers integrations that let LOs capture leads directly into CRMs and route referral flows.

Features:

- Free personalized SEO-optimized LO profile pages/mini websites.

- Built-in mortgage calculators and educational content modules to engage searchers.

- Ad landing pages that can be paired with PPC ads.

- Mortgage CRM integrations and lead routing.

#2 LendingTree

LendingTree is one of the largest mortgage marketplaces in the U.S., connecting consumers who complete comparison shopping forms with multiple lenders. Lenders buy leads or enroll in referral products. The platform emphasizes volume and consumer choice. LendingTree tends to deliver high lead volume and a broad demographic reach. Many lenders use it for scale acquisition, though competition for leads is high, and many of the lower-priced products are shared. LendingTree provides analytics and filters so lenders can target by loan type, geography, and borrower attributes.

Features:

- Large consumer audience and high lead volume.

- Multi-step qualification flow that increases lead intent.

- Real-time delivery and lender portal analytics.

- Price tiers and filters for loan type and exclusivity.

- Integrations for lead delivery into lender CRMs.

#3 Bankrate

Bankrate is a well-known personal finance publisher that monetizes its traffic via rate comparison tables and lead products. The platform draws high-intent visitors researching rates and mortgage education, making Bankrate leads valuable for lenders seeking informed borrowers. Bankrate sells leads and advertising placements (rate table products) and can target by product, geography, and borrower attributes. Bankrate tends to price its rate-table leads at a premium because the audience is actively comparing rates.

Features:

- High-intent rate-comparison traffic.

- Premium lead products and rate-table placements.

- Editorial and calculator content that supports SEO and user trust.

- Advanced targeting and reporting in advertiser dashboards.

- Pricing is variable and typically higher than mass marketplaces.

#4 Lendgo

Lendgo is a smaller lead provider focusing on fresh purchase and refinance leads with emphasis on data accuracy and real-time delivery. Lendgo markets itself as a platform that verifies borrower information quickly to increase conversion potential and reduce wasted contact attempts.

Features:

- Fresh, real-time lead delivery and verification checks.

- Filters for loan size, credit band, and product type.

- API and CRM integrations for immediate routing.

- Analytics dashboard for performance tracking and ROI calculations.

#5 OwnUp

OwnUp claims to use machine learning to score leads by intent and match them to lenders most likely to close. These vendors price leads by predicted conversion. Higher-intent leads cost more but may save time and improve funded-loan ROI.

Features:

- Intent scoring using behavioral and demographic signals.

- Multiple lead products like preapproval, warm transfers, and web leads.

- Outcome-based or predictive pricing models.

- Real-time matching and delivery.

- Reporting that ties leads to funded outcomes where possible.

Best Ways to Buy Mortgage Leads Online

Besides buying mortgage leads from companies, you can start your own ad campaign and get leads through Google, Meta, etc.

Google Search Ads

Google Paid search can capture borrowers who are actively searching with a high intent. Search-ad conversion rates vary by study. Many sources put search conversion in the 3–7% range overall and higher for finance when tightly targeted. WordStream/industry trackers show aggregate Google Ads conversion averages around 5–7% for many verticals. Actually, your actual CR depends heavily on landing page and offer.

According to WordStream, CPCs for competitive mortgage keywords commonly range from $10 to $40+ per click in competitive metros. Resulting CPLs often fall $70–400+, depending on landing page conversion and competition. Start with a minimum budget of $1,000–$3,000/month to test and optimize.

Facebook/Instagram

Ads on Facebook and Instagram are good for mid-funnel nurturing and lookalike targeting. It's cheaper CPLs than search but with lower immediate intent. Platform averages vary. Marketing trackers show CPLs around $15–60 for financial verticals. Some reports put finance CPL significantly higher by region, and lead-to-application conversion depends on ad targeting and funnel quality.

LinkedIn Ads is effective for B2B mortgage products (jumbo, investor lending, wholesale relationships) and for connecting with referral partners. LinkedIn CPLs are generally higher. Many reports show $80–$400+ for finance/B2B leads, but lead quality can justify the cost for high-value loans.

Organic Traffic

Search-generated leads commonly deliver the best long-term ROI because visitors are researching and often have higher intent. Organic CPL is low after content investment. That's a long-term game, but you'll get free mortgage leads when you're able to obtain organic traffic. Zeitro has offered loan officers such an easy feature to build a personal page to get organic search for free.

Get Mortgage Leads Through Local Workshops and Webinars

Getting mortgage leads by local workshops and webinars can benefit with high trust and strong qualifications. Attendees opt in and demonstrate intent.

For your reference, the conversion to consultation is often high by LeadPops. Many practitioners report 20–40% from attendees to consultation rates. And the cost per attendee can range from $25–$200, depending on venue, partnerships, and promotion. Webinars scale at a lower per-attendee cost but need quality content and follow-up automation.

Conclusion

Buying mortgage leads can scale pipelines quickly, but measuring cost per funded loan is the only reliable KPI. Track CPL → lead → application → clear-to-close → funded and optimize for cost per funded loan.

If you just became a loan officer, you should test multiple channels including search, marketplaces, social, and organic, measure true funnel conversion, and scale what produces profitable funded loans. Prioritize speed-to-contact and multi-touch nurture sequences for purchased leads.

Actually, platforms that combine organic SEO of personal LO pages with ad landing pages and CRM routing, like Zeitro's Growth Hub, are a practical way for loan officers to balance short-term paid volume and long-term organic acquisition.