Mortgage Broker vs Loan Officer: Learn All the Differences Here

Whether you want to be a loan officer or a mortgage broker, or you're a first-time buyer who failed to figure out who is who, you should take a look at this article. You'll learn what a mortgage broker is, what a loan officer is and then the difference between mortgage broker and loan officer in 8 aspects. After that, you will definitely have a clear mind.

People Also Read

- Rocket Mortgage Reviews 2025: Learn All About it with Real Ratings

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- Detailed Guide: How to Get Preapproved for a Mortgage Loan?

- How Much Mortgage Can I Afford? Know Your Affordability

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

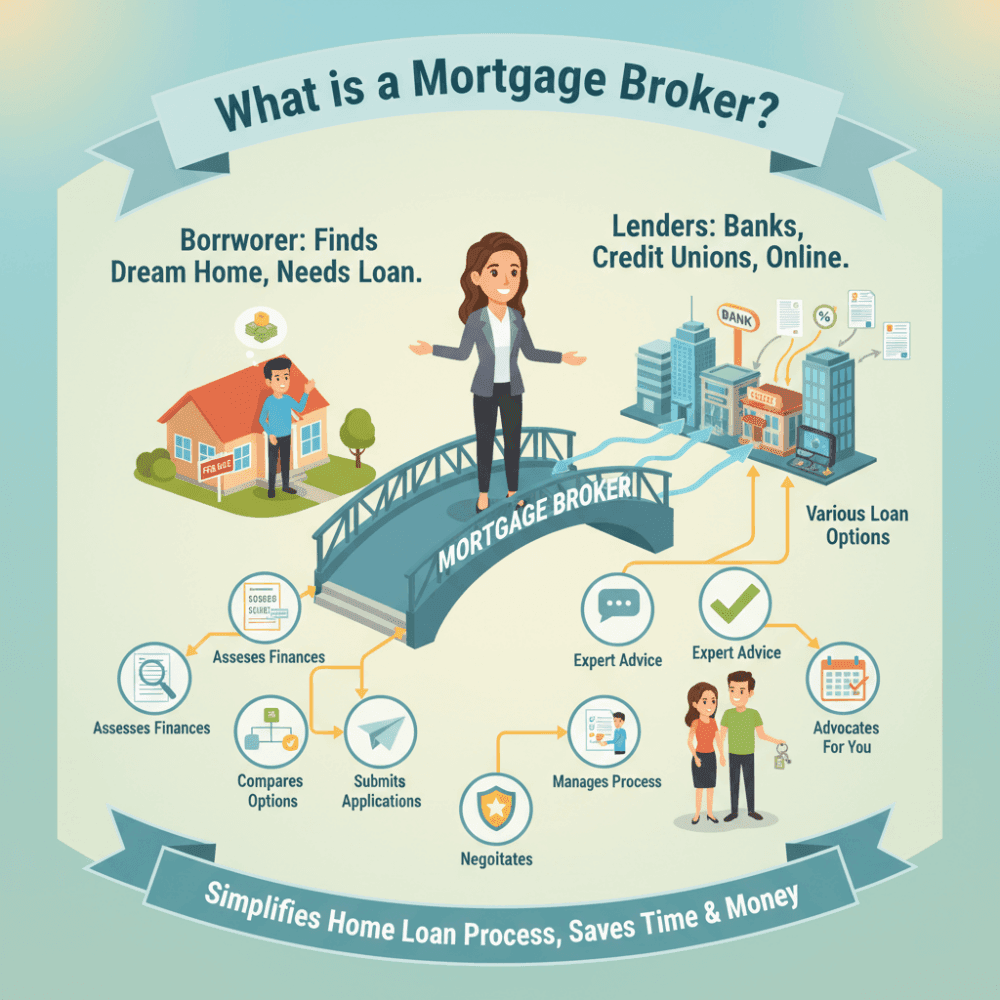

What is a Mortgage Broker?

A mortgage broker is an independent intermediary who shops your loan application to multiple lenders to find competitive rates and programs. Brokers collect borrower documents, run credit checks, usually with borrower consent, and submit loan packages to lenders on the borrower's behalf.

They can provide access to a broader set of products from banks, credit unions, and specialty lenders, than a single bank or captive lender. Brokers are typically paid by the lender or borrower via an origination/broker fee. Industry guidance shows broker fees commonly range from about 1% to 2% of loan amount. Federal rules cap certain fees and prohibit tying fees to interest rate.

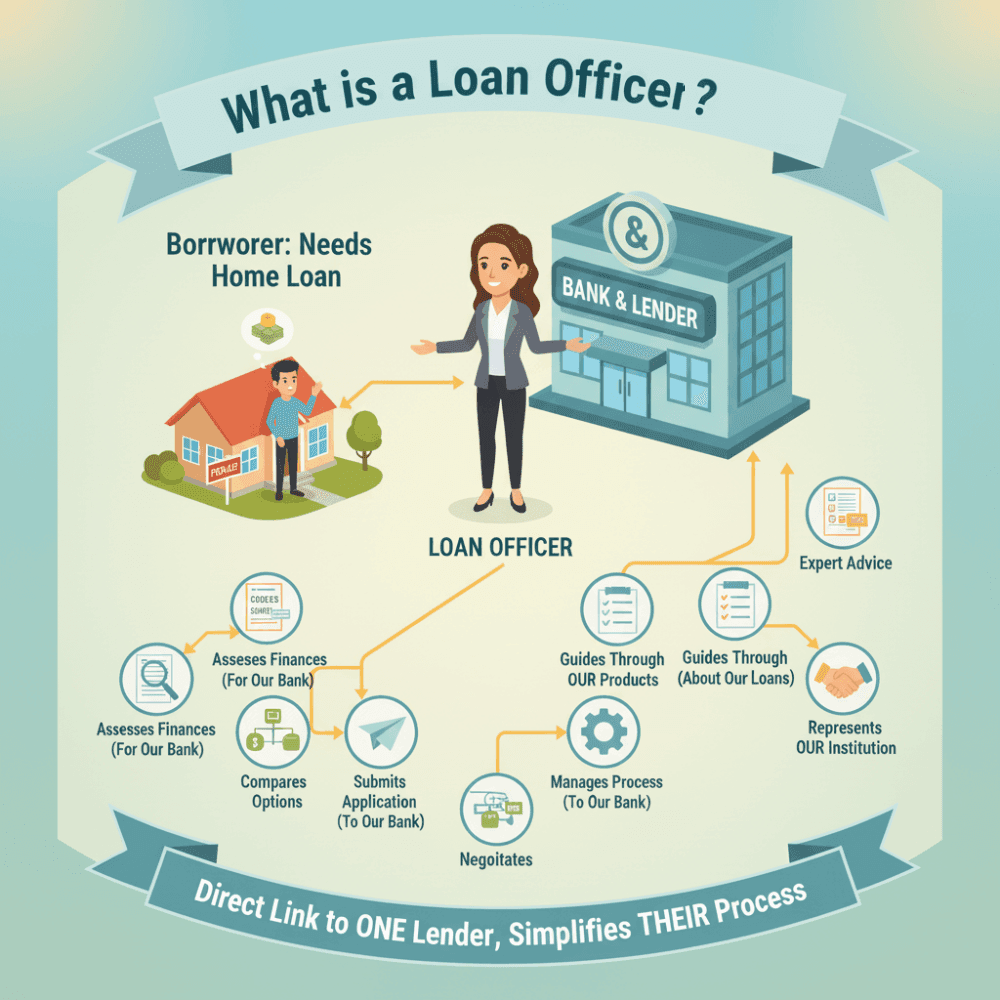

What is a Loan Officer?

A loan officer, which is also called a mortgage loan officer or mortgage loan originator in regulatory contexts, is usually employed by or contracted to a single lender like a bank, credit union, or mortgage bank. Loan officers originate applications for their employer's loan products, help applicants complete paperwork, explain product options available at that institution, and guide the file to underwriting.

Underwriting and final approval are typically completed by an internal or third-party underwriter, not the loan officer. Compensation commonly includes salary plus commission/bonus for loans originated. Structure varies widely by employer.

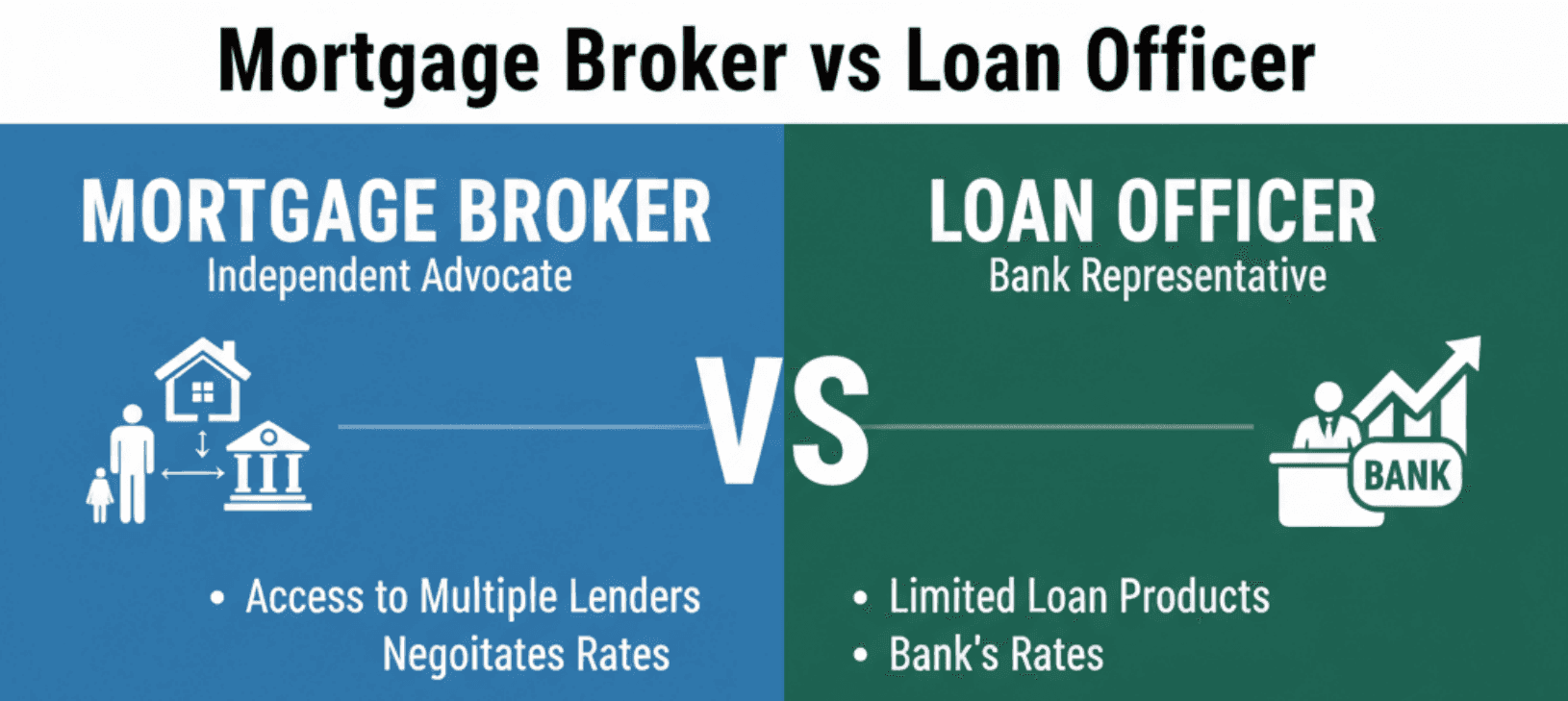

What is the Difference between Mortgage Broker and Loan Officer?

When it comes to a mortgage loan officer vs broker, let's grasp the idea in terms of role, employment, lenders represented, loan options, fees, salary, skills, and license.

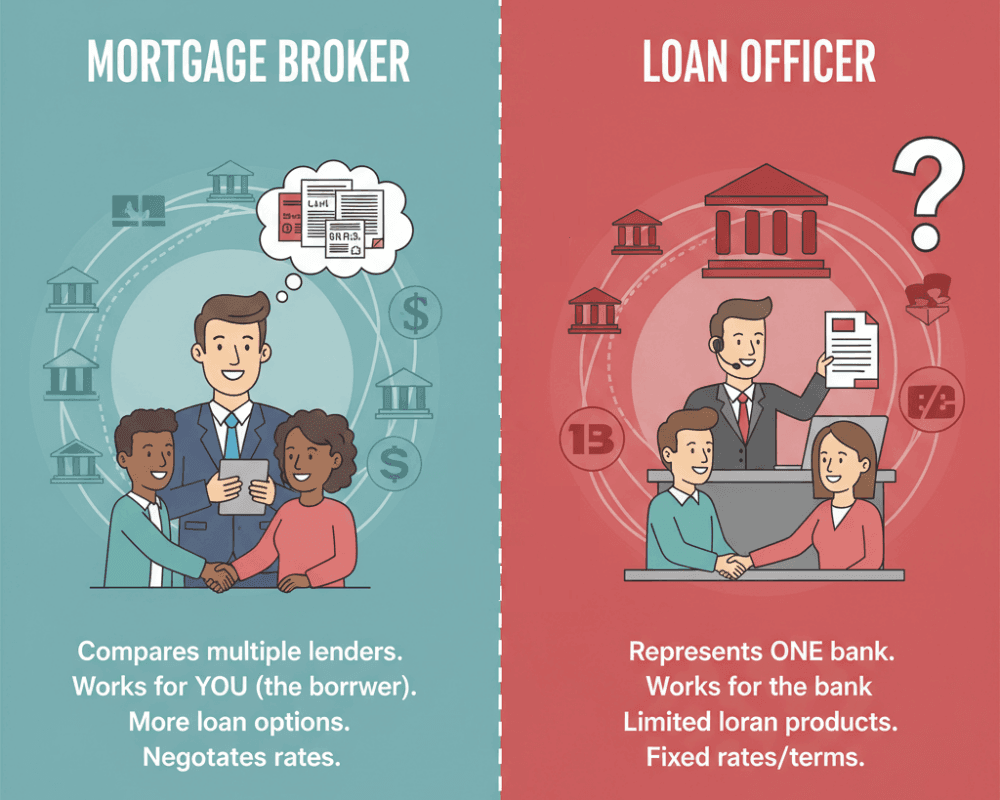

Role

-

Mortgage Broker: shops multiple lenders and presents the borrower to many potential funders. acts as the borrower's market intermediary.

-

Loan officer: markets and originates loans for one lender, steering borrowers toward that institution's products. Final underwriting is performed by underwriting teams.

Employment

-

Mortgage Broker: independent or works for a brokerage firm. Not usually a direct employee of lenders.

-

Loan officer: employee or commissioned representative of a bank, credit union, or mortgage lender. may have a salary + commission.

Lenders Represented

-

Mortgage Broker: represents many lenders with wider marketplace access.

-

Loan officer: typically represents a single lender's product set.

Loan Options

-

Mortgage Broker: can surface niche/nonstandard products. Good for complex files.

-

Loan officer: has deep knowledge of their institution's programs and any proprietary offerings the institution may provide.

Fees

-

Mortgage Broker: may be paid by the lender or the borrower. Typical broker fee range: ~1%--2%, though structures vary. Federal guidance restricts fee practices, and some caps apply. Always ask for a Loan Estimate showing broker compensation.

-

Loan officer: The borrower typically does not pay the loan officer directly. Lender's pricing and origination charges are included in the Loan Estimate. Compensation to the officer comes from the employer (salary/commission).

Salary

-

Mortgage broker: Reported averages vary. Brokers are often paid on commission tied to loan volume, so successful brokers can earn substantially more. Indeed shows that the average salary of a mortgage broker in the United States is $171,967 a year.

-

Loan officer: Reported averages also vary widely by source/employer. Compensation is often salary + commission, with wide variance by region and channel. Use local employer data and job postings to estimate current market pay. Indeed shows that the average salary for a loan officer is $186,404 per year in the United States and $35,500 commission per year.

Skills

Both roles need strong communication, sales/negotiation, and compliance knowledge. Brokers need marketplace relationships and rate-shopping skills. Loan officers need deep knowledge of their employer's guidelines and internal processes. Both must be detail-oriented and able to manage documentation and deadlines.

License

Both mortgage brokers and loan officers must be licensed when required by state law and registered in the Nationwide Multistate Licensing System (NMLS). The SAFE Act requires 20 hours of pre-licensing education for state-licensed MLOs and annual continuing education (8 hours) for renewals. Exact state add-ons may apply. Verify license status via NMLS Consumer Access.

FAQs About Mortgage Loan Officer vs Mortgage Broker

Q1. Is a mortgage broker better than a loan officer?

Not universally. It depends on your needs. Brokers can shop a wider panel, which helps with unusual files or if you want a market sweep. Loan officers may offer faster processing and in-house programs if you have an existing bank relationship. Compare actual Loan Estimates from both options.

Q2. What is the disadvantage of using a mortgage broker?

The potential drawbacks include that broker networks don't include every lender, so they may miss a lender you could reach directly, and broker fees or compensation arrangements can add cost if not paid by the lender. Please always request the Loan Estimate and an explicit broker compensation disclosure.

Q3. What is the difference between a loan officer and a loan originator?

Some people may not know the differences between a loan officer and a loan originator. In regulatory language, "mortgage loan originator" (MLO) is the licensed role. "Loan officer" is commonly used for individuals performing those loan originations. Practically, they're often the same, though "originator" can sometimes refer to the entity that originates loans (bank or brokerage).

Q4. How to find a loan officer near me?

When speaking of finding a loan officer, you can use referrals (trusted agent, friends), your bank/credit union website, and NMLS Consumer Access to look up licensing of loan officers. Marketplaces like MyMortgageRates can help connect borrowers to local loan officers and compare options quickly.

Q5. Is it better to get a mortgage through a broker?

It depends. For broad shopping and nonstandard files, brokers add value. For a simple loan and strong bank relationship, a loan officer may offer speed and in-house programs. Best practice is to get Loan Estimates from both a broker and a lender to compare price and service.

Q6. Is it stressful being a mortgage broker?

Yes, it can be. Brokers coordinate multiple lenders and deadlines, manage varying investor overlays, and must track changing market pricing. But many brokers value the independence and variety the role offers. Workload and stress depend heavily on volume and support staff.

Conclusion

Mortgage brokers and loan officers can both get you a loan, but they serve borrowers differently. Brokers offer market access and product breadth. Loan officers provide deep knowledge of an institution's programs and potentially faster in-house workflows.

As for borrowers, you should validate credentials (NMLS), compare Loan Estimates, and ask direct questions about fees and who will service the loan. When in doubt, get quotes from both a broker and a lender and compare total cost and speed. That's the most objective way to choose. Better yet, you can get in touch with a loan officer nearby and track the whole process on MyMortgageRates with ease.