NMLS Meaning: What is NMLS? Everything You Should Know

Whether you want to become a loan officer or you are just a first-time homebuyer, you have to learn what is NMLS. This post is going to help you clear your mind and know the ins and outs of NMLS. What is it? How does it work? How to look it up? Moreover, what is NMLS license and NMLS number? You got to learn all of them here. Just read on.

People Also Read

- Mortgage Broker vs Loan Officer: Learn All the Differences Here

- Mortgage Prequalification vs Preapproval: All Differences in 2025

- Mortgage Loan Originator vs Loan Officer: Differences and Similarities

- 6 Best Loan Origination Software for Mortgage in 2025 [Never Miss]

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

What is NMLS?

NMLS (the Nationwide Multistate Licensing System & Registry) is the centralized electronic system of record used by state and territorial financial regulators for licensing and registration of non-depository financial services, including mortgage companies and mortgage loan originators. NMLS was created by state regulators (CSBS working with AARMR) to replace dozens of separate state forms and databases and improve transparency and consumer protection.

The platform is operated on behalf of state regulators by the State Regulatory Registry (SRR), which is governed by state regulator representatives. NMLS is the repository that state agencies use to process license applications, renewals, amendments and to publish certain license information to the public via NMLS Consumer Access.

History of NMLS

Now, let's learn the history of NMLS. It launched in January 2008 as a voluntary state system and was expanded after the SAFE Act (part of the Housing and Economic Recovery Act) required state licensing/registration standards for mortgage loan originators. The SAFE Act became law on July 30, 2008.

The system originated to combat fraud and to ensure bad actors could not easily move between states without regulatory visibility. Since launch, the system has expanded to serve multiple non-depository industries and to host consumer-facing license lookup via NMLS Consumer Access.

How Does the NMLS Work?

So, how exactly does it works? NMLS stores a single, persistent record for companies and individuals: companies use the MU1 (company), individuals have MU2 (individual record) and MU4 (individual license application), and branches use MU3. These standardized "MU" forms let licensees apply to multiple jurisdictions without separate paper filings.

NMLS assigns a unique NMLS ID to each company, branch, and individual. That ID follows the person or company across employers and states and is visible (in part) through NMLS Consumer Access so consumers and regulators can verify licensing status.

What is NMLS Number?

An NMLS number (NMLS ID) is the system-wide identifier for a company, branch, or individual. It is permanent while the record exists in NMLS and is the primary way consumers, lenders, and regulators verify who an MLO or company is and which jurisdictions they are authorized to work in. Use NMLS IDs in marketing and disclosures per regulator guidance. Many state rules and NMLS guidance require or encourage displaying the ID.

Who is Required to Have an NMLS Number?

Individuals who act as state-licensed Mortgage Loan Originators (MLOs) must obtain an NMLS ID and become licensed/registered through NMLS in states that participate. Federal depository institutions' MLOs are federally registered in NMLS through a different pathway. The SAFE Act and implementing rules require background checks, fingerprints, and pre-licensure education or federal registration, as applicable.

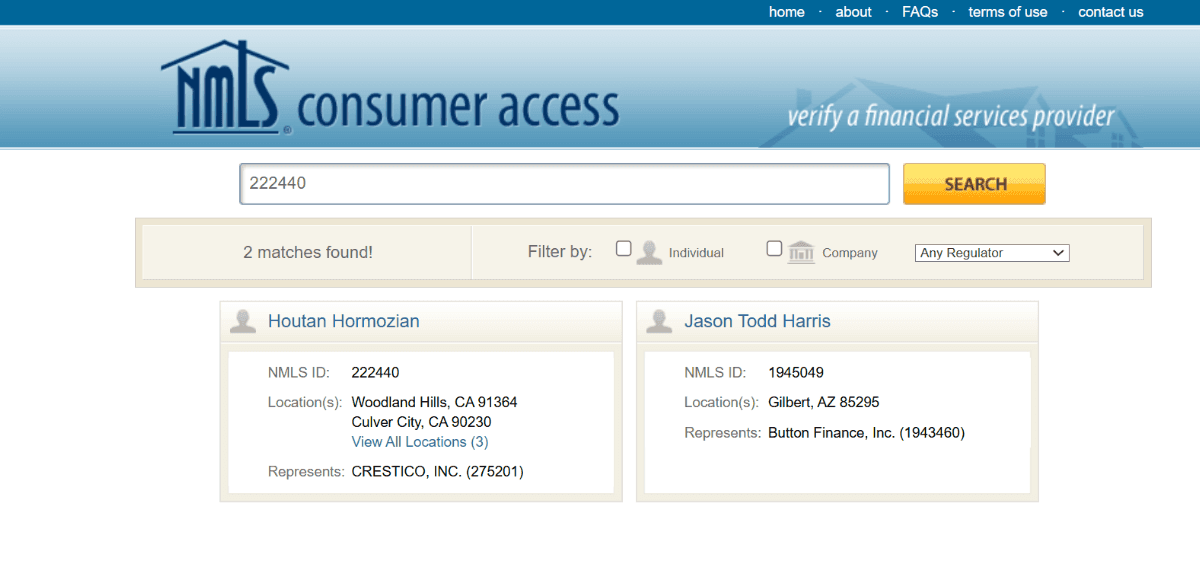

How to Look up NMLS Number?

Actually, it's really easy to look up NMLS of a loan officer. You just use NMLS Consumer Access to look up an MLO or company by name, city/state, or NMLS ID. Consumer Access shows license status, jurisdictions of licensure, and disciplinary actions that are reportable. This is the recommended verification step per CFPB and CSBS guidance.

What is NMLS License?

The license itself is issued by the state regulatory agency, NMLS is the platform that processes and records the license. States remain the licensing authority. NMLS is the shared system of record that streamlines multi-state licensing and keeps records consistent and auditable. Annual renewals and reporting are typically handled in NMLS.

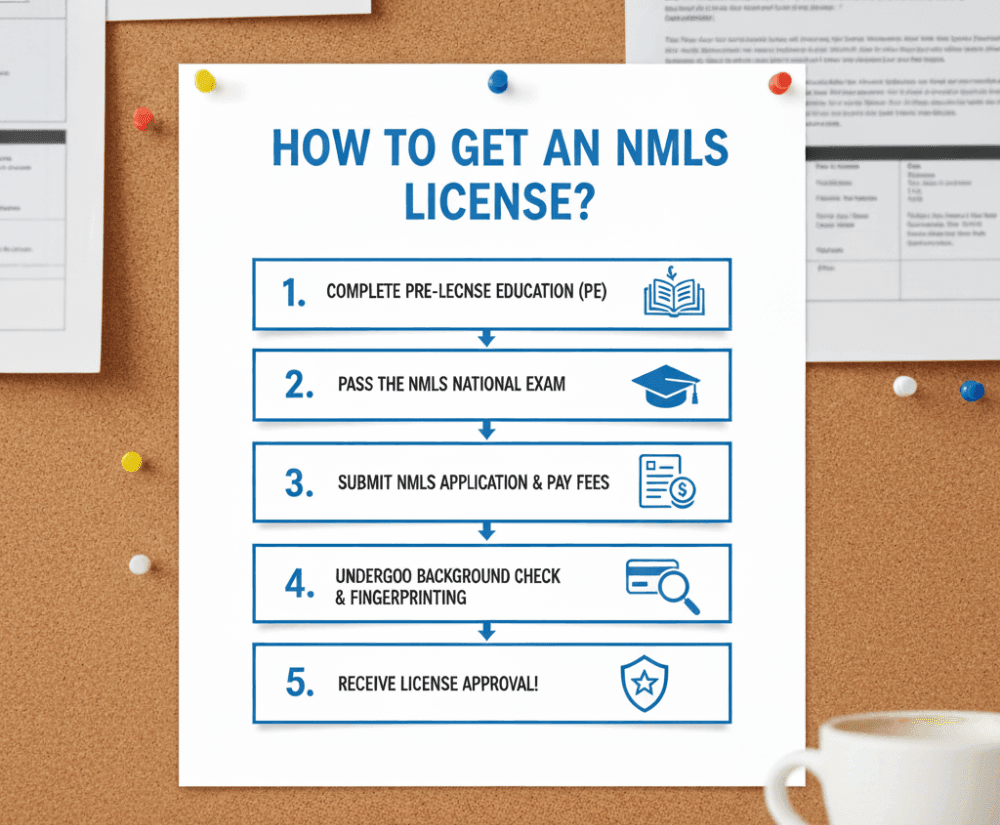

How to Get an NMLS License?

If you want to work as an MLO or a loan officer, you will have to get the NMLS license. Let's walk through the process below. Some state-level idiosyncrasies apply. You should always check the MLO Education & Testing Guide and your state agency page in NMLS for state-specific requirements.

-

Create an NMLS account and an MU2 record (individual) if you are new.

-

Complete the 20-hour pre-licensure education (PE) required under the SAFE Act. The typical PE breaks down into 3 hours of Federal law, 3 hours of Ethics, 2 hours of Non-traditional mortgage lending, and 12 elective hours. States may add requirements.

-

Register and pass the SAFE MLO national exam (National Test component with Uniform State Content). The NMLS testing handbook documents the exam content and structure. The NMLS national test component uses a standardized content outline.

-

Complete fingerprints/authorize background and credit checks via NMLS. Your sponsoring company must "endorse" (sponsor) your MU4 application before a state will approve your license. After state approval, you will have an active license in the jurisdictions listed.

How NMLS Benefits Homebuyers?

If you're a first-time buyer, you'll have to verify the NMLS number of MLOs. NMLS can offer you benefits like:

-

Transparency: Consumers can verify whether a loan officer or company is licensed in their state and see reportable disciplinary actions. This reduces the risk of working with unlicensed or problematic originators.

-

Accountability: Because NMLS IDs are persistent and portable, originators cannot easily "reset" their record by moving states or employers, and regulators and consumers can trace employment history and actions.

-

Consumer Protection: NMLS supports fingerprinting, background checks, testing, and continuing education requirements that raise minimum professional standards for MLOs.

FAQs About NMLS Meaning

If you have any lingering questions, let's go further and check FAQs out.

Q1. Is NMLS a certification?

No, NMLS is not a certification body. It is a licensing and registration platform and public registry. State agencies grant the actual license or registration. NMLS is the standardized system used to apply for and maintain those licenses.

Q2. Is the NMLS test hard?

The SAFE MLO national test with Uniform State Content currently consists of 120 multiple-choice items (115 scored + 5 unscored) and a time limit. The test covers Federal mortgage laws, Uniform State Content, general mortgage knowledge, mortgage loan origination activities, and ethics.

Industry reporting and test-prep providers place the first-time pass rate in the mid-50% range (roughly ~54–56% in recent aggregated reporting). That means many first-time takers fail without adequate study. deeper study than the minimum pre-licensure hours is commonly recommended.

Q3. Why do I need NMLS?

The SAFE Act requires state-licensed MLOs to be licensed/registered through NMLS. Without an active license/registration, you cannot legally originate residential mortgage loans in the jurisdictions that require NMLS licensing. NMLS also provides public verification tools that protect consumers.

Q4. How many hours to study for NMLS?

The statutory pre-licensing education is 20 hours, but passing the exam frequently requires additional study: many candidates study for 2–4 weeks with daily focused sessions and multiple practice exams. Actual study time varies by background. Those with prior mortgage experience typically need less additional prep than newcomers. Industry providers recommend several dozen hours of practice questions and weak-area review beyond the 20-hour PE.

Conclusion

NMLS is the industry's standardized licensing system, operated for state regulators via SRR/CSBS, that centralizes background checks, education tracking, testing, and license maintenance for mortgage professionals. It improves transparency and consumer protection through NMLS Consumer Access and standardized professional requirements (PE, testing, CE).